Algorand (ALGO) price has seen a jump in the last 24 hours, with the token swaying between an intra-day high of $0.408 and a low of $0.2952. This rally has prompted analysts to project a price surge above the $1 mark, largely driven by the ‘Golden Cross’ observed on the ALGO price chart.

Algorand Price Surges Over 30%, Rally To $1?

In the last week, the Algorand price has been on a bullish rally with the price soaring over 60%. As of press time, ALGO price was trading at $0.3939, a 32% surge from the intra-day low. During the rally, ALGO’s market capitalization and 24-hour trading volume soared by 32% and 440% respectively to $3.27B and $1.38B, respectively.

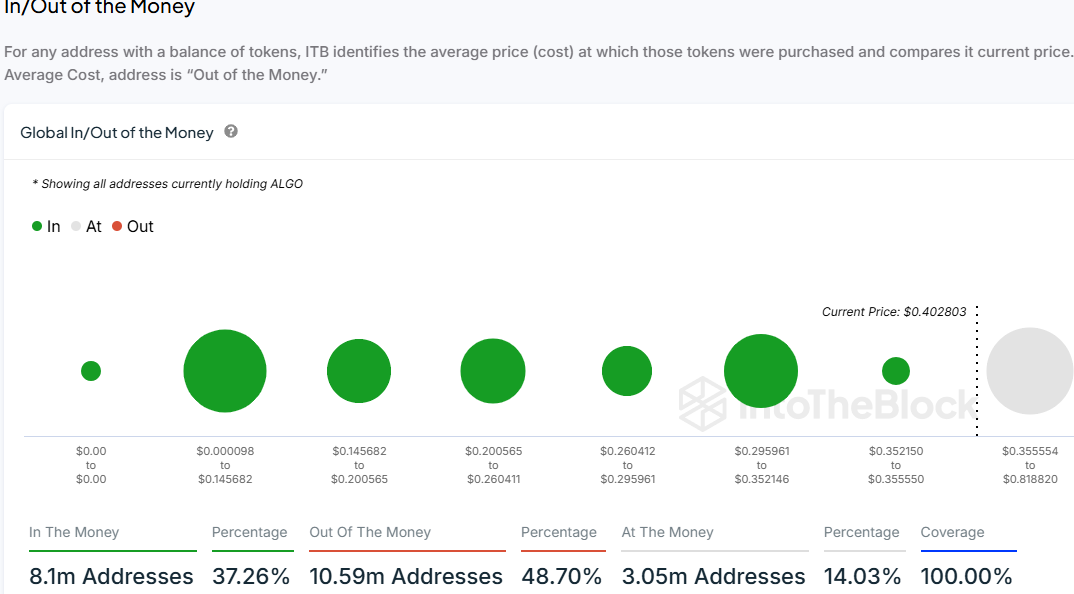

This surge reflects the increasing investor confidence with ALGO price securing the top spot on today’s top gainers. Concurrently, the fact that 37% of holders are in profit indicates that a significant portion of the market is optimistic about the coin’s potential, while the remaining holders may either hold their positions in anticipation of the ALGO price recovery.

Furthermore, ALGO’s open interest hit an all-time high (ATH) of $81 million, reflecting a 28% increase in just 24 hours. The rise in open interest suggests that a growing number of traders are betting on further gains for the token.

The high open interest, combined with increasing trading volumes, indicates that the bullish sentiment surrounding ALGO could persist in the near term.

