If you’re eyeing $1,000 in annual dividend income from Nike (NKE 1.72%) stock, you’re likely curious about how much you need to invest. First of all, congratulations on setting a specific investment goal! Now let’s see how reachable it might be.

Based on the athletic shoe and apparel giant’s most recent dividend announcements, I can calculate a forward-looking dividend yield to help answer that question.

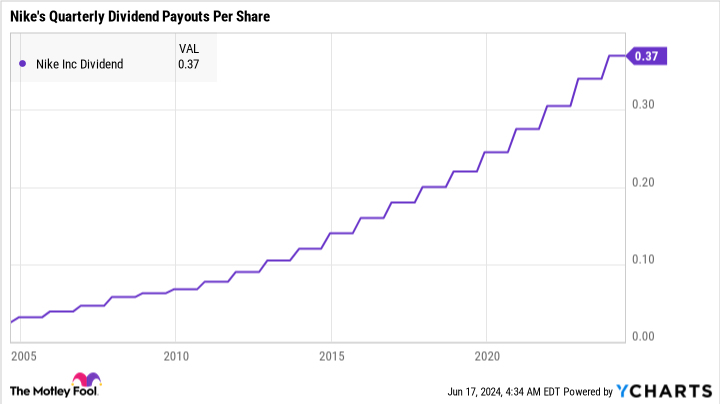

Nike’s dividend history

Nike’s quarterly dividend is currently $0.37 per share. That’s up from $0.34 per share a year ago, part of Nike’s consistent payout increases over the years:

NKE Dividend data by YCharts

Let’s do the forward-looking dividend yield math

To figure out the forward-looking dividend yield, start by annualizing the most recent quarterly dividend. The fresh dividend amount of $0.37 is multiplied by four, since there are four quarters in a year. This works out to an annual dividend of $1.48 per share.

Next, consider Nike’s current stock price. As of June 17, 2024, Nike’s stock is trading at $94 per share. This information shows the dividend yield by dividing the annual dividend by the stock price. In this case, the yield comes out to about 1.57%.

How much to invest in Nike for $1,000 in yearly dividend income

To achieve $1,000 in annual dividend income, the required investment follows this equation:

Required investment = $1,000 / forward dividend yield

Nike’s current forward dividend yield is 1.57%; $1,000 divided by 1.57% (or 0.0157 in decimal terms), results in $63,694. Hence, to earn $1,000 in dividend income annually from Nike stock, you would need to invest approximately $63,694 today.

It should be noted that Nike’s dividend yield is unusually high at the moment. The never-ending payout increases have met lower share prices since the start of the inflation-based economy crisis.

For comparative purposes, the forward yield stopped at 1.17% a year ago. At that point, securing a $1,000 annual dividend income would have required a Nike investment of $85,470.

Assuming that Nike can get back on its proverbial feet after this inflation-powered stumble, you should consider locking in Nike’s modest buy-in price and generous dividend yield while the getting is good.