SingularityDAO, Cogito Finance, and SelfKey have announced a strategic merger to form Singularity Finance. This new entity will enhance the tokenization of the artificial intelligence economy through a specialized Layer-2 network. The unified platform will introduce the SFI token as its core network token, consolidating the three existing tokens, SDAO, CGV, and KEY, into a single currency to streamline transactions and governance within the ecosystem.

SingularityDAO, Cogito, SelfKey Merge to Form Singularity Finance, SDAO Price Rally 19%

The collaboration between SingularityDAO, Cogito Finance, and SelfKey has resulted in the creation of Singularity Finance. This platform will transform the AI sector by tokenizing real-world assets and integrating AI into the decentralized finance (DeFi) landscape.

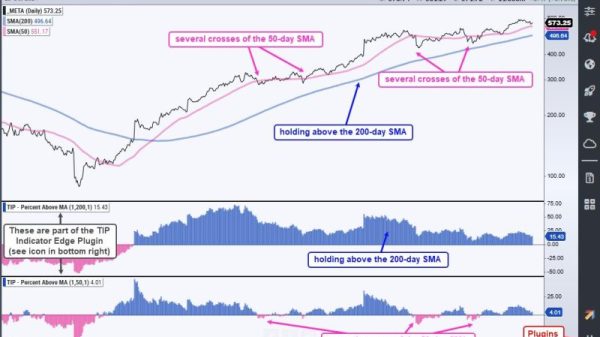

Moreover, the merger leverages each company’s strengths to create a robust Layer-2 solution on the Ethereum blockchain. It aims to democratize access to AI technologies and financial products. Following the merger announcement, SingularityDAO’s token, SDAO price, experienced a significant uptick, rising 19% to a trading price of $0.34.

Courtesy: CoinMarketCap

The new entity will deploy Cogito’s advanced tokenization frameworks as the merger progresses. SelfKey’s identity solutions will also be integrated to ensure compliant user participation. This strategy will offer enhanced liquidity and improved access to AI-driven financial tools.

Token Consolidation and Future Plans

In addition, the creation of Singularity Finance will consolidate SDAO, CGV, and KEY into the new SFI token. This move will unify the economic structure of the merged entities and simplify the user experience across its platforms.

However, the token conversion will take place based on different ratios, with consideration on the trading history of each tokens. In particular, the SDAO tokens will be exchanged for SFI at 1:80.353, CGV at 1:10.890, and for KEY token at 1:1 ratio. Selling of the SFI token will commence on the Ethereum and BNB Chain, but the expansion will be done on other blockchains after the mainnet scheduled for early 2025.

Before these changes occur some form of governance will be put in place to addresses them. As such, token holders will exercise their voting rights in several rounds of voting to take place before the end of October. This will create a community-based approach in the new financial environment.

Moreover, the merger will introduce decentralized marketplaces and financial instruments that leverage Artificial Intelligence to optimize asset management, risk assessment, and investment strategies. More so, Singularity Finance will facilitate the tokenization of physical assets like GPUs and extend to computational resources and AI models, thereby broadening the scope of assets available onchain.

SingularityDAO will revolutionize AI and DeFi through this merger, paving the way for a tokenized future in artificial intelligence.

The post SingularityDAO To Form AI-Focused Merger For New SFI Token appeared first on CoinGape.