ALGO Price Technical Analysis

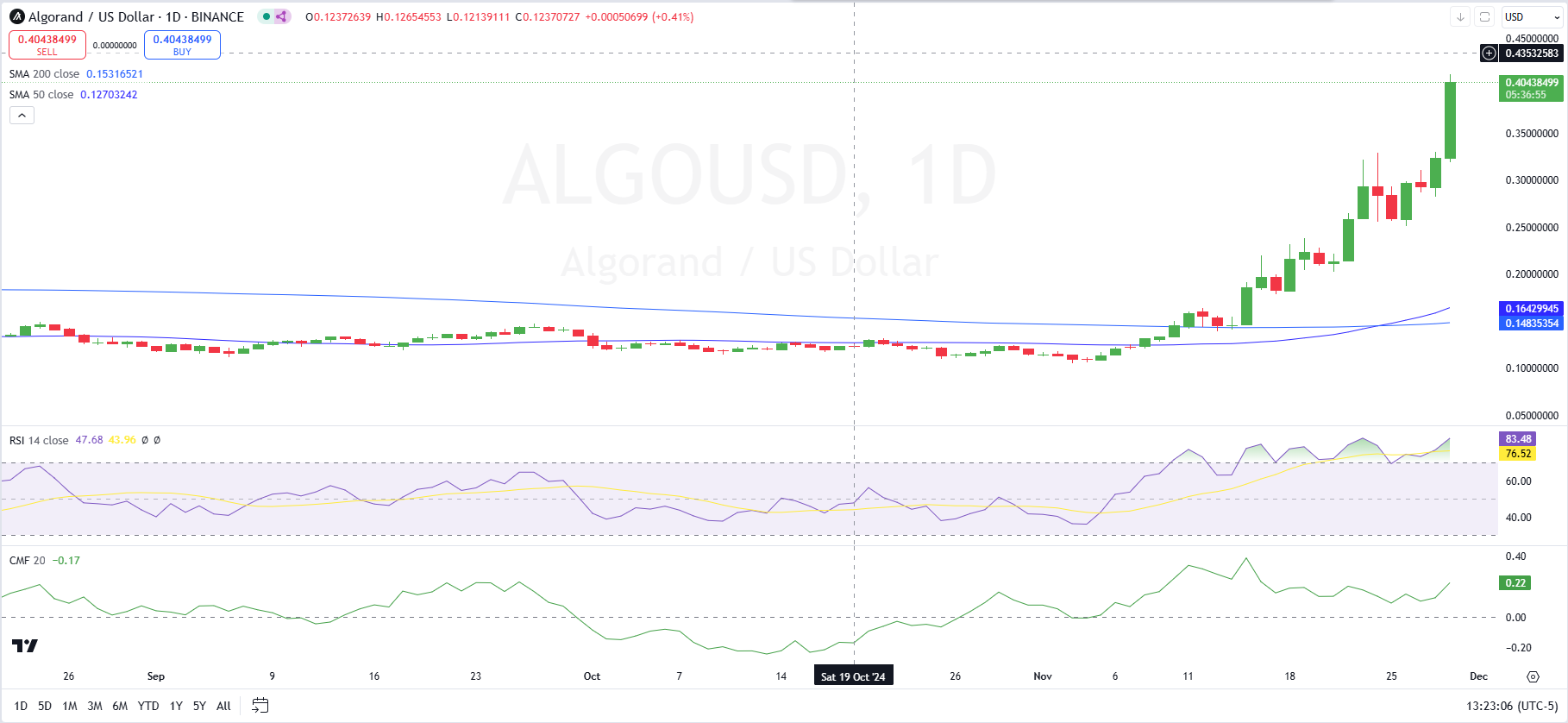

From a technical perspective, the recent price surge in ALGO is supported by strong momentum indicators. The Relative Strength Index (RSI) for ALGO is currently at 83.63, suggesting that the token is in overbought territory. While this indicates that a short-term pullback or consolidation may be imminent, it also highlights the strength of the current bullish trend.

A key driver behind the recent bullish move is the formation of a “Golden Cross” on the ALGO price chart. A Golden Cross occurs when a short-term moving average crosses above a long-term moving average, typically signalling a shift toward bullish market conditions. In the case of ALGO, the 50-day Simple Moving Average (SMA) has recently crossed above the 200-day SMA, marking a technical buy signal for investors with the price projected to hit $1 soon.

Additionally, the Chaikin Money Flow (CMF) for ALGO stands at 0.24, indicating that there is significant buying pressure. This is consistent with the high open interest and strong market volume, further supporting the view that investor sentiment remains positive.

Concurrently, analysts are optimistic about the potential for ALGO to surpass the $1 mark. Technical targets, based on the recent bullish breakout, suggest that the price could reach as high as $1.26, marking a potential 300% increase from current levels.

The post Algorand (ALGO) Price Rockets 32% After Bullish Golden Cross appeared first on CoinGape.