Warren Buffett is one of the best investors of all time. You can track which stocks Buffett is buying by reviewing the portfolio of his holding company, Berkshire Hathaway (BRK.A -0.45%) (BRK.B -0.28%).

Right now, he’s betting billions of dollars on two stocks with very similar business models. If you want to bet on Buffett, these two stocks are for you.

Warren Buffett loves this kind of business

Buffett has a very specific investing style. In most cases, he likes to buy businesses that he can hold on to for decades, if not forever. These types of businesses are very rare, but there is one trick you can use to identify them.

One of the most important characteristics to look for is the network effect. This characteristic describes a business that grows more powerful the larger it becomes.

Network effects are often used to describe social media platforms like Facebook or Instagram, both of which are owned by Meta Platforms. As more people use these platforms, even more people are incentivized to use them. After all, what good is a social network with only a few people using it? When it comes to network effects, big usually wins.

Network effects have produced some of the largest companies in the world. Who doesn’t want to invest in stocks that gain more durable competitive advantages the larger they become? If you’re looking for stocks like this, the two Berkshire investments below are for you.

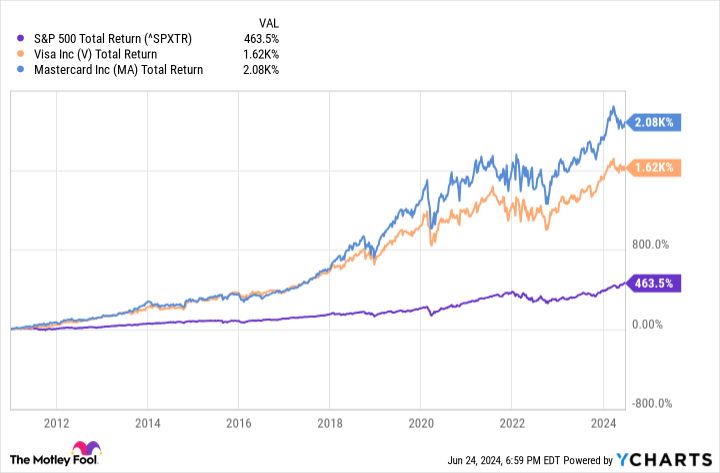

Berkshire is betting $4.2 billion on these two stocks

Visa (V -1.54%) and Mastercard (MA -0.36%) are some of the best network effect stocks today. Buffett and Berkshire Hathaway established a position in both in 2011. Fifteen years later, it’s one of the best moves he has ever made. Since the start of 2011, shares of both have trounced the S&P 500. According to filings, Berkshire’s Visa position is currently worth around $2.3 billion, while its Mastercard stake is valued at roughly $1.9 billion.

^SPXTR data by YCharts.

What has made these two such successful businesses? It all comes down to the network effect. A peek at each company’s market share tells this story perfectly.

According to data compiled by Statista, Visa and Mastercard together currently control 86.5% of the U.S. market in credit and debit cards. In 2007, they controlled around 81%.

Network effects naturally tend to create consolidated markets like this. Merchants want to accept payment methods that customers have access to. Meanwhile, customers only want to use payment methods that merchants will accept. The result is a handful of players dominating most of the market.

And as market share statistics demonstrate, network effects like this tend to strengthen over time. Over the next decade, there’s a good chance Visa and Mastercard will control more than 90% of this multitrillion-dollar market.

The best news is that shares of both companies aren’t as pricey as you might think. Right now, Visa trades at 31 times earnings, while Mastercard trades at around 37 times earnings. The S&P 500 trades at 28 times earnings.

Paying a small premium for an incredible business like Visa is a compelling opportunity, especially considering the company has been growing earnings by around 15% annually. Mastercard’s premium is also more than warranted, with earnings growing by around 30% per year.