The cryptocurrency market is gearing up for a massive bull run amid positive anticipation of the U.S. presidential election result. The bullish scenario could be suitable for high-performing assets like TON to replenish the recovery momentum. Here are three bullish charts hinting at a prolonged uptrend for the Toncoin price.

By the press time, TON price traders at $4.7 with an intraday loss of 3.3%. According to CoinGecko Data, the ToncoToncoin’set cap is $11.9 Billion, while the 24-hour trading volume is $234.4 Million.

3 Key Charts Indicating a Major Toncoin Price Rally This November

TON has shown signs of resilience and investor confidence despite recent market corrections. Below, we explore three critical charts that indicate a potential major rally for Toncoin price in November.

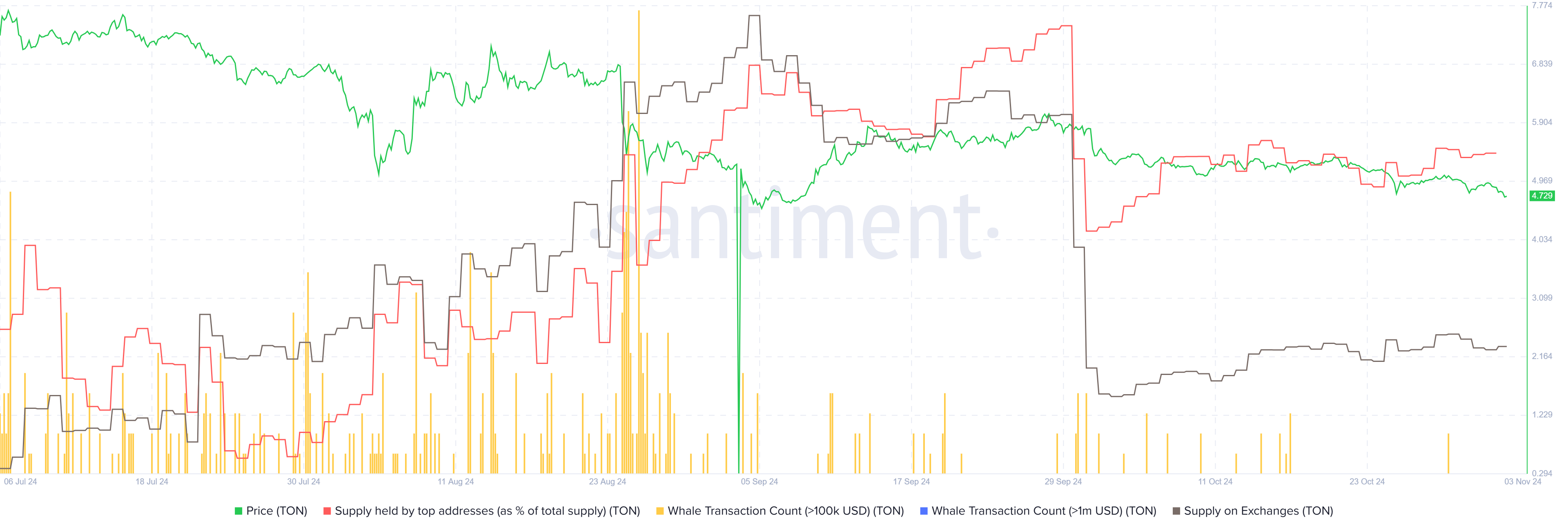

Whale Accumulation and Exchange Outflows Signal Potential Toncoin Price Rally

According to Santiment data, the percentage of TON supply held by top addresses has surged steadily from 23.7% to 27.5% in the last three months. This trend often suggests increased confidence among major investors in the assetasset’s-term potential. Historically, whale accumulation has led to price bottom formation and a precursor for a sustained uptrend.

Moreover, the TON supply on exchange has dropped drastically from 2.54 Million to 1.68 Million in the last two months. Such a supply shift often precedes a rally, as reduced exchange availability can create upward pressure on the price when demand rises.

