Bitcoin’s price momentum in October, affectionately dubbed “Uptober,” saw an approximately 12% gain, sparking speculation about a potentially “nuclear” rally. At the center of the buzz are rumors that over-the-counter (OTC) desks, commonly used by institutional buyers to acquire large amounts of Bitcoin without moving markets, are starting to run dry. This supply crunch, driven by growing institutional demand, is leading traders to predict that a Bitcoin squeeze may soon drive prices to new all-time highs.

The Bitcoin OTC Supply Squeeze: Institutions Quietly Drive Up BTC Demand

Crypto influencer Alex Becker and others have voiced concerns that institutions have been quietly buying up Bitcoin in massive quantities, suggesting a strategic plan behind these moves. Becker claims institutions are positioning to drive up Bitcoin’s price, noting,

Absolutely absurd amounts of Bitcoin is being bought OTC by institutions. When they have enough, they will have the media blast news about a new Bitcoin all-time high. Retail will then flock to Coinbase where there will be no supply left. Price will go nuclear. It’s planned.

This approach of absorbing available supply before driving media interest is familiar territory for institutional investors aiming to capitalize on retail FOMO (fear of missing out), which Becker and others believe could set off a chain reaction, pushing prices even higher.

The Bitcoin Therapist, another crypto trader, adds to the conversation by acknowledging circulating rumors of OTC desks running dry on Bitcoin, with a potential price squeeze on the horizon.

Rumors are circulating OTC desks are running dry on #Bitcoin and a squeeze is coming.

— The ₿itcoin Therapist (@TheBTCTherapist) November 1, 2024

As Bitcoin becomes increasingly scarce on OTC markets, retail traders will likely face a significant supply shortfall on public exchanges, potentially driving up prices due to high demand and limited availability.

All-Time Highs Within Reach as Institutional Interest Pushes Demand

Historically, institutional accumulation has played a vital role in Bitcoin’s price rallies. The recent October spike marked the largest monthly gain for Bitcoin since June, with prices hovering near $70,000. If the rumors about Bitcoin OTC supply shortages hold true, some analysts foresee a supply-demand imbalance that could push Bitcoin towards its previous all-time high and beyond.

This potential price surge comes at a time when Bitcoin has been trading within sight of its all-time high of $73,679, recorded earlier this year. While Bitcoin’s October gains are slightly below the month’s historical average of 22%, the anticipation of a squeeze suggests that major price action could still be in the cards for November and beyond.

Crypto experts point to Bitcoin’s scarcity and institutional interest as two key drivers that could combine to set off a “nuclear” rally, as mentioned by Becker and echoed by other traders.

At the time of writing, Bitcoin price has settled at $69,268.73.

