As November rolls in, Sui price shows no signs of slowing down. The price of SUI is on a short pullback after the entire crypto market hit a snag following the U.S. Stock market crash late October 31. The crypto market cap is down 5.3% and Bitcoin price is trading below the $70,000 price level. Despite the red markets, analysts are bullish on the price of SUI, which has skyrocketed over 400% from August 5 to October 31.

Why Sui Price is Poised to Continue Pumping In November

The price of SUI is currently trading at $1.93, which represents a 6.8% drop in the last 24 hours. From here, the asset is about 35% from its all-time high price of $2.34 before it can once again taste price discovery.

On-chain metrics are some of the strongest and signal the asset could extend its gains in the month of November. Here are three compelling reasons why the price of SUI is set to continue to rip this month.

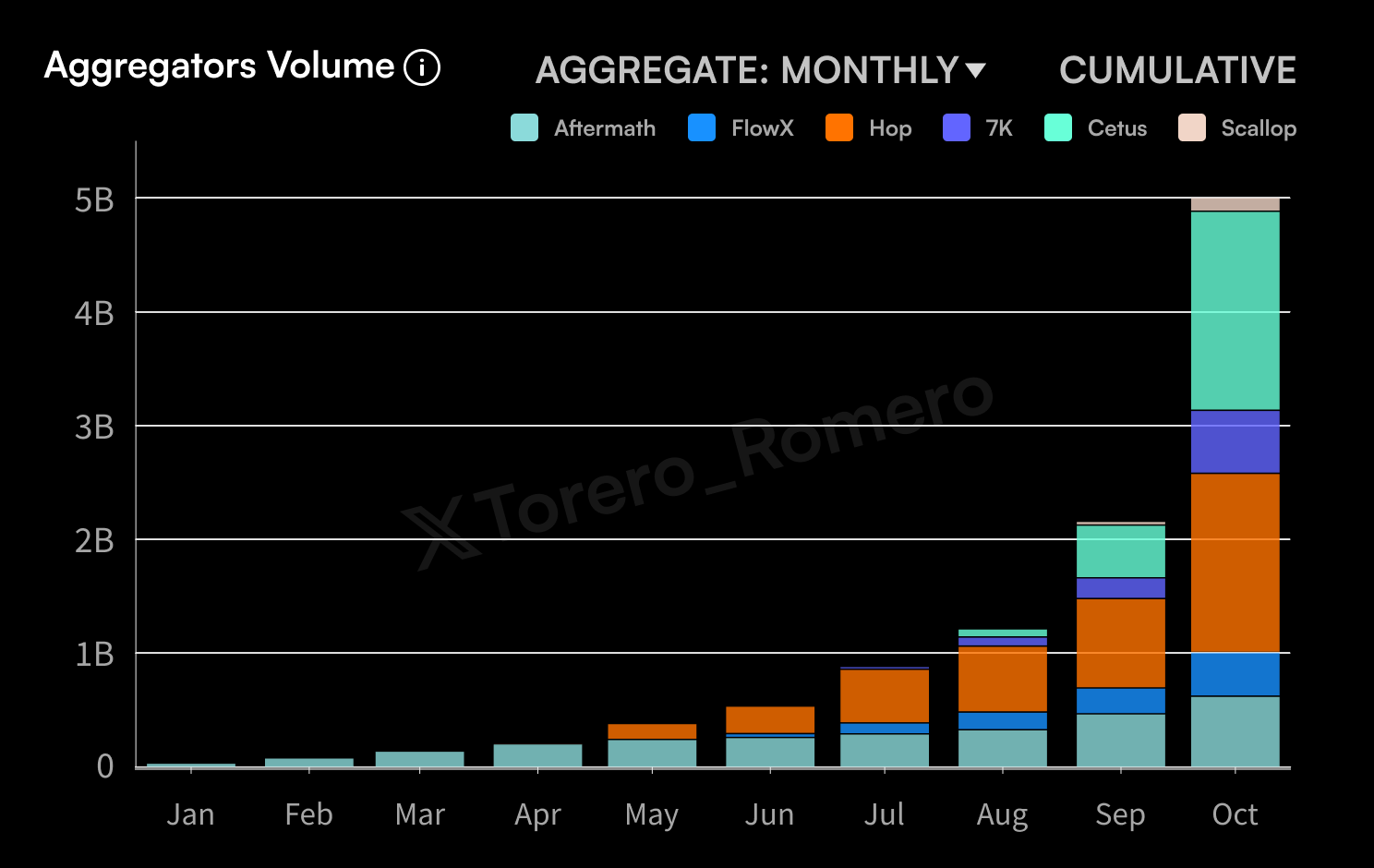

1. Sui Network Aggregators Hit $5 Billion

Trading volume on Sui’s decentralized finance (DeFi) aggregators soared to $5 billion in October, the highest recorded ever. Cetus raked in the most volume, followed by Hop protocol, Scallop and 7K.

