Terra Classic (LUNC) price has surged sharply over the past week, fueled by a broader crypto market rally. This bullish November trend is capturing the attention of investors, and analysts anticipate further upward momentum. Increased LUNC token burns reduce supply and add to the positive sentiment. This supply reduction aligns with rising demand, sparking renewed optimism in the coming days despite the market experiencing slight corrections.

Is LUNC Price Gearing Up for a Massive Bull Run?

A prominent crypto analyst recently shared an X post signaling a significant shift for LUNC. According to the post, after a phase of recalibration and recovery, LUNC is now poised for a breakthrough. The tweet suggests that the cryptocurrency is more resilient and primed for growth.

The community-driven initiative promises to have a substantial impact and drive LUNC to new heights. With renewed strength, the mission aims to capture the attention of crypto enthusiasts seeking a fresh journey.

#LUNC is ready for another major takeoff! After a quick refuel and recalibration, we’re stronger, more resilient, and set for the next level. The mission? New heights, real impact, and community-driven success. Who’s joining the journey?

#Binance $lunc #luncarmy pic.twitter.com/S1Z8vV0GM1

— Bull.LUNC (@Bullluncdao) November 13, 2024

LUNC Token Burn Surge: Whats Next For Terra Classic Price?

LUNC tokens experienced significant burns in the last hour. Approximately 64,808.30 LUNC tokens were burned through two transactions. For the entire day, 42,038,326.10 LUNC tokens were burned. This breakdown includes 81,520.59 LUNC burned via direct transactions and 41,956,805.51 through tax mechanisms.

In the past hour, there have been a total of 64,808.30 $LUNC tokens burned and 2 transactions.

TODAY BURNED By TX: 81,520.59 By TAX: 41,956,805.51 Total: 42,038,326.10

Website: https://t.co/q4WijVKbSr#luncarmy #lunc

— LUNC.TECH (@lunc_tech) November 12, 2024

In another instance, a separate burn in the last hour accounted for 1,477.61 LUNC tokens from a single transaction. Daily totals reached 4,188,417.60, split between 1,487.30 LUNC in transactions and 4,186,930.30 burned through taxes.

These token burns highlight ongoing efforts to reduce LUNC’s supply, aiming to impact its market dynamics positively.

Today’s crypto prices have stirred varied investor sentiments worldwide, showing fluctuating trends across leading digital assets. Bitcoin (BTC) is holding steady around the $87,000 mark, fueling market discussions about its next potential move. Ethereum (ETH) prices also displayed relative stability, hovering just above $3,100.

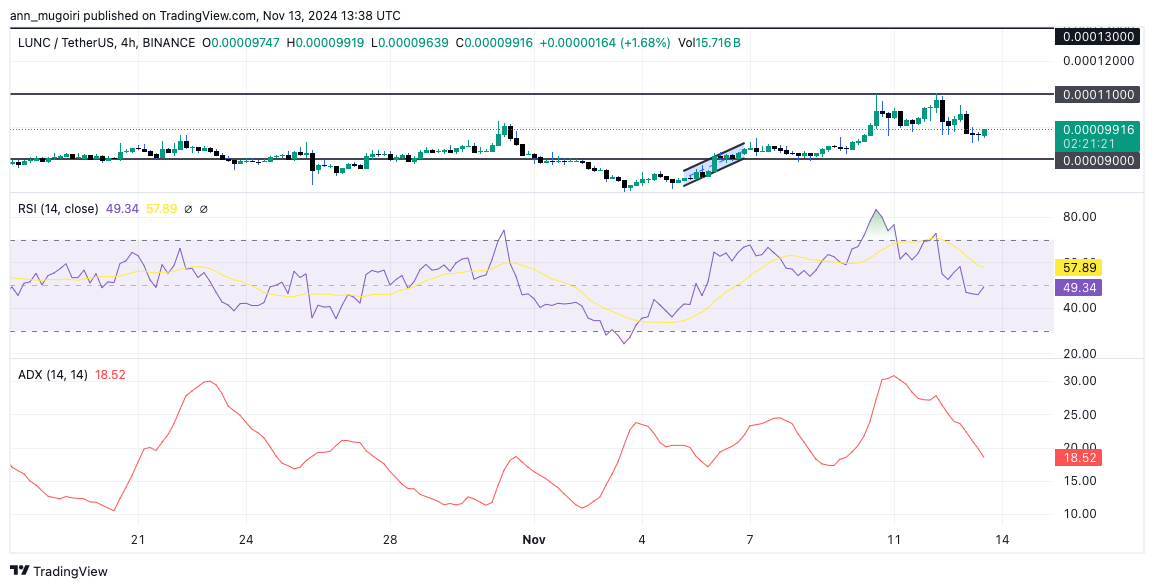

The Terra Classic price has declined after a bullish trend over the past week. Currently valued at $0.00009735, the cryptocurrency experienced a 2.76% drop within 24 hours. This decrease follows a recent peak when Terra Classic reached higher values earlier in the day.

The Relative Strength Index (RSI) reads at 49, indicating that LUNC is in a neutral zone. The Average Directional Index (ADX), currently at 18, supports a weakening trend strength.

LUNC’s recent burns bolster investor optimism as supply decreases, potentially fueling further price gains. Despite minor corrections, bullish momentum persists. Key indicators signal possible growth, but cautious monitoring of trends is essential for investors moving forward.

The post Is LUNC Price Ready for Another Major Takeoff Amid Token Burns? appeared first on CoinGape.