The Bitcoin price has noted a robust rally today, hovering near the brief $90,000 mark, while getting notable traction from the global investors. Besides, the BTC rally has also bolstered the broader market sentiment, as evidenced by the surge in other top altcoins. Amid this, a flurry of market experts predicts the flagship crypto to hit a new record of $100K soon, with many anticipating a further surge ahead.

Bitcoin Price Hovers Near $90,000

The recent surge in Bitcoin price, hitting new highs every day, has sparked optimism among investors. Besides, the top altcoins also followed suit, which indicates a growing confidence of the investors towards the crypto market.

However, as the BTC hovers near the $90,000 mark, many in the crypto market expect BTC to hit $100K next. For context, in a recent X post, Rich Dad Poor Dad Author Robert Kiyosaki lauded Bitcoin for crossing the brief $88K mark recently. Furthermore, he said that he will continue to add more BTC to his portfolio until the crypto hits the brief $100K.

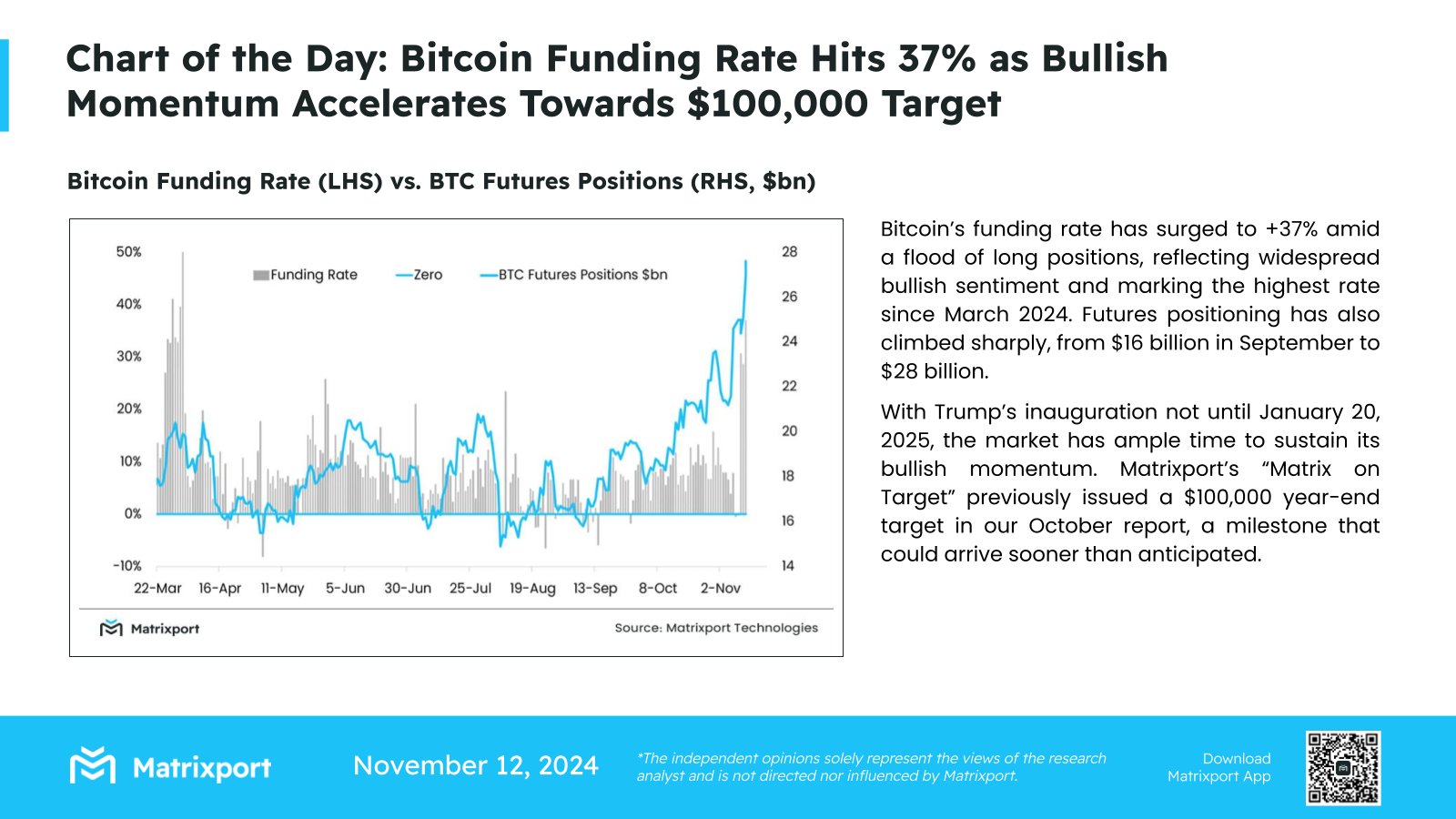

Adding to the sentiment, a recent Matrixport report has highlighted the BTC Funding Rate hitting 37%, saying that it would help continue the bullish momentum ahead. Notably, the report also highlighted the $100,000 mark as the next key target for the flagship crypto, which has fueled market confidence.

For context, the report explained that the funding rate has surged due to soaring investors’ long positions in the market. This marks a very positive momentum for the crypto as the rate has touched its highest since March 2024. Besides, the “Futures positioning” has also increased significantly from $16 billion in September to $28 billion, indicating a run toward the North ahead.

Will BTC Hit $100K Soon?

Donald Trump’s victory in the US Presidential election in 2024 appears to have propelled the current BTC rally. Given Trump’s active support towards the digital assets space, especially BTC, investors are anticipating the US to become a leader in the blockchain space. This development, if it happens, could boost the prices further in the coming days.

