Chainlink price on the weekly timeframe just broke below a crucial support level, risking a 45% crash. This decline follows the asset hitting a 50-month low against Bitcoin (BTC). LINK investors are concerned the price could continue dropping, with the asset showing weakness despite strong fundamentals.

The LINK price has decreased by 3.2% in the last 24 hours to trade at $10.66. The decline further exacerbates Chainlink’s precarious condition, in which a 45% crash is likely to occur in the coming day if market conditions do not change.

Chainlink Price Hits 50-Month Low Against BTC

A crypto analyst has observed, on the LINK/BTC chart, that Chainlink hit a 50-month low against BTC. This decline can be attributed to financial institutions’ increasing adoption of Bitcoin around the world, while the Chainlink price remains largely neutral to bearish.

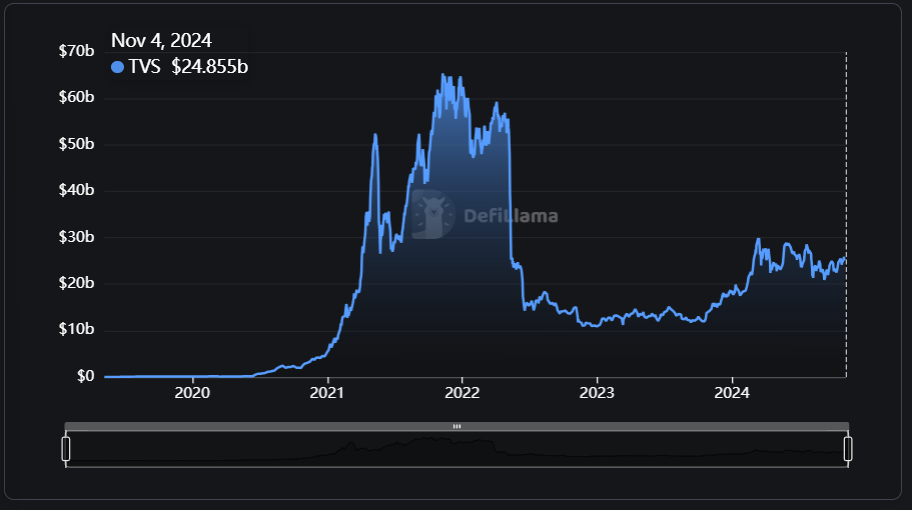

This phenomenon is mysterious as Chainlink has the most robust ecosystem in the decentralized finance (DeFi) world. Its Decentralized Oracle Networks (DONs) connect smart contracts to other blockchains, off-chain data and computational capacity. Chainlink feeds data into 170+ projects that collectively support $24.855 billion in value as of November 4, 2024.

Chainlink price hitting a 50-month low against Bitcoin (BTC) means that the value of Chainlink (LINK) relative to Bitcoin has significantly decreased over the past five years. This can indicate several things:

- Investors may be losing confidence in Chainlink, leading to selling pressure and a drop in its price relative to BTC.

- The broader cryptocurrency market might be experiencing fluctuations, with Bitcoin often acting as a benchmark. If BTC is performing well while LINK is not, the relative value of LINK against BTC will decrease.

- Such lows can sometimes signal a potential reversal if market conditions change and investors start buying into Chainlink again.

LINK Price Analysis: Is A 45% Crash 45% Imminent?

Chainlink price forecast shows it is going downward. The chart reveals a Head and Shoulders pattern, a classic bearish reversal signal, with the neckline located around the $11.50 – $12.00 level. This pattern indicates that LINK could be heading for a continued 45% decline if it fails to reclaim and hold above this neckline level.

The next key support level lies around the $5.00 – $6.50 range and has historically served as a strong demand zone. A break below this would be quite bearish for LINK.

On the flip side, the most immediate resistance is at the $11.50 – $12.00 area, which coincides with the neckline of the Head and Shoulders pattern. Additional strong resistance is around $15.00, the prior peak.

A break and close above the $11.50 – $12.00 area could signal market strength, turning the Chainlink price bullish and invalidating the bearish thesis.

The post Will Chainlink Price Crash 45% After Hitting A 50-Month Low Against BTC? appeared first on CoinGape.