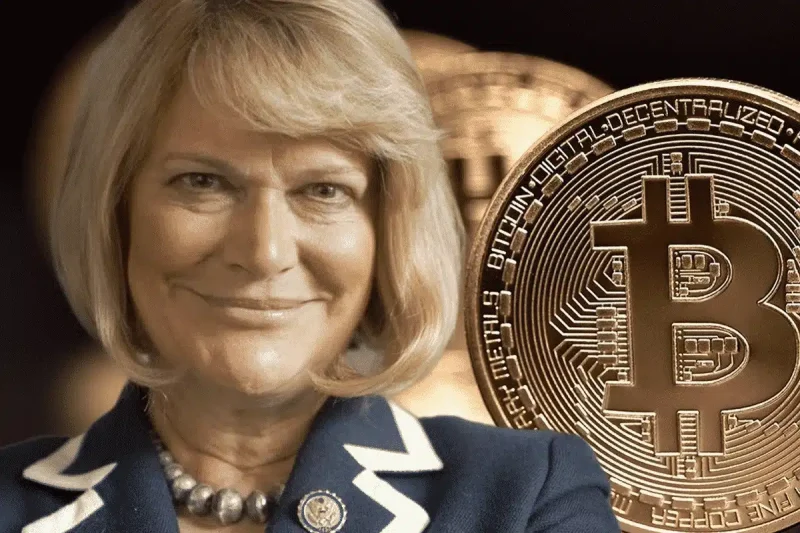

US Senator Cynthia Lummis introduced a groundbreaking proposal this year advocating for a Bitcoin bill. While commenting Trump’s victory, Lummis reiterated the promise of US building strategic Bitcoin reserve.

Lummis also underscored the importance of the Fed accumulating BTC to strengthen the US dollar and address the national debt. The proposal is officially named the “Innovative Investment for National Competitiveness Enhancement Act,” and is known as the “Bitcoin Bill.”

Republican Party has majorities in the Senate and the House now. So, the chances of passage for Senator Lummis’ Bitcoin Bill through Congress are far better. That wasn’t the case when efforts toward bipartisan bills in the Biden administration were greatly stifled due to divided Congress. An incoming Trump might ensure quicker approvals. And no matter what, creating sufficient Bitcoin stockpile is actually one of the Trump’s promises to crypto industry.

The proposal aims to have the US Federal Reserve accumulate up to 5% of Bitcoin’s total supply. It is setting an annual target of acquiring 1 million BTC. This ambitious plan signals a significant shift in US economic policy. Markets are likely to factor in the potential benefits in anticipation of the new administration.

According to Propy Escrow CEO Natalia Karayaneva, Senator Lummis will talk about this more thoroughly at the tomorrow’s summit.

Establishing US as Largest Bitcoin Holder

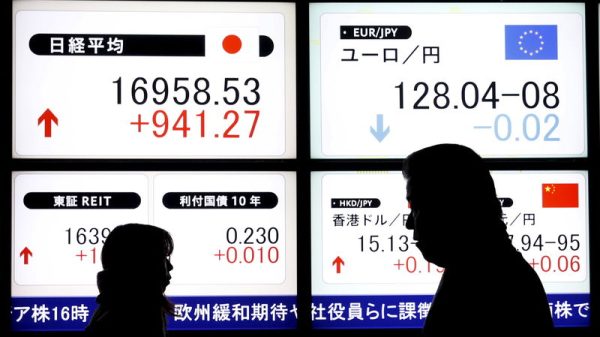

Another potential positive of Trump’s presidency is that, for the first time, the Justice Department could stall crypto asset sales. However, crypto sales from existing court decisions may still impact the market before Trump takes office in January.

Senator Lummis’s bill proposes leveraging existing Federal Reserve and Treasury funds to acquire 1 million Bitcoin, positioning the U.S. as the largest nation-state holder of the asset.

This ambitious move would grant the US approximately 5% ownership of the Bitcoin network, mirroring its stake in the global gold supply. If passed, this initiative would reinforce the US influence in the digital asset space and set a precedent for integrating Bitcoin into national reserves.