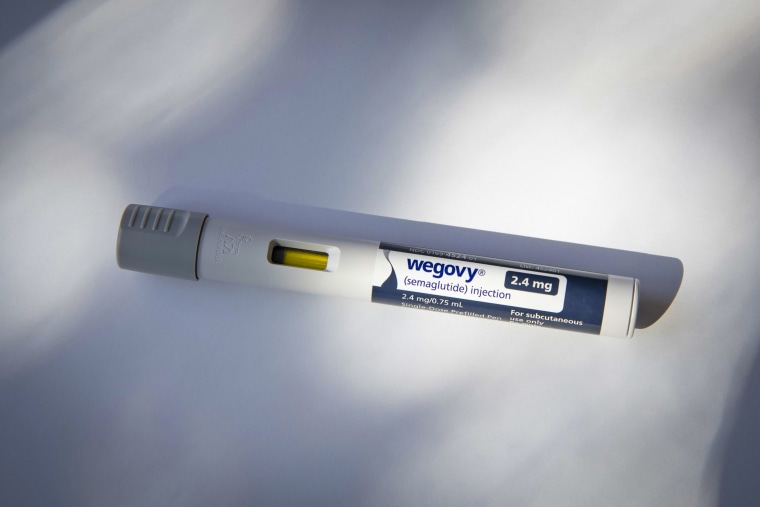

Novo Nordisk on Monday said it will spend $4.1 billion to build a new manufacturing plant in Clayton, North Carolina, in a bid to boost the supply of its blockbuster weight loss drug Wegovy, diabetes treatment Ozempic and other injectable therapies.

Demand for Wegovy and Ozempic has outstripped supply over the last year, spurring intermittent shortages in the U.S. and forcing the Danish drugmaker to invest heavily to increase its manufacturing footprint. The company said it plans to invest $6.8 billion in production this year, up from roughly $4 billion last year.

The new manufacturing facility will be responsible for filling and packaging syringes and injection pens for the drugs, according to a company release.

“This investment really gives us the opportunity to serve more patients,” Doug Langa, Novo Nordisk’s head of North American operations, said in an interview. “Importantly, I think the other key message here is it’s further investment in the U.S., so I think we’re very proud of that.”

Construction of the 1.4 million-square-foot facility has begun and is expected to be completed between 2027 and 2029, Novo Nordisk said. The company said 1,000 workers will staff the site, adding to the 2,500 employees already working at its three existing manufacturing plants in North Carolina.

That includes two sites that are already operational in Clayton — one responsible for fill and finish work and another dedicated to producing the active ingredient in the company’s diabetes pill Rybelsus. The company also has a site in Durham, North Carolina, responsible for manufacturing and packaging oral drugs and another facility in West Lebanon, New Hampshire.

Twelve other production sites are located in Denmark, France, China, Japan, Algeria, Brazil, Iran and Russia, according to a Novo Nordisk spokesperson.

Three lower doses of Wegovy are currently in shortage in the U.S. due to high demand, according to a Food and Drug Administration database. Patients start Wegovy with lower doses and gradually increase the amount every four weeks until they reach a target dosage.

Wegovy and Ozempic are part of a class of medications called GLP-1s that mimic hormones produced in the gut to suppress a person’s appetite and regulate their blood sugar.

Around 35,000 U.S. patients on average start Wegovy each week today, up from roughly 27,000 in May, a Novo Nordisk spokesperson said in a statement. Still, Langa said the company is being “very purposeful” about how many lower doses it is releasing into the U.S. market to ensure patients who have already started taking Wegovy can continue treatment with higher doses.

Rival drugmaker Eli Lilly has also committed billions of dollars to increase manufacturing capacity for its popular GLP-1s for weight loss and diabetes, Zepbound and Mounjaro. The company similarly has several production plants in North Carolina.