The surge in trading volume indicates an increase in market activity and interest which can lead to increased price volatility, as more users join the ecosystem.

Additionally, SUI token reached $150 billion cumulative monthly trading volume in October. High volume typically suggests strong momentum, and is an indicator of crypto assets that about to explode in price. In this case DeFi on the network could reach new all-time highs in November, pulling SUI price up.

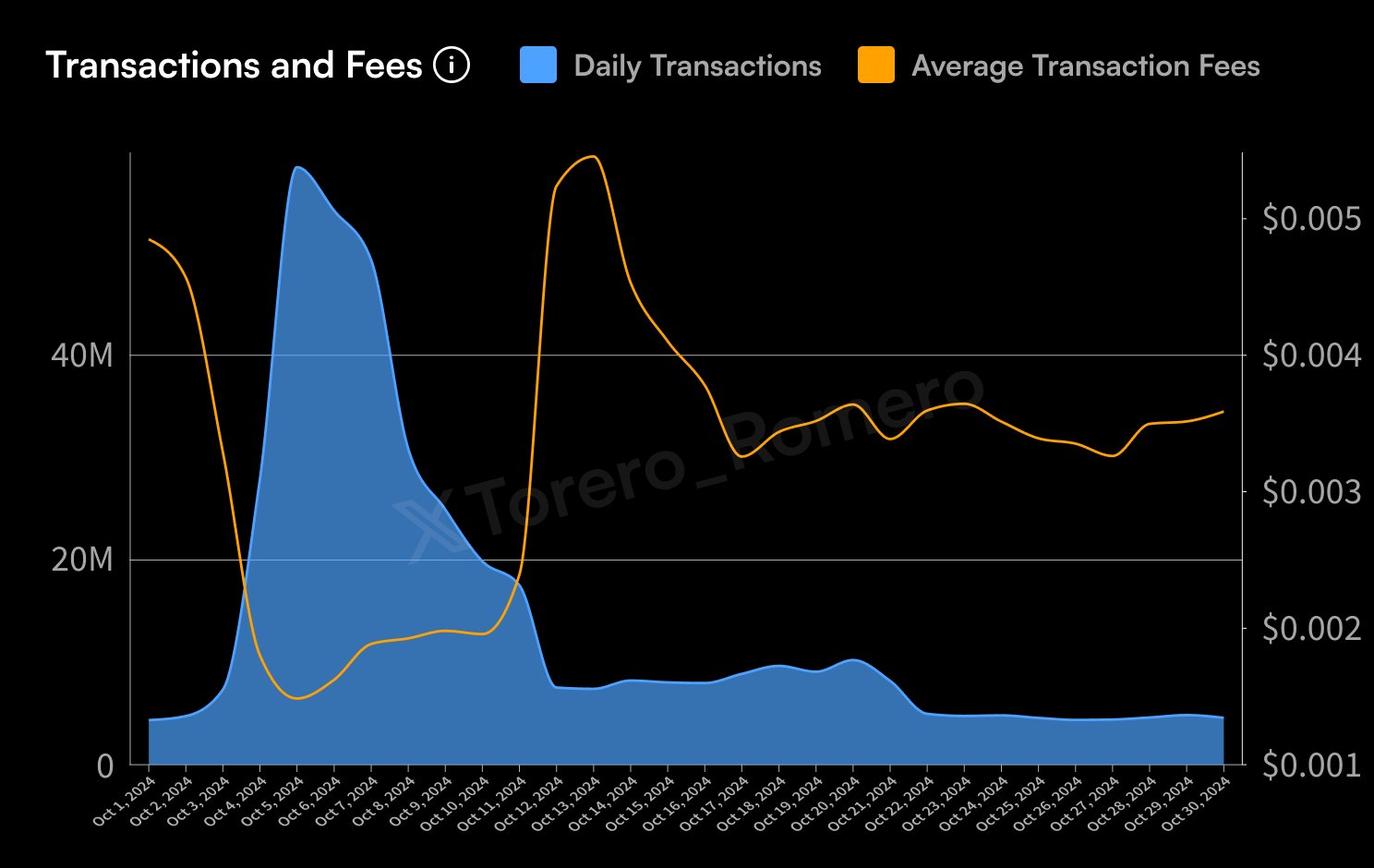

2. Volume Rising, But Fees Are Dropping

This is perhaps the most compelling reason for a SUI all-time high in November. The average daily transaction fees on the network dropped while transaction volume increased throughout out the month of October. The average transaction fee in October was $0.00331, the cheapest among a majority of the blockchains.

