Although the broader crypto market outlook has been sideways, Ethereum price is traversing a smaller range. For the first time in the past 85 days, ETH has shown signs that it is edging closer to breaking out of this range.

This optimism can be attributed to Bitcoin’s recent surge beyond $70,000 and toward an all-time high (ATH) of $73,949. Therefore, a successful breakout from the ongoing consolidation could mean ETH price retests $3,100 and is the next target.

Ethereum Price Likely, Hints MVRV Indicator

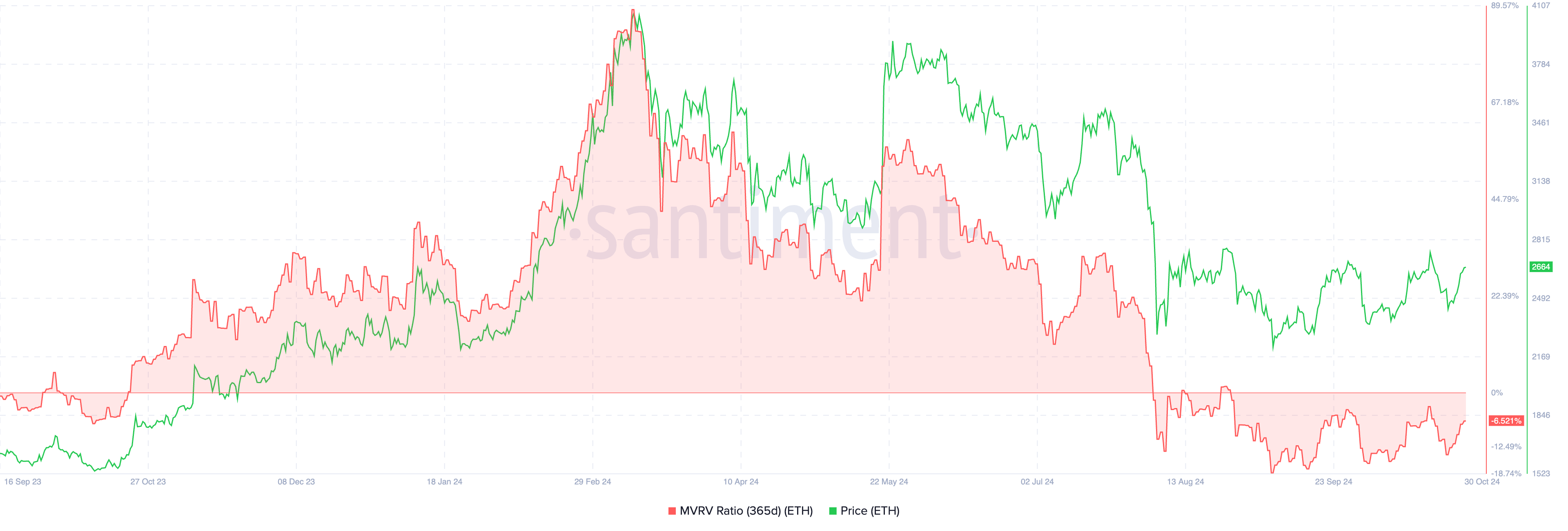

Santiment’s 365-day Market Value to Realized Value (MVRV) indicator shows key signals that suggest that long-term holder accumulation could be coming to an end. The metric has hovered between -17% and 0 for the past 85 days.

A negative 365-day MVRV value indicates that investors who bought ETH in the past year are underwater. Long-term holders often accumulate at these levels where short-term holders capitulate. Hence, massive negative spikes create opportunity zones that lead to quick price reversals.

To conclude, the 365-day MVRV day suggests that the value of ETH is set to inflate in the coming days.

Let’s see what technical analysis has to say about Ethereum price forecast.

