Bitcoin (BTC) price hit $73,681 on Bybit exchange on October 29 but failed to retest the all-time high (ATH) of $73,949. Although BTC was $267 away from its peak, there are no signs that investors have comeback yet. Hence, a potential crash could be brewing for Bitcoin.

In this CoinGape article, we will explore two signs that point to this bearish downturn for Bitcoin price.

Will Bitcoin Price Crash Again?

Yes, there are high chances of a crash for Bitcoin price. The upcoming US presidential election results on November 5 could induce volatility in the financial market not just in the US but across the world. Bitcoin and crypto markets could suffer a short-term setback as well.

Here are two reasons why BTC price might crash.

Bitcoin Active Addresses Shows Lack of Investor Interest.

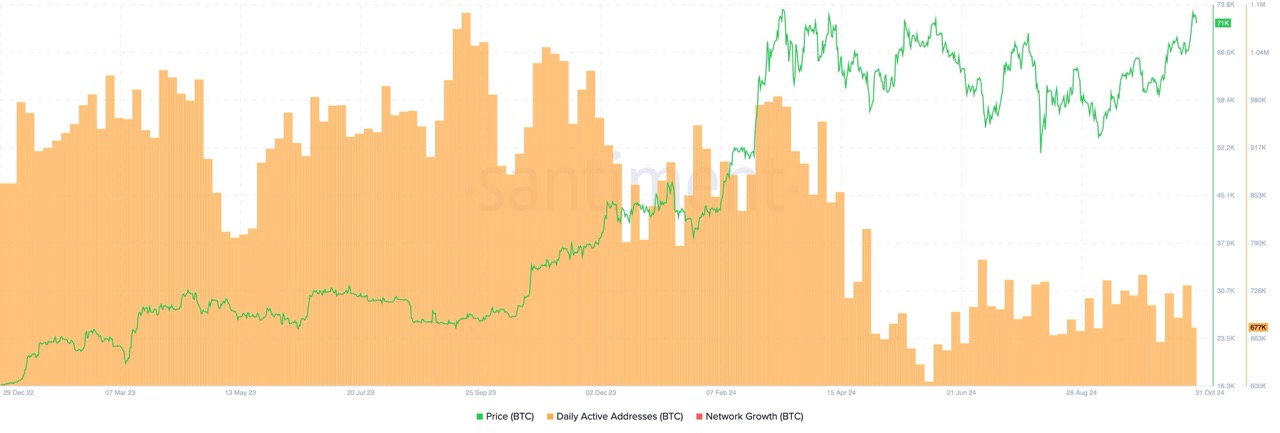

Active addresses on Bitcoin blockchain is currently hovering around 734K, which is 25% lower compared to 986K as seen on ATH in March 2024. A reduced investor interest shows that there is less capital flowing into BTC and the recent rally could be driven by fumes.

The reason for the lack of participation can be attributed to the US presidential elections that is set to air the results on November 5. This clear signal indicates that many investors are hesitant and are waiting for the conclusion of US presidential elections are over.

Investors Not Bullish On BTC Due to US Presidential Election

According to Polymarket, an online betting plaform, there is an 8% chance that Bitcoin price hits $80,000 before the US presidential elections. This information outlines how pessimistic investors are ahead of this key political event.

With this outlook in mind Bitcoin price predictions should be tempered and not bullish.

Bitcoin Price Analysis: Key BTC Levels

According to the daily chart, the seven-month consolidation has created a value area that extends from $68,958 to $59,364. As of October 31, BTC has crashed nearly 4%. If this outlook continues, then the next key supprot level is $68,958, which is the value area high.

If Bitcoin is bullish, it should not slip below this critical support level. In case there is a breakdown of this foothold, investors should consider themselves warned of a steep correction. The next key area of interest would be $63,099. This is the highest volume traded level in the past seven months. In case of a strong sell-off, Bitcoin price could revisit the vaule area low at $59,364.

A breakdown of $68,958 could lead to an 8% to 13% crash in Bitcoin price.

On the other hand, if Bitcoin price bounces off the $68,958 support level and stays above it until after the US elections are over, it signals strength. Such a development could send Bitcoin price to all-time high in November.

The post Will Bitcoin Price Crash Again As Active Addresses Are 25% Lower Than ATH? appeared first on CoinGape.