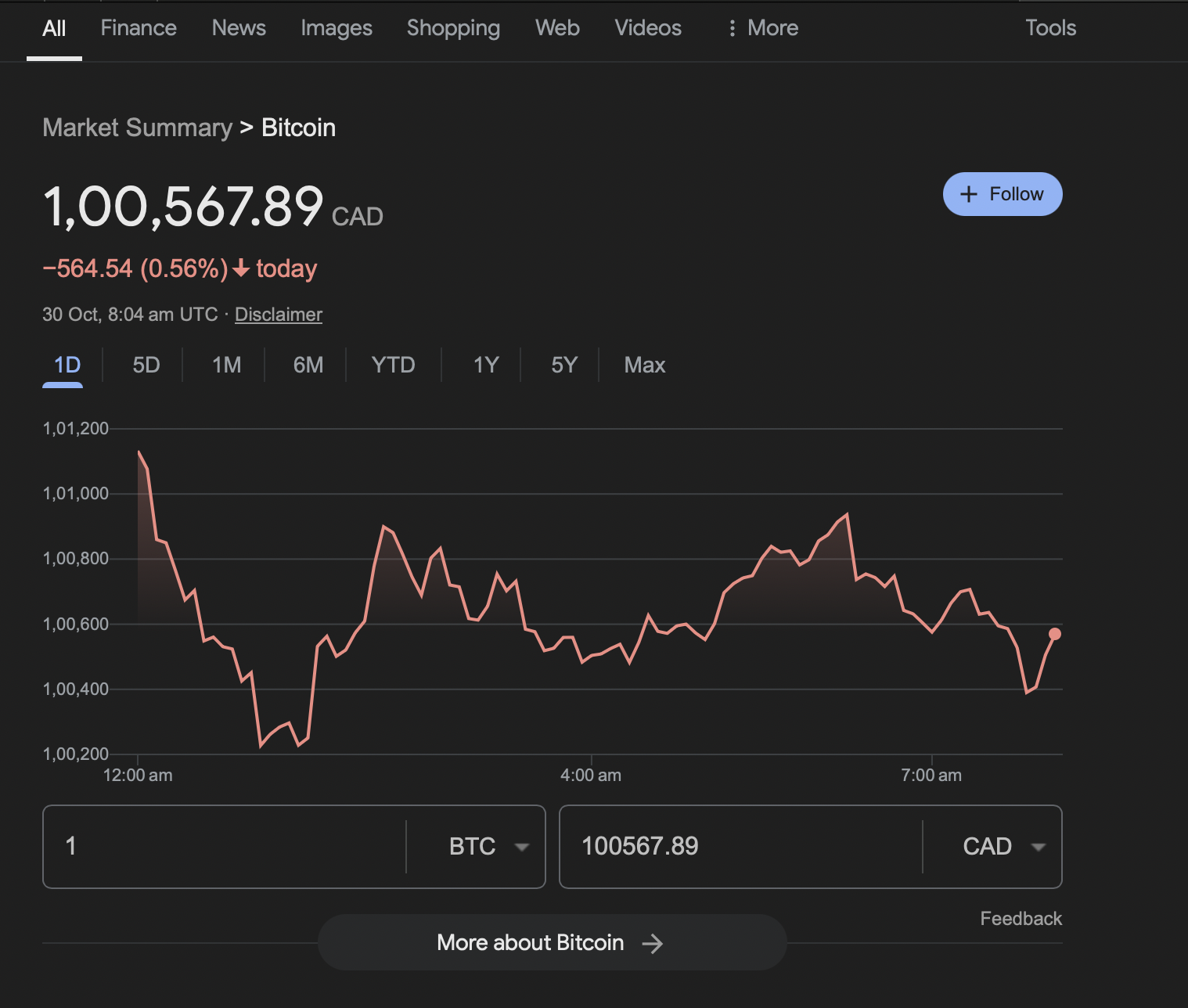

Bitcoin price hit $100,000 in Canada, i.e., BTC denominated in Canadian Dollars (CAD) touched the six-digit mark today. While the US dollar dominated, BTC price came close to retesting its all-time high of $73,949.

Let’s analyze the top factors that affected this Bitcoin surge to $100,000

Why Bitcoin Pirce Hit $100,000 in Canada

The past few weeks have been extremely bullish for Bitcoin price as it rallied 40% in just 52 days, bringing the year-to-date gains to 71%. As BTC stands just a few $267 away from its 2024 peak, the Canadian-denominated Bitcoin value hit $100,000 today. Let’s analyze five factors why this happened.

- The price of BTC in Canadian dollars not only hit $100,000 but also created a new all-time high of $102,202 on October 29. This is mainly because of the variation between the forex pairs, such as USD, AUD, or others.

- The second reason why Bitcoin prices surged to $100,000 in Canada is the rate of inflation, which is different for each country.

- The Canadian central bank policies are different from those of the US, which could be another reason why the BTC shot up to six digits.

