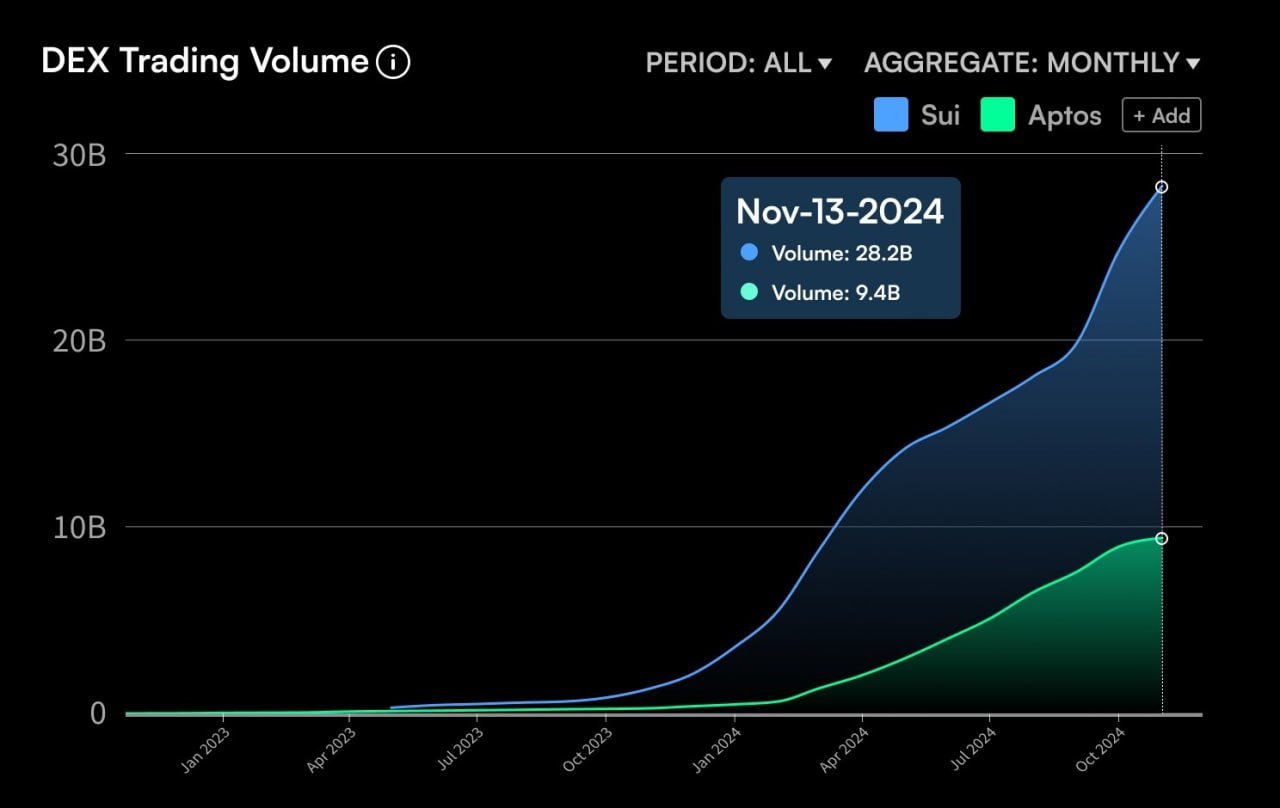

Sui (SUI) price, a prominent layer-1 blockchain, recently experienced a significant surge in its market value, highlighting robust performance and strong investor interest. The cryptocurrency has displayed a clear bullish trend, suggesting the potential for continued gains after reaching a new all-time high. As demand grows, this momentum reflects increased confidence and optimism within the market, with Sui’s decentralized exchange (DEX) volume now reaching an impressive $28 billion.

Sui Price Hits Record as DEX Trading Volume Surges

Sui price has reached a significant milestone, amassing $28 billion in decentralized exchange (DEX) trading volume. This volume is now nearly three times that of Aptos, which currently sits at $9.4 billion. The data, tracked up to November 13, 2024, highlights Sui’s rapid ascent in the competitive DEX landscape.

Starting from modest trading figures in early 2023, Sui’s volume gradually grew. By mid-2024, it experienced a noticeable spike, surpassing the $10 billion mark. This upward trajectory continued, with consistent monthly increases, culminating in the latest $28 billion valuation.

The sharp rise reflects growing interest and adoption among users and investors, positioning Sui as a leading player in the DEX ecosystem. Meanwhile, Aptos, though showing steady growth, lags significantly in volume compared to Sui.

Sui Price Soars 10%: Will Rally Countinue?

Over the past month, the SUI price has surged by 44%, drawing significant attention from cryptocurrency investors. At the time of writing, the SUI price is trading at $3.26. It has experienced a substantial 10% increase within the last 24 hours alone. This bullish momentum positions SUI as a notable performer in the crypto market.

Today, the price movement for SUI has ranged from a low of $2.86 to a peak of $3.31, closely approaching its all-time high of $3.31.

If the bullish trend in Sui’s price continues, layer one could experience a strong rally to reach $5. This would represent a significant increase of approximately 50% from its current levels.

Technical indicators support this potential surge, with the Relative Strength Index (RSI) showing overbought conditions at 77.05.

Sui has reached a Total Value Locked (TVL) of $1.31 billion, showcasing steady growth in its ecosystem. The network’s stablecoin market capitalization stands at $379.06 million, emphasizing its expanding financial presence. Within the past 24 hours, trading volume hit $354.16 million, indicating strong investor engagement.

Sui’s rapid rise reflects its strong investor interest and growing user base. As the DEX volume milestone hits $28 billion, analysts are optimistic. With bullish trends prevailing, Sui could continue its impressive upward trajectory in the coming months.

The post Sui Price Eyes 50% As Network Volume Soars Past $28B appeared first on CoinGape.