Dogecoin price has retraced by 12.2% in the last 24 hours after surging to a new yearly high of $0.4346. As traders book profit from Bitcoin and large caps, a rare indicator on the Dogecoin chart suggests the meme coin could hit $1 in November. This would constitute a 170% increase from the current price of $0.3679. Will DOGE pull this off and soar to a one-digit price tag this month?

Rare Technical Indicator Signals Major Dogecoin Breakout

A lesser-used onchain indicator called the Market Cap to its Realized Cap (MVRV) indicates that DOGE price still has room to rise. The MVRV Z-Score uses a z-score standard deviation between market value and realized value (MVRV) to identify DOGE market tops and bottoms.

According to this metric, the Dogecoin price hit bottom exactly 2 years ago today and has risen. Historically, values over ‘5.38’ indicate the price is overbought, and values below -0.25 indicate the price was oversold.

Currently, the DOGE MVRV Z-score is at 2.7 and is headed up. This suggests that while dogecoin is fast approaching the overvalued zone, there is still room to move, which could catapult the price to $1 and beyond.

DOGE Price Surge: Is a $1 Target Achievable This Month?

Dogecoin price is currently 170% away from hitting the $1 mark, and on-chain metrics suggest that this target is achievable this month.

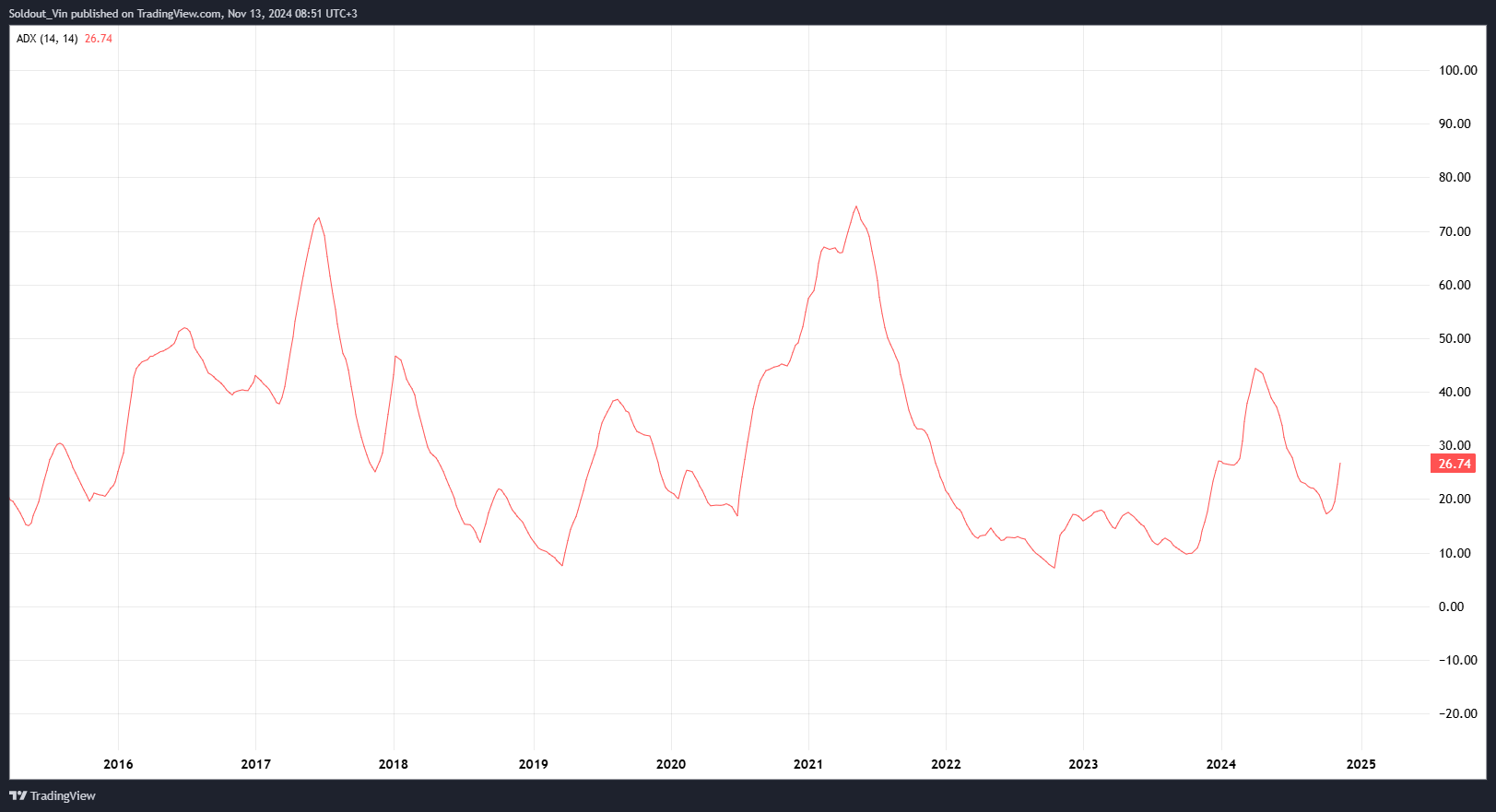

Although the Relative Strength Index (RSI) is overbought at 83.85, the average directional index (ADX), which shows how volatile a market is, is currently at 26 and moving higher. Usually, a value above 25 suggests high market volatility, which can signal a continued price increase.

Crypto analyst Ali Charts also noted that while historically, Dogecoin price topped out after MVRV crossed 78%, today’s price correction reset the MVRV to 45.65%, suggesting that DOGE still has room to climb.

Key Resistance Levels Dogecoin Needs to Break for $1

Dogecoin’s price currently sports a gigantic cup and handle in the 1-week chart timeframe. Cup and handles are generally bullish reversal patterns, and this one hints at the DOGE price soaring as high as $1.5 before hitting a major resistance.

However, on the way up, Dogecoin may encounter resistance levels of around $0.5 and $0.76, which coincides with its previous all-time high.

On the flip side, $0.35 is a local support level that the DOGE price may fall to if bears persist. Below that, the $0.2 resistance-turned-support is strong enough to hold the price up against high sell pressure.

If the price falls below $0.2, the current bullish thesis would be invalidated, and the Dogecoin price forecast indicates the meme coin would enter a bear market.

DOGE price is currently retracing, taking a breather before the next leg up. After the Trump-Vance published a circular naming Elon Musk and Vivek Ramaswamy as the heads of the Department of Government Efficiency (DOGE), investors are watching the DOGE price closely as it could erupt to $1.

The post Rare Indicator Hints $1 Dogecoin Price Is Inevitable In November? appeared first on CoinGape.