Chainlink (LINK) price, a key player in the blockchain industry, is gaining bullish traction with signs of further upward movement. Recently, LINK has shaped an ascending triangle pattern, hinting at potential gains ahead as it rebounds from prior lows. Analysts are optimistic about this momentum, setting their sights on the $15 mark as pivotal for LINK’s projected growth. This renewed optimism suggests a positive outlook for the token’s trajectory in the coming period.

Chainlink Price Target: Analyst Eyes $15 Breakout

A crypto analyst shared an X post highlighting a potential bullish breakout for Chainlink. The analyst noted that LINK is moving closer to a breakout point, drawing attention to an ascending triangle pattern on the chart.

This technical setup suggests that if the Chainlink price surpasses the current resistance level, it could continue a bullish uptrend.

Chainlink price is showing renewed momentum, with analysts setting a potential target at $15. This level is crucial, as breaking it might further affirm LINK’s upward trajectory. The pattern’s consistency bolsters the optimistic outlook, indicating that a resistance break could pave the way for sustained gains.

LINK Price Analysis: Is Bullish Momentum Signaling a Stronger Rally Ahead?

The top altcoin has shown a notable surge in value. The price of LINK is $11.95, reflecting a 4% increase over the last 24 hours. Within the same period, the price fluctuated between a low of $11.43 and a high of $12.12.

Today’s crypto market showcased a mix of price shifts, sparking global investor interest. BTC holds above the $72,000 mark, while ETH has surpassed $2,600, strengthening investor optimism. This trend has boosted other altcoins, with the Chainlink price experiencing notable volatility.

Currently, the Chainlink price prediction faces resistance at $12.10. If bullish pressure continues, LINK might target $13. If momentum builds further, LINK could potentially climb to $15.

The Moving Average Convergence Divergence (MACD) indicator reveals potential bullish signals. The MACD line (blue) has crossed above the signal line (orange), suggesting upward momentum. The histogram’s positive green bars reinforce this trend, indicating growing bullish pressure.

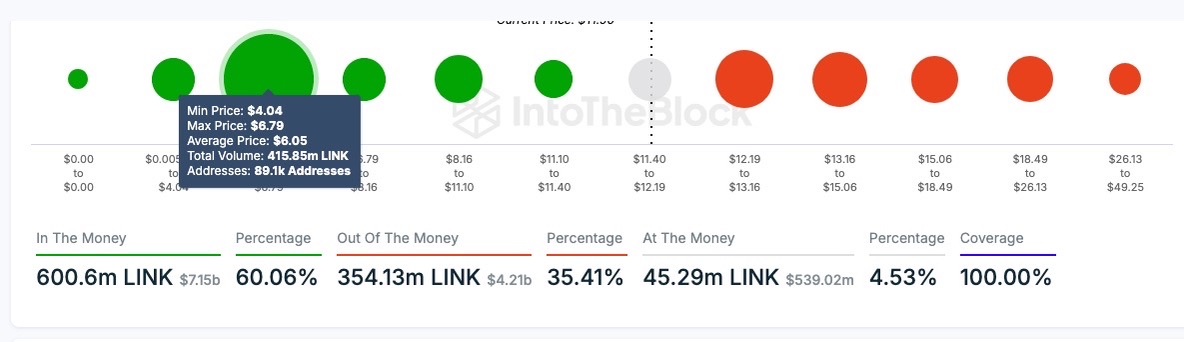

The latest LINK analysis shows 60.06% of LINK holdings, worth $7.15 billion, “In the Money” between $4.04 and $6.79. Meanwhile, 35.41%, valued at $4.21 billion, is “Out of the Money,” with 4.53% “At the Money.” This highlights holder profitability and price distribution in the LINK market.

The Chainlink price bullish momentum, supported by technical patterns and key resistance levels, suggests a potential for further gains. Breaking $15 could confirm its upward trajectory, positioning LINK favorably. Investor optimism remains strong, with profitability levels underscoring LINK’s potential for sustained growth.

The post Will Chainlink Price Skyrocket Above $15 This Week? appeared first on CoinGape.