During Tuesday’s U.S. market session, the Aptos price analysis shows a 5% jump to hit a 6% month high of $10.7. The uptick offers APT buyers the next stepping stone for a potential extended rally, fueled by a golden crossover between the 50- and 200-day exponential moving averages. Could this altcoin follow SUI’s price rally and see an 80% surge in Q4?

Missed the SUI Rally? Aptos Price Analysis Hints at an 80% Surge Ahead

Since mid-September, the Aptos price analysis showcased a high momentum rally from $5.65 to $10.55, accounting for 86% growth. The bullish trajectory managed to surpass crucial horizontal resistances such as $7.5 and $10.2, paving the way for further gains.

Maintaining this breakout would confirm that Aptos has escaped a 6-month consolidation phase, mirroring the pattern observed in SUI’s September rally. After its breakout, SUI saw a remarkable 102% price surge, reaching a new high of $2.36. With Aptos price analysis showing similar pre-breakout consolidation patterns, its recent breakout is expected to trigger a significant rally.

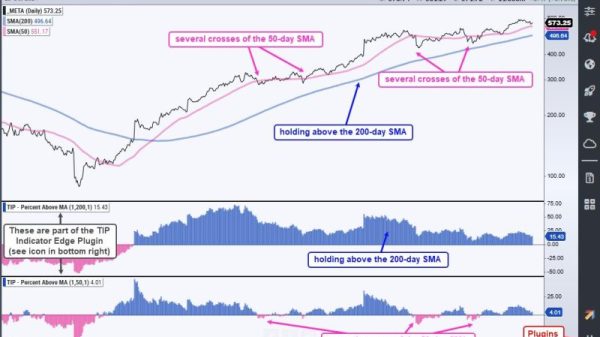

APT/USD 1-dChart

With sustained buying, the APT price could rally 80% to hit the $19.5 high resistance. Moreover, the daily chart analysis also shows a surge above key exponential moving averages (20, 50, 100, and 200), suggesting a positive shifting market sentiment.

APT Futures Open Interest Hits $250M as TVL Soars

According to DefiLlama data, Aptos’ total value locked (TVL) has surged from $328 million in early August to $739 million, marking a significant increase of over 125%. Generally, the rise in TVL indicates the investor’s confidence strengthening as more assets are locked into decentralized applications.

The Aptos network activity soaring should further boost user activity and drive natural demand for native cryptocurrency APT.

Within this period, the derivative market shows the APT future open interest surged massively from $54.58 to $250 Million— an increase. This increase signals heightened trader activity in speculation for future price movement.

These indicators suggest a bullish outlook for Aptos coin with the potential to drive a higher rally.

On the contrary note, if the Aptos price analysis failed a $10.2 breakout, the sellers would accelerate the bearish momentum to drive a major reversal. The potential downsizing could signal the continues to symmetrical triangle pattern.

The post Missed the SUI Rally? Aptos Price Analysis Signals Next 80% Surge appeared first on CoinGape.