ETH Technical Analysis: Ethereum’s Next Logical Target is $3,100

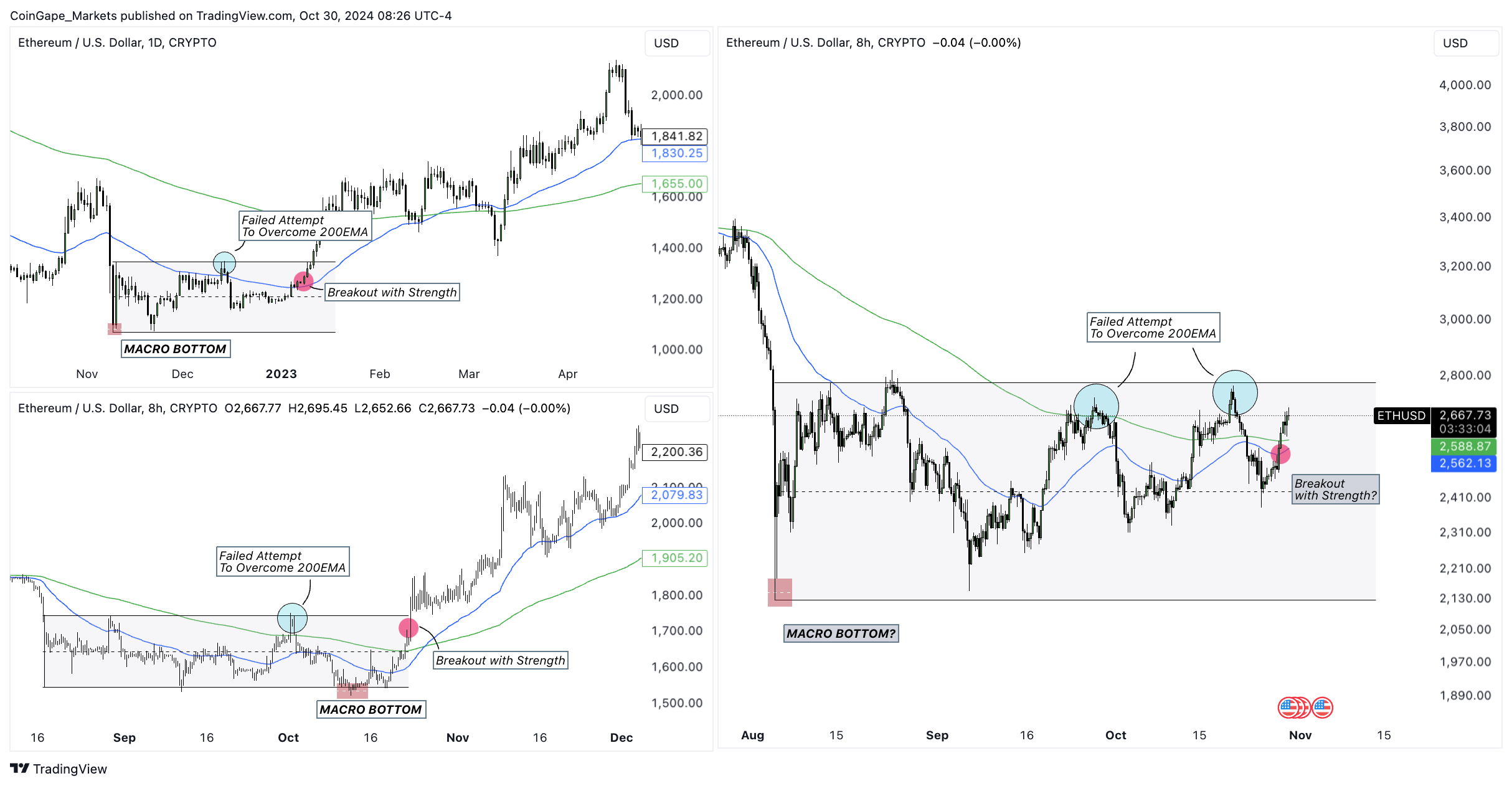

From a technical standpoint, Ethereum price action is a fractal. ETH is repeating a similar move that was seen twice. Interestingly, these patterns formed also marked macro or cycle bottoms, i.e., rally that began here lead to new all-time highs for ETH.

From a long-term perspective, the cycle bottom for Ethereum price formed on August 4 at $2,127.

From a short-term perspective, however, ETH could retest $3,141, which is key supply zone. This area was followed by a massive crash to $2,127. Hence, revisiting this area could trigger some of the unfilled orders.

The first confirmation of the oncoming uptrend is the breach of the 50-period and 200-period EMAs. The second one would be a crossover between the aforementioned EMAs. If this development occurs with a breakout from the 85-day range, it would propel ETH to $3,141.

On the other hand, if Ethereum price fails to move higher due to a sudden, unexpected crash in Bitcoin price, then the 50-period and 200-period EMAs at $2,588 and $2,562 will serve as support floors. A breakdown of these levels is the first signal of bullish momentum failure.

A breakdown of the October 25 swing low of $2,382, will invalidate the bullish thesis for ETH. Such a development could send Ethereum price down to $2,270. In dire cases, the smart contract token could drop to $2,127.

The post Ethereum Price Eyes $3,100 After Bitcoin’s Revival appeared first on CoinGape.