BNB has experienced significant price fluctuations this year, reaching a high of $720 in June before undergoing a downward correction. More recently, technical patterns such as ascending triangles have signaled periods of consolidation, suggesting the market could be at a pivotal moment. With prices dipping, traders and investors are eyeing potential entry points

These patterns suggest that Binace Coin price could be preparing for a potential breakout, offering insights into its future trajectory. After peaking, BNB began forming an ascending triangle, hinting at consolidation and a possible continuation of the uptrend that began in October. However, the recent price correction has added uncertainty.

BNB Price Soars In DEX Trading Volumes: Should You Buy the Dip Now?

BNB has been performing strongly in decentralized exchange (DEX) trading, ranking third among the top networks by volume over the past 30 days as investors are left wondering if this could be the right time to buy the dip and position for the next rally.

Top 15 networks by trading volume on DEX over the last 30 days #SOL #ETH #BNB pic.twitter.com/cRAtDVJrPd

— CryptoLens.News (@cryptolens_news) October 22, 2024

According to recent data, Binance Smart Chain recorded a significant $21.8 billion in trading activity, closely following Ethereum and Solana, which led with $41.6 billion and $37.7 billion, respectively.

This highlights BNB’s continued relevance in the decentralized finance (DeFi) space, where it remains a key player.

Will Binance Coin Price Hit $620 This Week?

The token has shown volatility over the past week, reflecting the broader crypto market trend. Bitcoin recently surged above $67,000, but profit-taking activity has introduced some instability. This led to a minor correction, pulling the current BNB price down to around $595, marking a slight dip of 0.31%.

The Relative Strength Index (RSI) shows a reading of 47, indicating neutral market conditions.

BNB price is showing encouraging signs of a potential bullish trend. If upward momentum returns, the token could test the $610 resistance level. Furthermore, sustained buying pressure may push major altcoins beyond $615 in the near future.

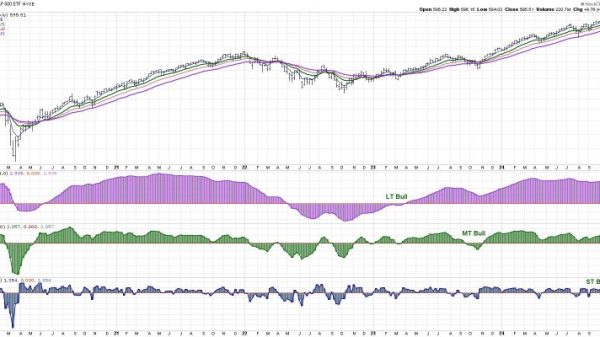

BNB Price Chart| Source: TradingView

The whale activity has correlated with a recent dip in BNB’s price, as the percentage of stablecoins held by whales has increased. Despite accumulating more than $5 million in stablecoins, BNB’s price has declined, suggesting that large investors may be repositioning in the market.

Source- Santiment

BNB price faces a pivotal moment. While short-term volatility persists, a breakout above $610 could signal a bullish turn.

The post BNB Price Prediction: Is It Time To Buy the Dip Now? appeared first on CoinGape.