Solana price went vertical on Wednesday, November 6, as cryptocurrencies welcomed Donald Trump’s win. It jumped to an intraday high of $188.40, its highest level since July 29 as a popular Wall Street analyst predicted a SOL ETF approval in the incoming administration.

Solana Price Rises Amid ETF Approval Odds

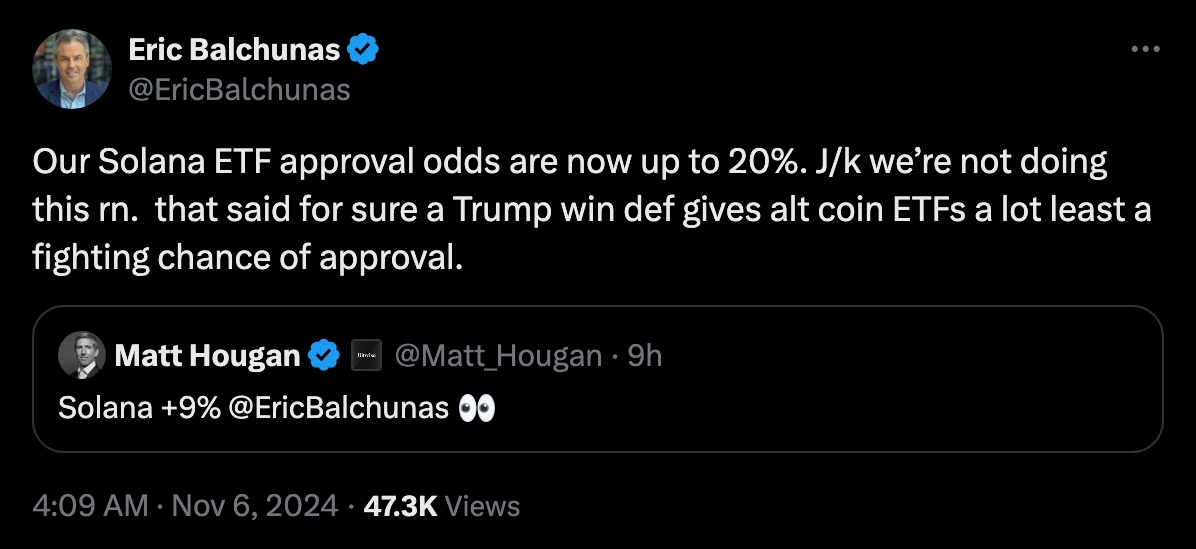

In an X post, Erick Balchunas, the lead analyst for Bloomberg ETFs, humorously said that his odds for a SOL ETF approval rose to 20% after the election, in which Trump defeated Kamala Harris.

Several companies like Canary Capital, VanEck, and 21Shares have applied for a Solana ETF following the successful launch of Ethereum funds a few months ago.

The SEC, under Gary Gensler, has pushed back on these applications, arguing that Solana was an unregistered security. For the agency to approve the fund under Gensler, then it needs to become regulated, which would include more documentation.

Still, it is unclear whether Wall Street will welcome Solana ETFs since most institutional investors have leaned towards Bitcoin. According to Sosovalue, spot Bitcoin ETFs have accumulated cumulative inflows of $23.5 billion, while Ethereum funds have had net outflows of $554 million.

Crypto Analysts Are Bullish On SOL

Meanwhile, cryptocurrency analysts are optimistic that Solana price will continue rising in the near term.

In an X post, TraderKox, who has 130,000 followers, gave a Solana price prediction in which he predicted that it will soon make a bullish breakout after an eight-month consolidation. He expects that the coin will jump to $500, implying a 169% increase from the current level.

Evan Luthra, another analyst with 452,000 followers, gave an even bolder forecast. He sees Solana surging to $1,000 and Bitcoin hitting $100,000 during this bull run.

SOL Price Analysis Hints Major Breakout

SOL price has some strong technicals. On the daily chart above, it has formed an inverse head and shoulders pattern, a popular bullish sign. It has also risen above the key resistance level at $183, invalidating a small double-top pattern that was forming.

SOL token also formed a golden cross as the 50-day and 200-day moving averages crossed each other. The Relative Strength Index has jumped to 65, while the coin has moved to the overshoot point of the Murrey Math Lines.

Therefore, the short-term Solana price forecast is where it keeps rising and retests the year-to-date high at $210, which is 15% above the current level. A break above that level will point to more gains, potentially to $300.

This bullish view will become invalid if it drops below the double-top’s neckline at $155. A drop below that price will see it slip to $100.

The post Solana Price Eyes $300 Rally as SOL ETF Approval Odds Rise appeared first on CoinGape.