Simultaneously, Trump also said that he would make Bitcoin a strategic reserve for the US, which has sparked investors’ optimism. This could significantly send the Bitcoin price to a new high, while many other countries may also come forward to adopt a similar strategy in the coming days.

Meanwhile, the crypto community also eagerly awaits the exit of the US SEC Chair Gary Gensler from his office. Notably, many deem Gensler as an anti-crypto regulator, who has so far hindered growth and innovation in the sector. However, with Trump’s win, many expect Gary Gensler to leave his position as soon as this year.

Considering all these aspects, the future of the crypto market looks promising. However, volatility remains a major concern for digital assets, and considering that, investors should exercise due diligence while putting their bets into the market.

Will Bitcoin Price Face A Pullback?

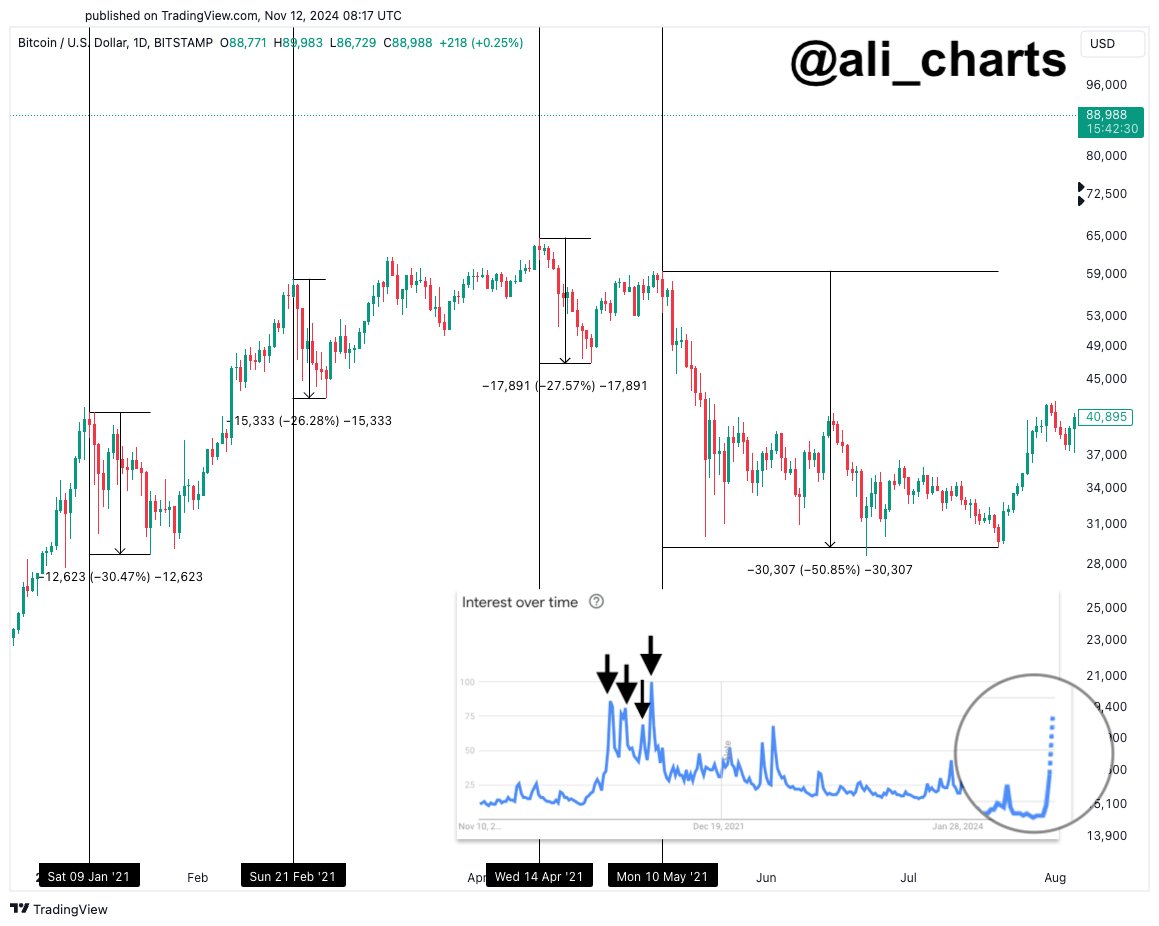

Amid the positive sentiment hovering in the market, many expect a slight pullback in Bitcoin price, citing historical trends. For context, a popular crypto market expert Ali Martinez recently warned users over a potential dip in BTC.

For context, in a recent X post, Martinez noted that retail interest in BTC indicates more capital inflows ahead. However, he also said that the spike in search trends for Bitcoin sometimes hints at a potential price dip in the coming days. He highlighted the 2021 trend, saying that the “top surges in search interest” for BTC coincided with corrections of between 26% and 50%.

However, despite that, the future looks positive. The recent robust inflow into the US Spot Bitcoin ETF, according to Farside Investors data, indicates the growing institutional focus on the crypto. In addition, the clear regulatory path and Trump’s focus on making the US a crypto leader have further fueled market sentiment.

Meanwhile, BTC price today was up 6% to $86,770 during writing and its trading volume rocketed 82% to $147 billion. Furthermore, Bitcoin Futures Open Interest rose 8% over the last 24 hours, indicating a strong market interest in the crypto.

Besides, top crypto market expert Peter Brandt recently predicted BTC to hit $200K in the coming days. Simultaneously, many other experts also remained bullish over a bullish run ahead, given the positive trends in the market.

The post Bitcoin Price Is Getting Close To $90,000; Will It Hit This Record? appeared first on CoinGape.