Terra Luna Classic price is inching closer to a breakout following increased market volatility resulting from the just-completed U.S. elections. LUNC price increased by 8.6% in the last 24 hours and is trading at $0.00009162 after Bitcoin momentum picked up and pushed the entire crypto market up by 6.4% to $2.588 trillion.

After Binance burned over 1 billion LUNC and the TFL incinerated another 251 billion coins, the ‘LUNCArmy’ community was disappointed to see the price remain stable. However, the winning of Donald Trump has put life back into the markets, and the price of LUNC eyes a potential breakout that could send it up by over 200%.

Terra Luna Classic Price Eyes $0.00028, But Must Clear This Obstacle

LUNC price has been consolidating inside an ascending triangle since July 2024. However, it is inching near the apex of the triangle and will soon have to decide.

Ascending triangles are generally bullish continuation structures, and once the price breaks above the upper horizontal resistance, it usually rises by a measure move.

Once the LUNC price breaks the $0.000095 resistance, the asset is likely 81% to $0.0001680, with an occasional stop around $0.00012. If the bullish pressure is maintained, the Terra Luna Classic price could surge higher and test the first high established after the 2022 crash.

Conversely, a break below the lower trendline support would signal market weakness. LUNC price would drop lower and find further support around the $0.000069 and $0.00005435. This would invalidate the current bullish thesis.

Following the non-reactive price after a major LUNC and USTC burn, the community is looking for other methods to boost prices besides reducing the supply.

Futures Traders Are Bullish on LUNC

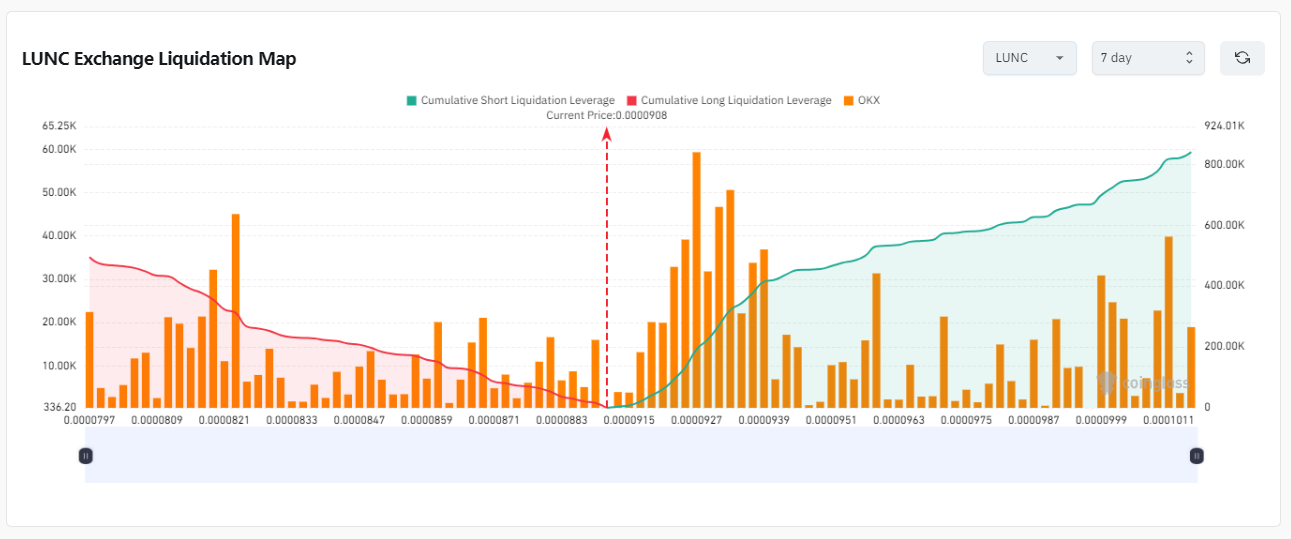

An analysis of traders’ behavior reveals they are bullish on LUNC. Data from the Coinglass Liquidation Map shows traders have opened more longs than shorts on the daily and monthly timeframes. However, in the weekly timeframe, there are more sellers than buyers.

This may be due to the overhead resistance at $0.000095, which has suppressed the price for the last four months. Nevertheless, with Bitcoin hitting a new all-time high, things could be different this time, and LUNC could breach this resistance.

Additionally, LUNC’s open interest (OI) dropped by 2.3% while the price increased by 8.6% in the last 24 hours, signaling that traders are closing their short positions in profit. When they do this, traders tend to open long positions. Hence, Terra Luna Classic price could witness increased volume in the coming days, which could fuel its rally beyond $0.000095 resistance and move toward $0.00028.

The post Terra Luna Classic Price Could Soar 207% After This Breakout appeared first on CoinGape.