In its most recent report examining the implications of digital assets, the US Treasury noted that the “growth in stablecoins has resulted in a modest increase in demand for short-dated Treasuries.”

The 132-page report, released for the Treasury Borrowing Advisory Committee, discusses digital assets, focusing on major players like Bitcoin and stablecoins.

US Treasury: Stablecoins Boosting Treasury Demand

In its latest report on the implications of digital assets, the US Treasury said the “growth in stablecoins has led to a slight increase in short-dated Treasuries demand.”

The 132-page report, issued Wednesday for the Borrowing Advisory Committee, contains a small section on digital assets based upon more prominent players such as Bitcoin and stablecoins.

As the the authorities said, “Digital assets have proliferated from a low starting point. That growth has come from native cryptocurrencies, such as Bitcoin and Ethereum, as well as stablecoins.”

The aggregate market capitalization of digital assets remains relatively low compared with other financial and real assets. This growth does not seem to have impinged on demand for Treasuries.

Tether’s Treasury Holdings Revealed

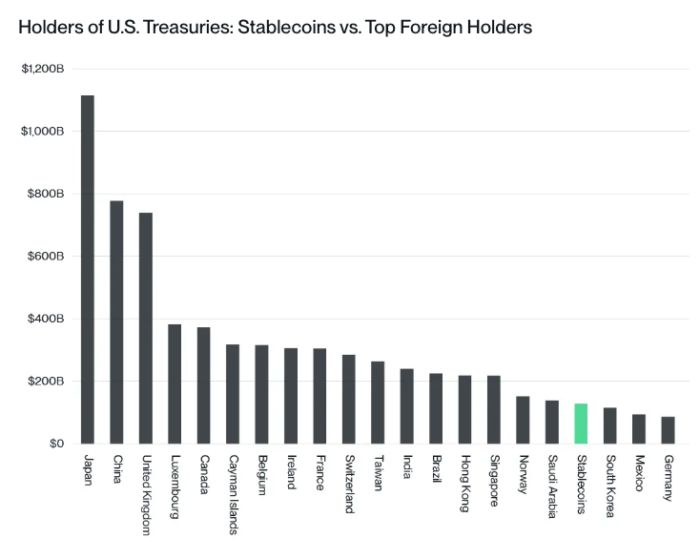

Tether, the company behind USDT, has said it puts a significant portion of the cash backing its token into US Treasury. According to CEO Paolo Ardoino, Tether owns more Treasury bills than countries like the UAE, Australia, and Spain.

An estimate from the US Treasury puts close to $120 billion of stablecoin collateral invested in US Treasuries. That includes Tether holding almost $81 billion in T-bills. The aggregate market capitalization of all stablecoins, stands at over $177 billion.

It observed that “stablecoins play an integral role in intermediating transactions in digital asset markets.” Today, over 80% of all crypto transactions involve a stablecoin as part of the transaction.

Going forward, the Department looked ahead to the possibility of continued stablecoin growth and potential problems. “Medium-term regulatory and policy choices will determine the fate of this ‘private currency, ‘” the report said. “History shows that ‘private currency’ that fails to meet regulatory requirements can lead to financial instability.” Therefore, it is highly undesirable.

In reviewing Bitcoin, the Department also stated that structural demand for Treasuries may increase with the digital asset market cap both as a hedge against downside price volatility and as an ‘on-chain’ safe-haven asset.

Circle CEO: Stablecoins to Hit $10 Trillion Market Cap

Recently, Jeremy Allaire, chief executive officer of Circle, predicted that stablecoins are about to become a big part of the global financial system and not just US Treasury. Circle is a financial services company issuing USDC, the second-largest stablecoin in the crypto market.

Jeremy Allaire is one of the masterminds lobbying for the stablecoin regulation in the US. The point many makes is that with proper regulatory guidance, the firm can create and grow the stablecoin products properly.

The recent interview by Allaire on the future of the stablecoin ecosystem included a projection of stablecoins capturing 5% to 10% of a $100 trillion money supply over the decade as the technology evolves-just as other financial innovations have.

If realized, this would imply a potential market capitalization of $10 trillion for the entire stablecoin segment. This is quite ambitious considering the current market cap is about $170 billion. Still, USDC has a market cap of $35 billion, relatively low compared to USDT, with market cap of over $120 billion.

The post Stablecoins Driving Demand for Short-Dated Treasuries, Says US Treasury appeared first on CoinGape.