This interesting trend suggests that the network is becoming more efficient and scalable. Lower fees can attract more users and developers to the network, potentially boosting overall activity, adoption, and price.

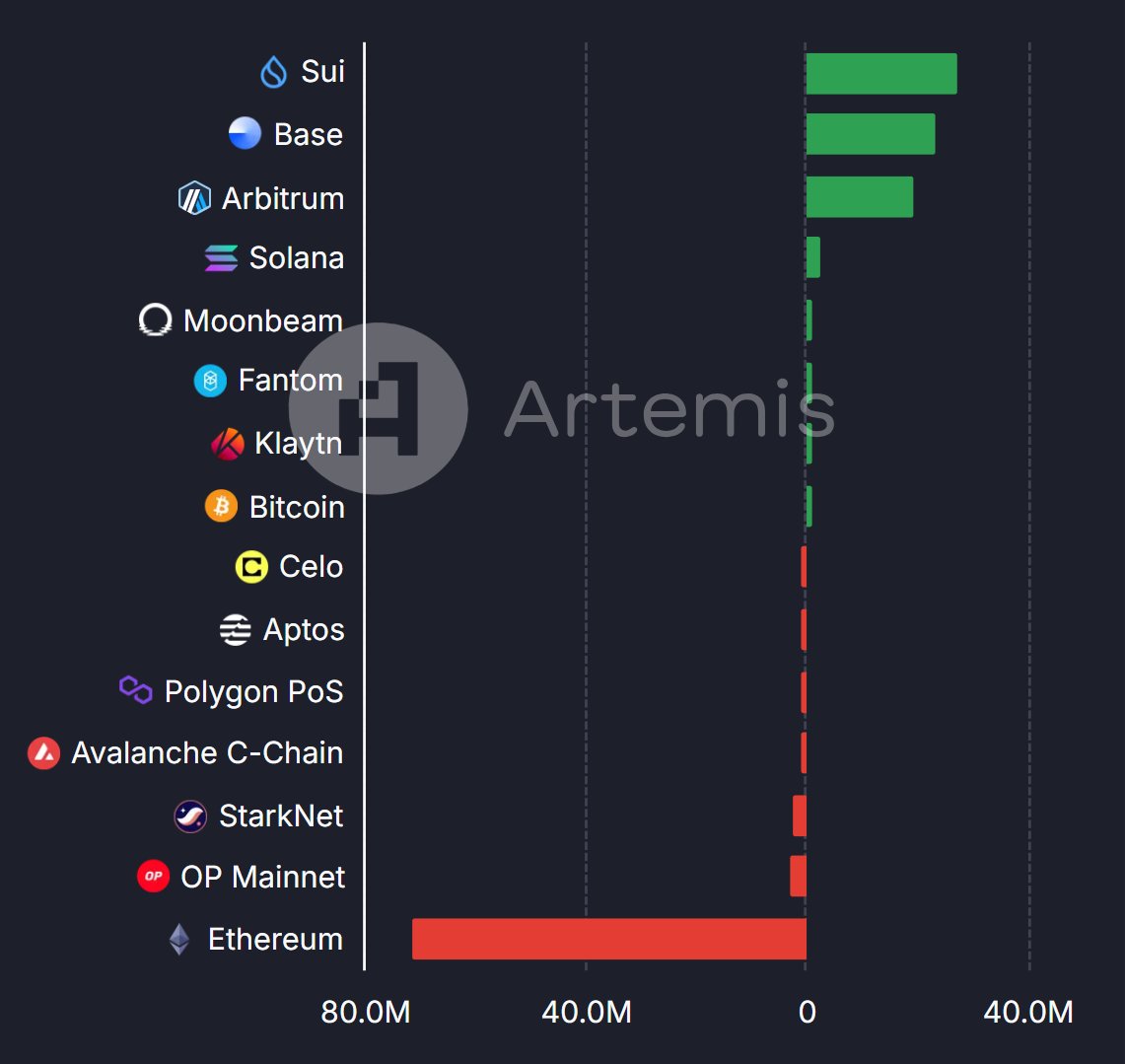

3. Active Accounts on Sui Top 25 Million

Sui network active account hit an all-time high of 25 million up from less than 2 million in early July. This is an exponential growth that has reflected in its price and could propel the asset to reach for higher highs this November.

On October 27, data from Artemis Analytics shows Sui saw massive inflows of funds from Ethereum, suggesting that investors are looking for greener pastures.

In the same week, the network also recorded the highest net inflows among all chains, dwarfing Ethereum, Solana and Arbitrum which came in second, third and fourth, respectively. SUI had over $20 million net inflows while Ethereum followed behind with about $10 million.

