AVAX price is down 12% in the last 24 hours after liquidity began flowing out of large caps and into mid-caps, causing projects like PNUT and DOGE to soar double-digit percentages. Nevertheless, market observers are still bullish on Avalanche, calling $130 the base. A high correlation between Ethereum (ETH) and Avalanche (AVAX) suggests that the latter will likely go on a 660% breakout after ETH recently breached an 8-month falling channel. Can AVAX soar 5X and reach $300?

Analyst’s Bold Call: Why $130 Is the Base for AVAX Price

Crypto analyst Grronk has predicted that Avalanche’s price will return to $130 “faster than you can imagine.” His prediction comes after analyzing AVAX’s previous price history and noting that after dropping 27% around October 2023, Avalanche soared 479%.

If history repeats, Grronk predicts AVAX price could soar 500% to $130, which he says is the base. AVAX price is trading at $32.06, with volume up 7% in the last 24 hours.

Avalanche Price Analysis: Is a 660% Surge Possible?

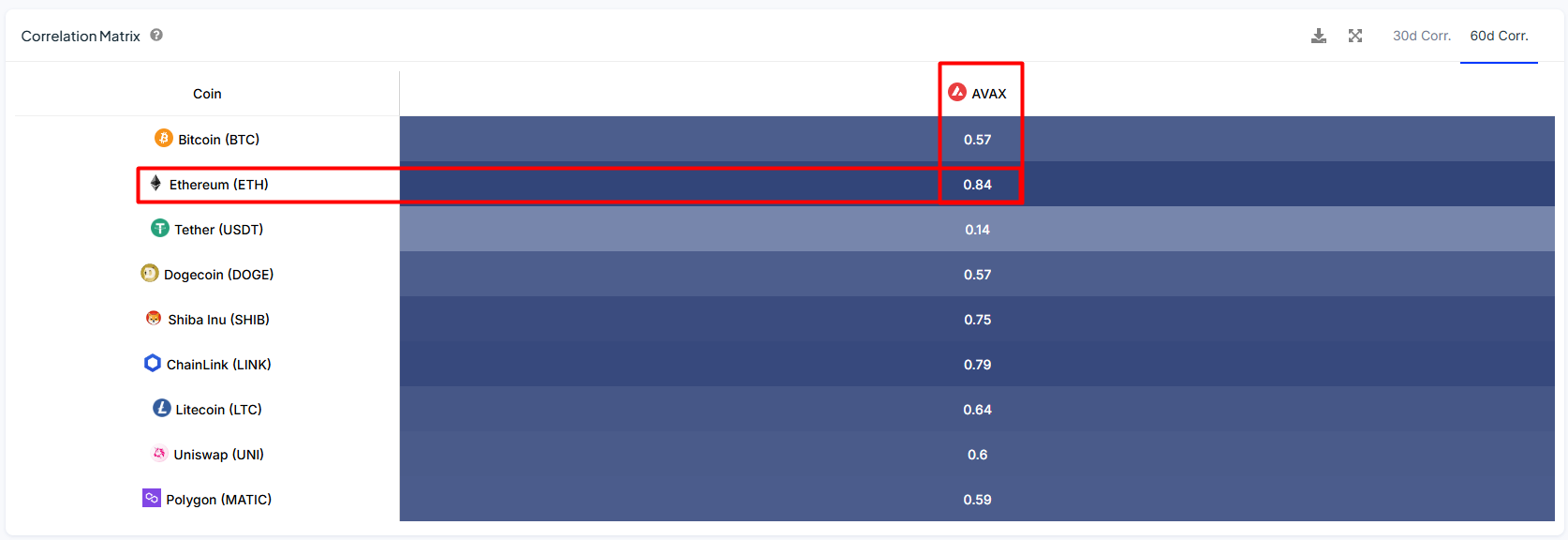

Avalanche price forecast suggests a 660% surge is possible for the asset. First off, Avalanche has a very high correlation to Ethereum, which means if ETH moves up, this L1 crypto asset is most likely to move up as well. Data from IntoTheBlock shows AVAX has a 60-day correlation of 0.84 with ETH.