- Additionally, investor sentiment and decisions based on these macroeconomic policies are different and could have contributed to this recent uptick in BTC to new highs.

- The fifth reason is simply the shift in the crypto market and investor sentiment in the past few weeks. With these holders overcoming the macroeconomic policy shift, geopolitical tensions, and massive supply overhangs, it was bound for Bitcoin to surge to new highs.

What’s next for BTC?

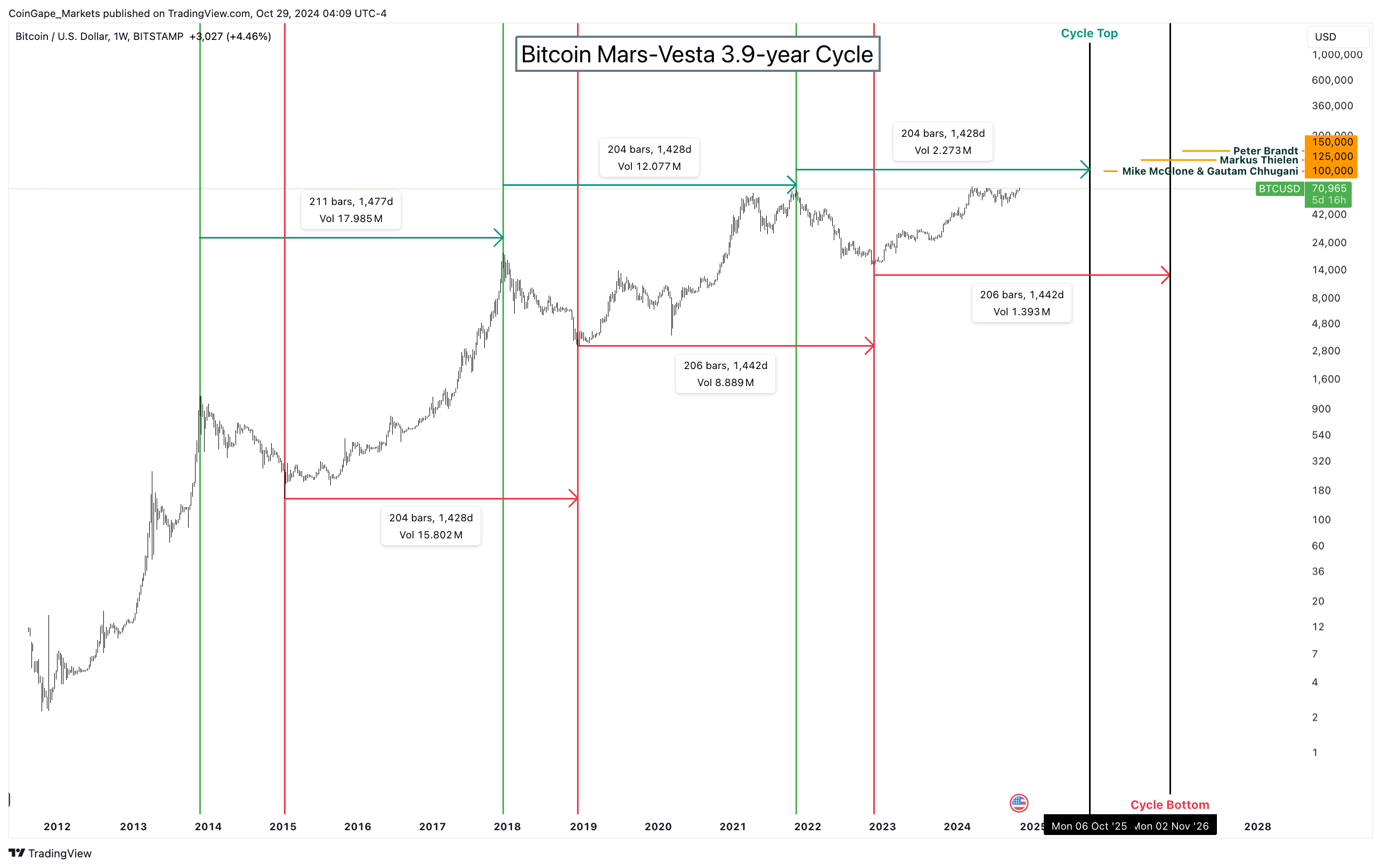

With the sentiment optimistic, it wouldn’t be long before Bitcoin denominated in the US dollar will also hit a new all-time high. Additionally, investors can expect the BTC/USD pair to also hit a six-digit territory. In a recent CoinGape article, we explore where the next Bitcoin top could formed based on the astrological positions of planet Mars and Vesta, the second largest asteroid in the asteroid belt.

Based on this thesis, October 2025 is when Bitcoin price could hit a local top. Bitcoin price forecasts from many experienced investors like Peter Brandt, Jamie Dimon, Larry Fink, Michael Saylor, and so on have different targets, but all agree that a six-digit value for one BTC is highly likely.

The post Top 5 Factors Why Bitcoin (BTC) Price Surged to $100,000 in Canada appeared first on CoinGape.