How High Can Sui Go in November?

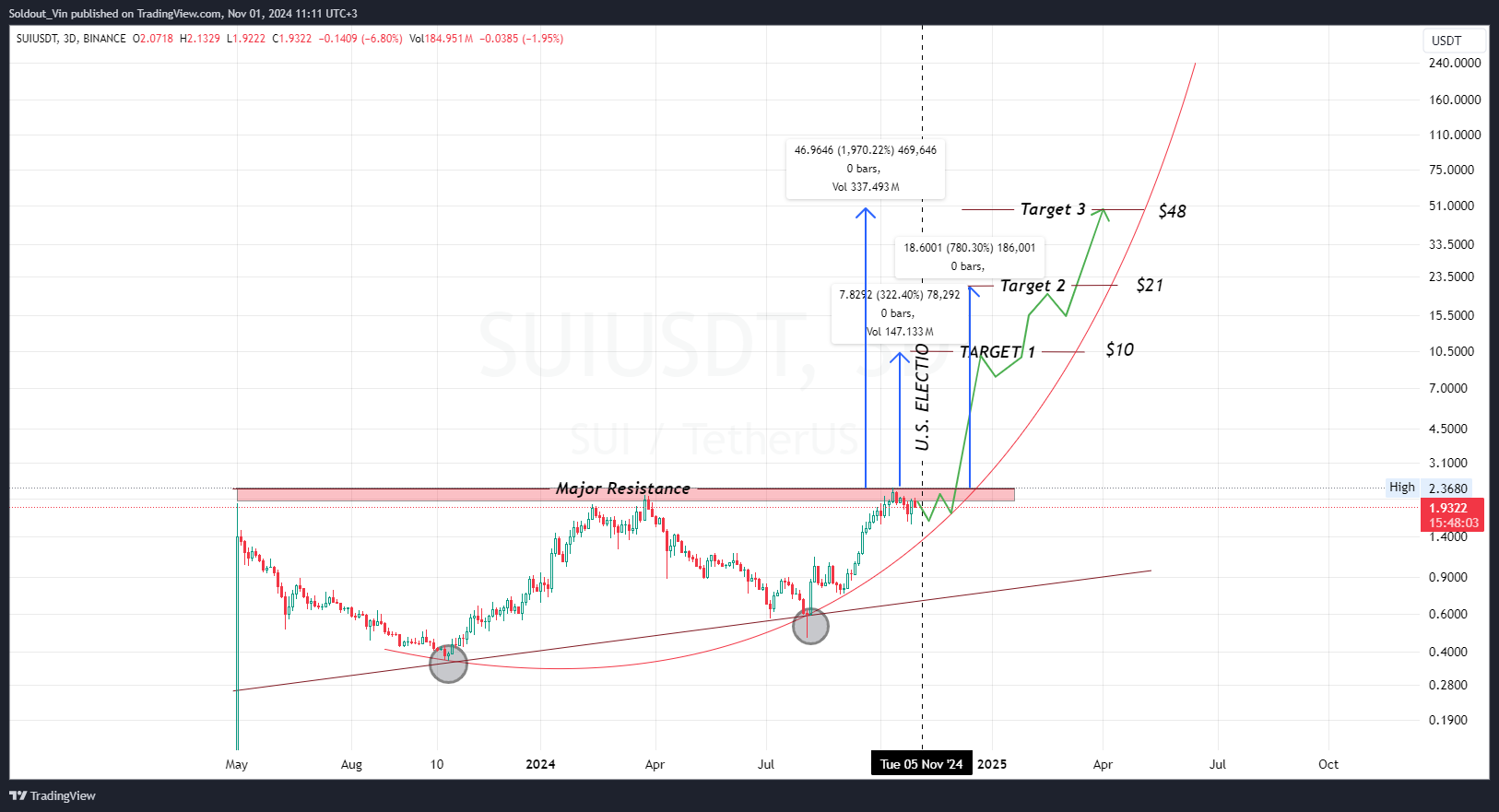

Sui price analysis suggests that is ready to soar as high as $48 in November. The main catalyst, on top of the robust on-chain metrics, is the upcoming U.S elections next week. Already the network has PolitiFi meme coins from either party ready to explode no matter which candidate wins.

Meme coins have contributed to Solana’s impressive growth this years and in the coming weeks following the election, we could see a repeat performance from SUI.

Key levels to watch for include $2.34 resistance, which if broken could catapult price to $10, $21 and $48. Conversely, if price breaks below the parabolic curve, the asset could turn bearish, dropping to $0.60.

The post 3 Reasons Why Sui Price Will ‘Continue To Rip’ In November appeared first on CoinGape.