The tech market is rapidly expanding. The Nasdaq-100 Technology Sector is up 32% in the past 12 months, outperforming the S&P 500′s growth of 24% in that period. The rise brings to mind the old proverb, “The best time to plant a tree was 20 years ago, but the second best time is now.” The same sentiment applies to the stock market, especially tech stocks.

The tech industry has a reputation for delivering significant gains over the long term, benefiting from its innovative nature and consistent demand for upgraded products and software. Meanwhile, recent advances in markets such as artificial intelligence (AI), self-driving cars, and virtual/augmented (VR/AR) reality indicate the tech market is nowhere near hitting its ceiling. As a result, there’s no time like the present to invest in tech.

Here are two hypergrowth tech stocks to buy in 2024 and beyond.

1. Nvidia

Shares in Nvidia (NVDA 1.75%) have hit record heights over the last year, rising 207% alongside soaring earnings. Stellar growth has seen the company become the first chipmaker to achieve a market cap above $3 trillion, making it the world’s third most valuable company this year, only after Microsoft and Apple (AAPL -0.82%).

Nvidia’s success comes down to its dominant position in AI graphics processing units (GPUs), the chips crucial to performing AI tasks and running AI platforms. While competitors such as Intel and Advanced Micro Devices prioritized central processing units (CPUs) in recent years, Nvidia’s focus on GPUs gave it a head start in AI and perfectly positioned it to become the go-to chip supplier for AI developers worldwide.

In its most recent quarter, the first quarter of fiscal 2025, Nvidia’s revenue increased by 262% year over year while operating income rose nearly 700%. The company enjoyed impressive growth in its data center segment, which posted revenue gains of 427%, illustrating a healthy boost to AI GPU sales.

However, its diverse business model is the best reason to invest in this hypergrowth tech stock. In addition to AI chips, Nvidia has positions in consumer PCs, video games, self-driving cars, and more.

In Q1 2025, revenue in the company’s automotive segment increased by 17% sequentially and 11% year over year. Nvidia CFO Colette Kress has expressed massive potential in automotive as advances in self-driving cars increase chip demand. On a recent earnings call, Kress said that she expects automotive to be the “largest enterprise vertical” within the data center segment in 2024.

Nvidia has delivered an impressive growth year but could have much more to offer investors as the tech market develops and the company continues to be a leading chipmaker. And with a price/earnings-to-growth ratio of less than 1, this hypergrowth tech stock is too good to pass up this year.

2. Apple

Shares of Apple are up 341% over the past five years, while annual revenue and operating income have soared 47% and 79%. The company has often been praised as one of the best growth stocks to invest in over the long term.

However, Apple has been in a slump over the past 12 months. The company has a reputation for consistently outperforming the S&P 500. Yet while the renowned index has risen 24% since last June, Apple’s stock price has increased by 16%. Investors have grown weary of Apple’s products business after repeated sales declines.

Meanwhile, the emergence of AI has highlighted the disparity in Apple’s AI technology compared with some of its rivals. The iPhone giant isn’t leading in the AI space today. However, recent developments and its Worldwide Developers Conference (WWDC) on June 10 have made Wall Street bullish again.

Apple’s stock jumped 10% after the conference, where the company debuted new AI services that could boost product sales in the coming months. At WWDC, the tech giant unveiled Apple Intelligence, a new AI platform that will bring generative updates across its product lineup. iPhone 15 Pro models, Apple Silicon Macs, and iPads equipped with M1 through M4 chips will give users access to Apple Intelligence, including features such as image and language generation, editing tools, an updated Siri, and much more.

Apple Intelligence could motivate millions of consumers to upgrade to the company’s more recent devices, providing the boost that its product business needs to overcome recent headwinds.

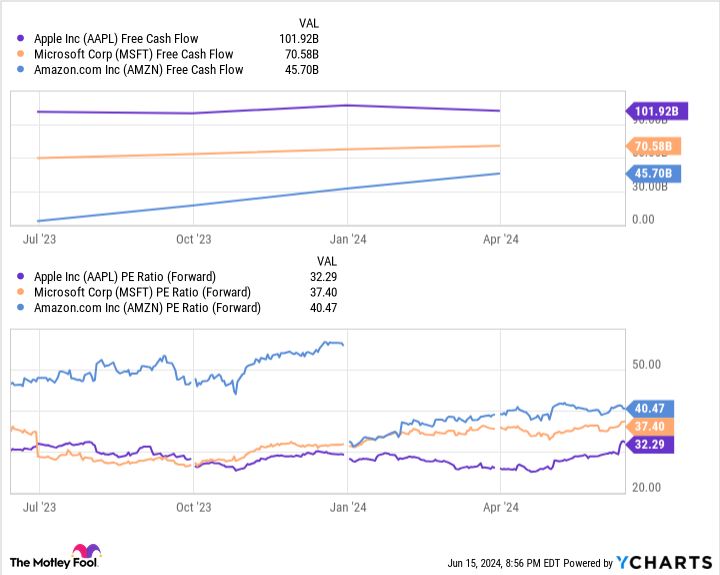

Data by YCharts

Shares in Apple are trading at a premium, with its forward price-to-earnings ratio at 32. However, as the table shows, this figure is below the same metric for AI rivals Microsoft and Amazon, indicating that Apple’s stock is a better value than both companies.

Apple also significantly outperforms both companies in free cash flow, which could mean it is better equipped to catch up with its competitors in AI and keep investing in its business. In addition to a solid growth history, Apple strikes me as a screaming buy in 2024 and beyond.