It’s going to be an important week on the political and macro front with the US election results, and the Fed Rate cut expectations ahead. The race between Donald Trump and Kamala Harris is once again getting pretty close as crypto traders maintain caution ahead of the final results. The Bitcoin (BTC) price continues to stay under $70,000 levels while altcoins faced even greater selling pressure over the last weekend. Thus, the broader crypto market prepares for volatility and liquidity stress this week.

Crypto Traders Brace for FOMC and US Election Volatility

Bitcoin (BTC) closed the month of October under the crucial resistance of $70,000 after failing to hit a fresh all-time high-level last week. Altcoins also faced strong selling pressure as crypto traders sought caution ahead of the FOMC meeting and US election results.

On Thursday, November 7, the Federal Reserve will announce its latest interest rate decision. As per the CME data, there’s a 99.7% probability of a 25 basis points rate cut. On the other hand, the US Election voting will begin on November 5, with results expected around November 6, which is likely to impact the broader financial and crypto market.

Key Events This Week:

1. U.S. Presidential Election – Tuesday

2. ISM Non-Manufacturing PMI data – Tuesday

3. Initial Jobless Claims data – Thursday

4. Fed Interest Rate Decision – Thursday

5. MI Consumer Sentiment data – Friday

6. ~15% of S&P 500 companies report earnings…

— The Kobeissi Letter (@KobeissiLetter) November 3, 2024

In recent weeks the crypto market has been largely reacting to US political development as well as staying macro-driven. Thus, it could largely follow the trajectory of the S&P 500 moving ahead.

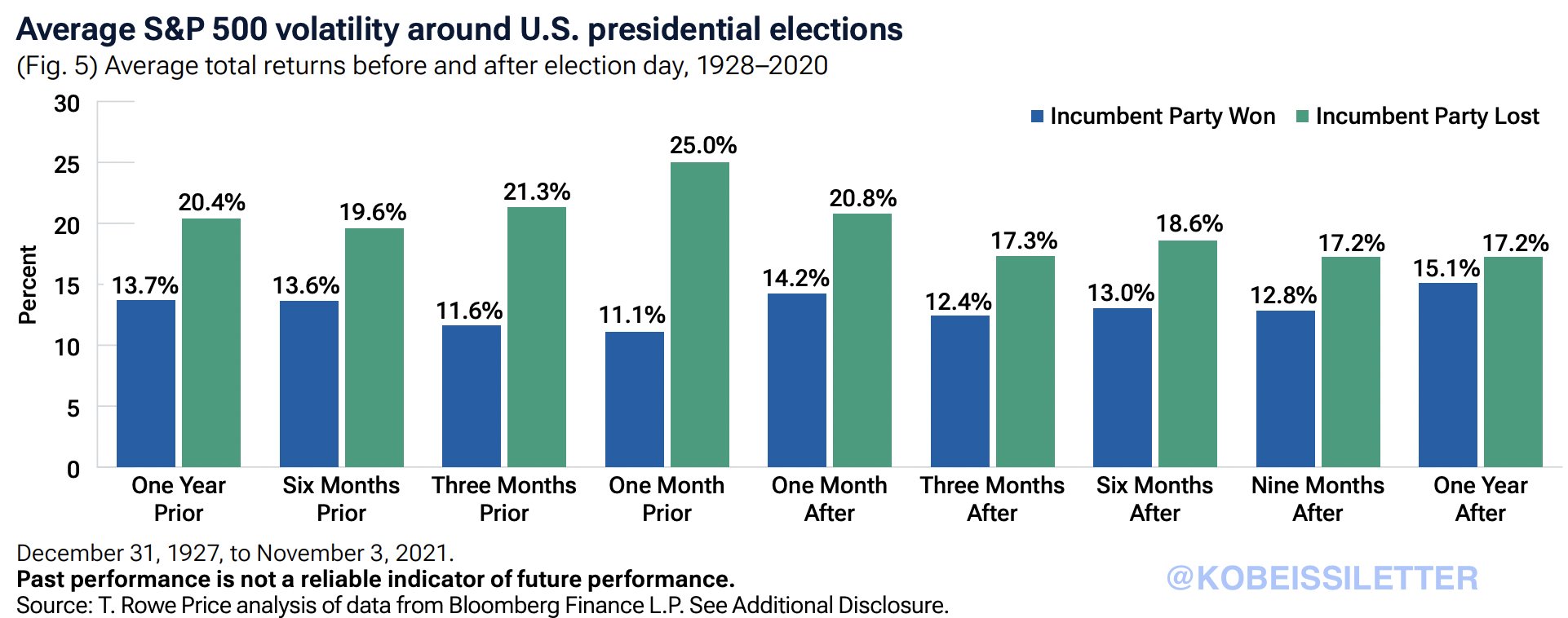

According to The Kobeissi Letter, historical data suggests that when the incumbent party—in this case, the Democrats—appears likely to lose, the S&P 500 generally experiences softer returns leading up to the election. Over the past year, the S&P 500 has surged by 40%, marking one of its strongest rallies on record. Thus, this may indicate market sentiment leaning toward a Republican win.

However, they also noted that whenever the incumbent party loses, market volatility increases both before and after election. Throughout 2024, the volatility index (VIX) stayed elevated, rising 65% year-to-date even as the stock market hit new highs. As a result, crypto traders and the overall crypto market could face similar volatility around the US elections.

Additionally, the newsletter also stated:

“It’s worth noting that regardless of whether a Republic or Democrat wins, the market has averaged a POSITIVE return during election years. Since 1928, the S&P 500 has returned an average of +11.3% during election years. 19 of the 23 years (83%) provided positive performance”.

Is Bitcoin (BTC) Preparing For A Parabolic Rally?

As said, the crypto market is bracing for greater volatility this week with the FOMC meeting and US election on the horizon. However, analysts believe that this rally could have a lasting power.

Historically, significant bull runs have often followed the election period, and the Bitcoin (BTC) price is gearing up for the next stage of the rally. Bitcoin’s upward trajectory is likely to continue, potentially pushing it to the $100,000 mark by year-end. If the BTC price replicates a similar performance to the last two cycles, we can even see a parabolic rally to $200,000 and more.

Being a Bull taught me that history always repeats. #Bitcoin drops before elections, but look at what happens next… pic.twitter.com/jZxrvqWxhE

— Scottie Pippen (@ScottiePippen) November 3, 2024

The post Crypto Traders Turn Cautious on Volatility & Liquidity Issues Ahead of FOMC, US Elections appeared first on CoinGape.