During Wednesday’s U.S. market session, the Ethereum price winessed signal down below $3,200. This bearish turnaround is likely a post-rally pullback, allowing buyers to recuperate the exhausted bullish momentum. With Bitcoin’s continued surge driving the broader market recovery, here are three reasons why ETH buyers could regain strength for a rally to $4,000

With the crypto market today, ETH price had traded at $3,181, with an intraday loss of 2.15%. According to Coingecko, the asset market cap holds at $382.4 Billion with a 24-hour trading volume of $50.6 Billion.

3 Reasons Ethereum Price Could Surge to $4,000 Before November Ends

In the last two weeks, the Ethereum price witnessed a massive inflow, triggering its breakout from 3-months accumulation. Amid the post-breakout rally, whale buying, Ethereum ETFs inflow, and reversal pattern are three key reasons supporting a rally to a $4,000 high.

Whale Accumulation Signals Confidence in Ethereum’s Growth

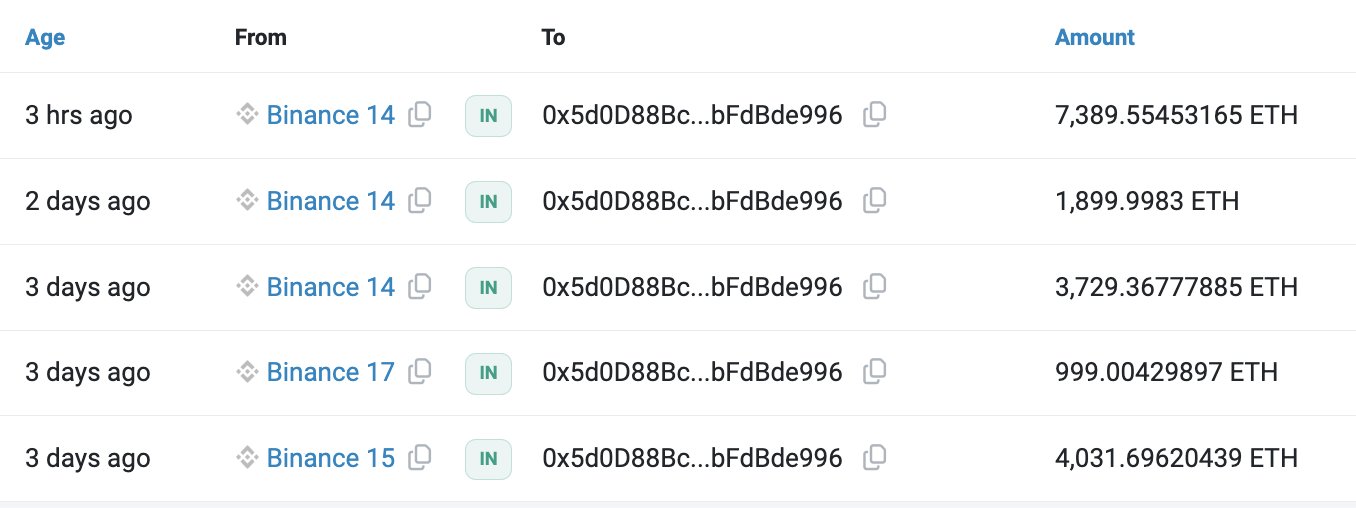

The Ethereum price recovery is backed by whale accumulation. According to lookonchain data, a fresh whale wallet accumulated 7,389.5 ETH( worth approximately $23.44 Million) in the last 4 hours.

In the past three days, this smart money has purchased a staggering 18,049 ETH (worth approximately $59.3M) from the crypto exchange Binance. These transactions indicate that the large holders are accumulating at market dips with confidence in Ethereum’s future growth.

Historically, whale accumulation has conceded with a major market bottom and a catalyst for sustained recovery.

ETH ETFs See $210M Inflows as Institutions Ramp Up Exposure

The recent victory of Donald Trump in the U.S. presidential election has reignited institutional interest in cryptocurrency ETFs. According to data from Lookonchain, nine Ethereum ETFs registered a net inflow of 63,701 ETH ($210.34M) on November 13.

BlackRock alone accounted for 39,987 ETH inflows worth $132.04 million, bringing its total Ethereum holdings to an impressive 569,536 ETH, valued at $1.88 billion.

This strong institutional backing suggests increased adoption of Ethereum as a long-term investment vehicle.

Nov 13 Update:

10 #Bitcoin ETFs NetFlow: +9,098 $BTC(+$844.47M)

#Blackrock inflows 8,691 $BTC($806.7M) and currently holds 467,347 $BTC($43.38B).

9 #Ethereum ETFs NetFlow: +63,701 $ETH(+$210.34M)

#Blackrock inflows 39,987 $ETH($132.04M) and currently holds 569,536… pic.twitter.com/jAS2iqnkqW

— Lookonchain (@lookonchain) November 13, 2024

ETH Price Analysis Signals Wedge Breakout Rally to $4,000

Since late March 2024, the Ethereum price prediction has recorded a sharp correction in the daily chart, resonating with a falling wedge pattern. Theoretically, this chart setup drives a temporary downtrend within two converging trendlines for buyers to recuperate the buying momentum.

In the last nine days, the ETH price witnessed a massive surge of $2,378 to $3,177, accounting for a 33.7% surge. The rally offered a decisive breakout from the pattern’s key resistance trendline, signaling the end of the prevailing correction.

If the pattern holds true, the Ethereum price could rally another 28.5% to hit a high of $4,100.

On the contrary note, the ETH price is currently witnessing a post-rally pullback. If the bearish turnaround breaks below the 200-day EMA, the sellers could strengthen their grip over this asset for a renewed correction trend.

The post 3 Key Reasons Why Ethereum Price Could Hit $4,000 by November End appeared first on CoinGape.