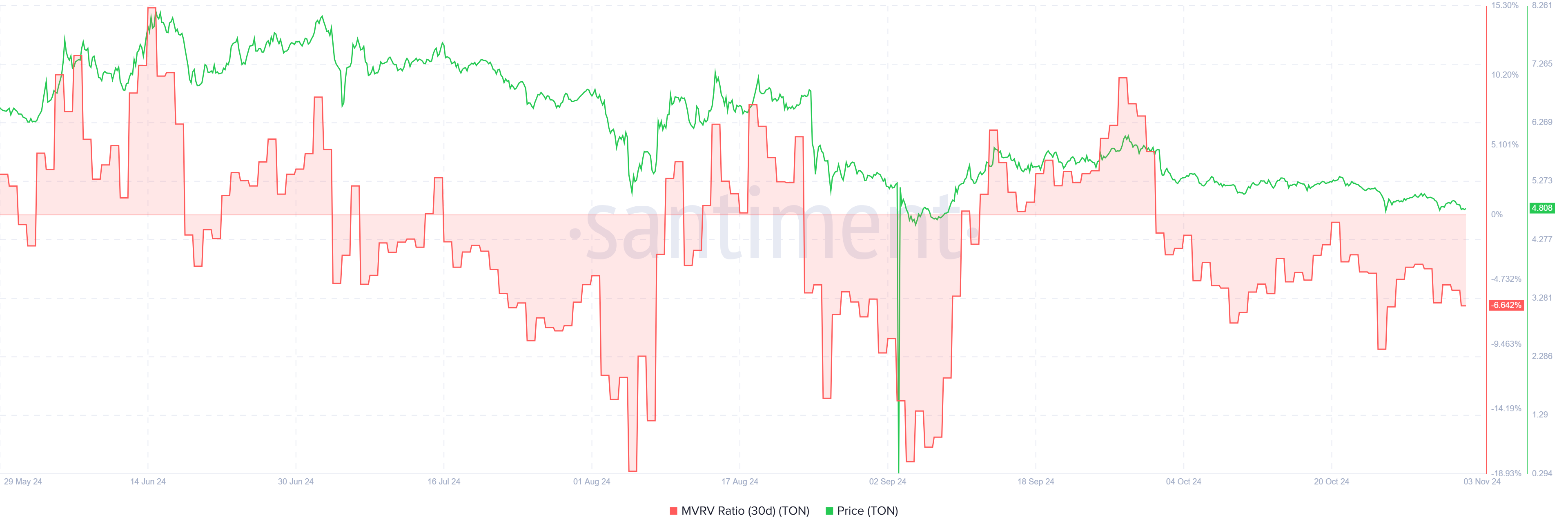

Plunge in MVRV Ratio Hints at Potential TON Market Rebound

Amid the recent market correction, the 30-day Market Value to Realized Value (MVRV) ratio has plunged to -6.6%. The MVRV ratio is a metric that compares an asset’s capitalization to its realized capitalization, offering insights into whether the asset is overvalued or undervalued.

Generally, a negative value indicates that short-term buyers are at a loss and could capitulate if the correction is prolonged. Such exit for speculative traders often attracts long-term buyers in the market and drives a market recovery.

TON Price Analysis Signals Breakout from 4-Month Correction

Over the past four months, the Toncoin price has witnessed a steady correction from $8.17 to $4.7, registering a loss of 42%. The daily chart displays this correction with a downsloping trendline offering dynamic resistance to TON.

As the crypto market anticipates a bullish outlook around the upcoming U.S. presidential election, the Toncoin price shifted its bearish trajectory sideways. With sustained buying, the crypto buyers could drive an 8.5% surge to challenge the dynamic resistance. A potential breakout from this resistance could accelerate the bullish momentum and push the asset 74% to $8.2.

On the contrary, if sellers defend the overhead trendline, the current correction could be extended for November.

The post 3 TON Charts Signaling a Major Toncoin Price Rally This November appeared first on CoinGape.