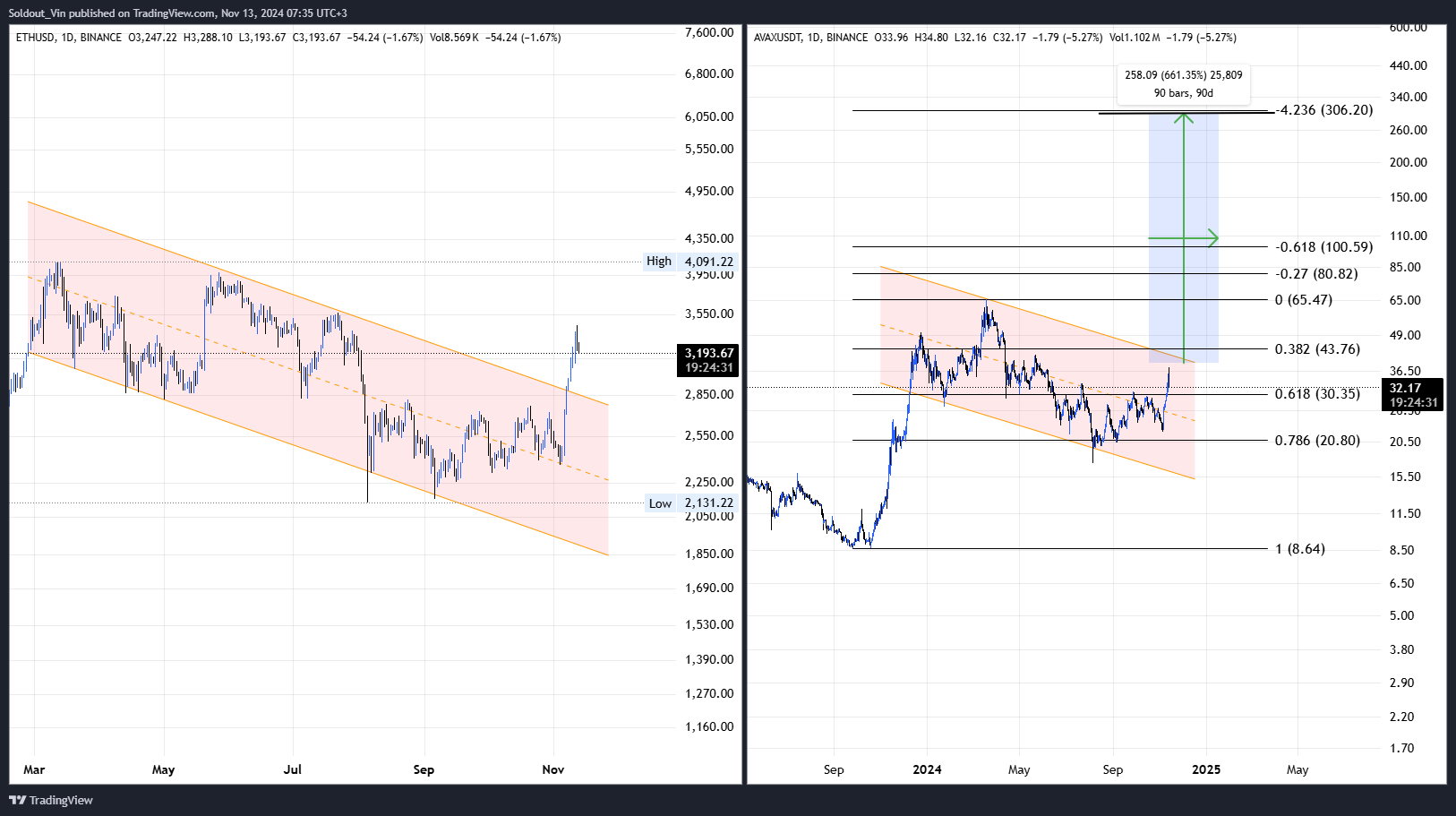

The correlation was observed when Ethereum price recently broke out of an eight-month falling channel, and Avalanche closely followed the pattern. Nevertheless, Avalanche price is still within its falling channel and needs some extra juice to break out.

Given the net inflow of U.S. spot Ethereum ETF, the price of ETH will likely continue surging. Furthermore, the overhead resistance levels for Ethereum are around $3,550 and $4,000, which could be more robust, meaning that as Ethereum slices through these barriers, AVAX price is likely to follow suit and rise higher.

AVAX Price Eyes $65 Short-Term Target

As Avalanche price soars higher, it may encounter resistance around $43.76. This is a strong barrier and will likely be challenging for the price to slice through. However, beyond that, the price may soar to a $65 yearly high before attempting to reclaim the $147 previous all-time high.

AVAX is a robust cryptocurrency with bullish fundamentals. Currently, over $1 billion AVAX coins are on the line that could either enter profit or sink under water depending on which direction the crypto asset takes.

AVAX price will likely wait until Ethereum begins moving to initiate its move. Once the falling channel is broken, Avalanche could quickly rise 660% to $306.

The post Is AVAX Price Set To Soar 660%? Analyst Says ‘$130 Is The Base’ appeared first on CoinGape.