Emerging Opportunities: The Role of Rexas Finance

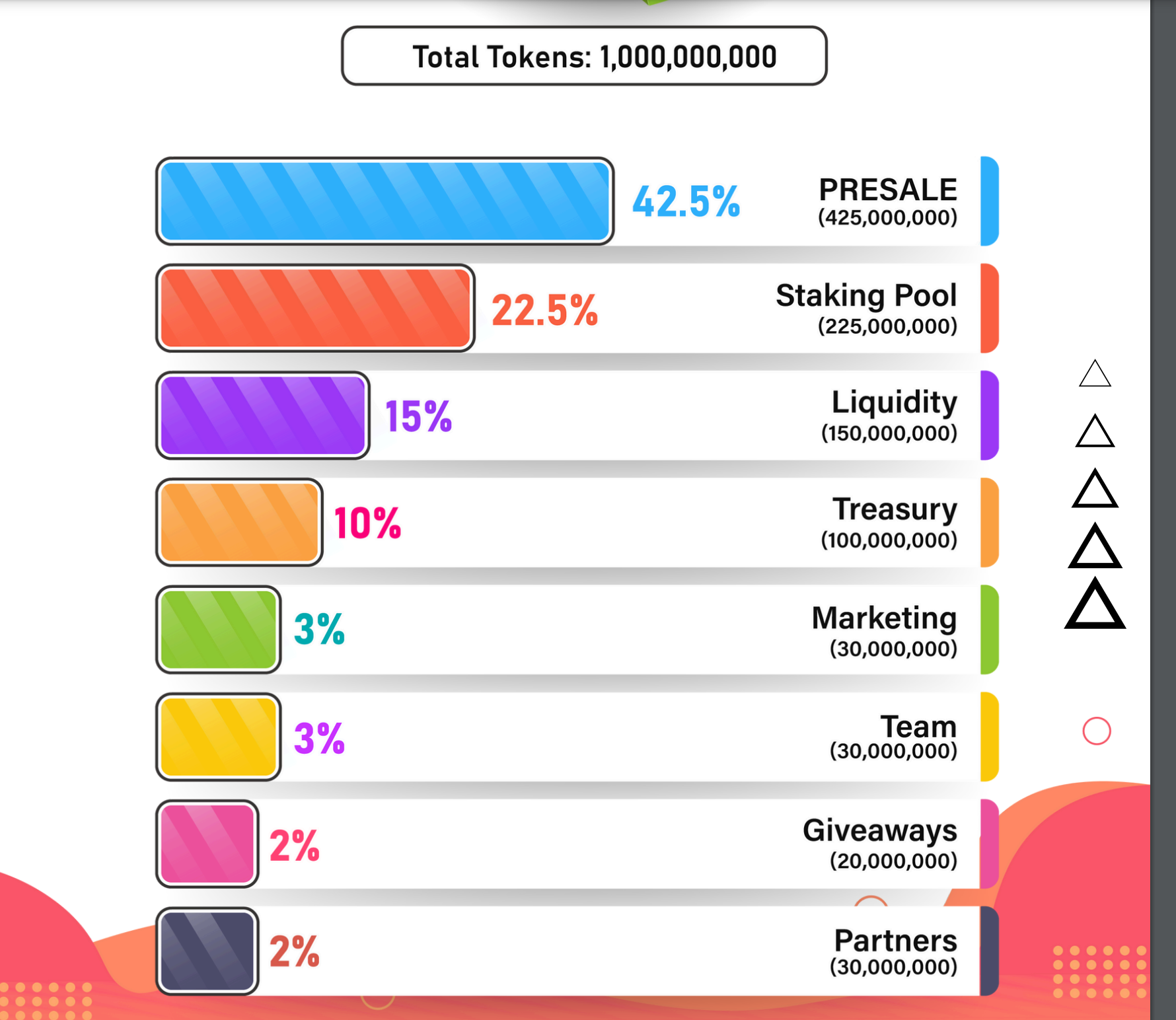

In the midst of this bullish environment for Bitcoin, new ventures such as Rexas Finance (RXS) are also starting to attract attention. Rexas Finance specializes in real-world asset (RWA) tokenization, enabling users to tokenize a variety of assets including real estate and commodities. Analysts anticipate a significant growth potential for RXS, with a possible value of $17 by 2025, while the current price sits around $0.060.

With growing institutional interest in cryptocurrencies, RWA crypto projects such as Rexas Finance could see advantages from greater exposure and funding. The platform’s unique method of increasing accessibility to investment opportunities fits in nicely with the current market trend supporting tokenized assets.

Visit Rexas Now

For now, the crypto world watches as institutions quietly build their Bitcoin reserves. If the OTC supply squeeze of Bitcoin materializes, retail traders could face an uphill battle in securing Bitcoin as prices escalate. This unique situation highlights the growing influence of institutional players in shaping BTC’s market dynamics, and whether or not it’s “planned” as Becker suggests, it has certainly stoked excitement among traders eager for Bitcoin’s next big move. Investors are seeking opportunities beyond Bitcoin, and new players like Rexas Finance are in a good position to benefit from the increasing interest in tokenization and alternative investments.

The post Is Bitcoin Ready to Go Nuclear? What the OTC Supply Squeeze Means for Prices appeared first on CoinGape.