$11.5 trillion AUM BlackRock Inc is in earlier talks to acquire a minority stake in $70 billion hedge fund manager Millennium Management LLC. Izzy Englander’s Millennium, which has never sold a portion of its business to a third party, is growing at a faster rate due to its strategy to diversify investments in multiple assets.

BlackRock Eyes Bitcoin ETF Dominance With Millennium Deal

Larry Fink-led BlackRock looks to acquire minority stake in one of the most profitable hedge fund managers Millennium Management, FT reported on November 8. As per the reports, the plan reflects Larry Fink’s interest in expanding into alternative assets such as Millennium.

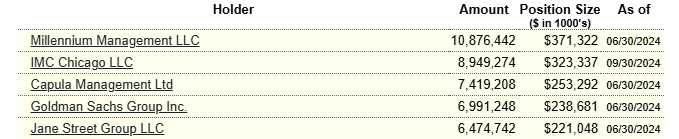

Interestingly, Millennium Management is the largest holder in iShares Bitcoin ETF (IBIT) valued at $371.32 million. Moreover, the hedge fund manager has holdings worth $588.97 million in Fidelity Wise Origin Bitcoin ETF (FBTC). The company also invested in Grayscale, Bitwise and Ark 21Shares Bitcoin ETFs, as per the U.S. SEC filing.

Millennium Management also has its largest investment iShares Core S&P 500 ETF (IVV), which is valued at $3.29 billion. IVV ETF has rallied more than 26% year-to-date and 92% in five years.

Recently, Larry Fink affirmed Bitcoin as a legit asset class like gold and the potential in BTC price to rally higher. “I mean, we believe Bitcoin is an asset class in itself. It is an alternative to other commodities like gold,” said Fink.

Millennium Deal May Not Happen

According to sources familiar with the matter, discussions are in the early stages and may not result in a deal. Millennium has backed smaller hedge funds, similar to last year’s partnership talks with Schonfeld Strategic Advisors, but the deal fell apart months later.

As per Financial Times, Izzy Englander still owns 100 per cent of Millennium and has grown to manage nearly $70 billion in assets. Contrarily, BlackRock had deals to buy Global Infrastructure Partners and Preqin, and is in talks with private credit manager HPS.

Meanwhile, BlackRock iShares Bitcoin ETF (IBIT) saw $1.1 billion in inflow on Thursday as the US Fed rate cut boosted liquidity flow in the crypto market. BlackRock Bitcoin ETF (IBIT) has shot up to $34 billion with a staggering 447,281 BTC holdings. For context, this is nearly double the 252,220 BTC holdings of Michael Saylor’s MicroStrategy.

The post Is This The Secret Reason Behind BlackRock’s Stake Acquisition in Millennium? appeared first on CoinGape.