Pepe coin price is correcting after surging to a daily high of $0.00001480. Despite declining 10.6% in the past 24 hours, the PEPE price is still up 37% in the past week, and its trading volume has soared to a 3-month high following a bullish breakout. Can the price of PEPE soar 15X after clearing a five-month resistance?

Pepe Coin Price Breaks Out As Trading Volume Hits 3-Month Peak

Coingecko data shows this trending meme coin is pushing over $7.23 billion in daily trading volume across three chains (BSC, Ethereum, and Arbitrum One) and multiple exchanges, indicating a surge in interest and activity from traders. The last time such volume levels were hit was during the August 5 crash.

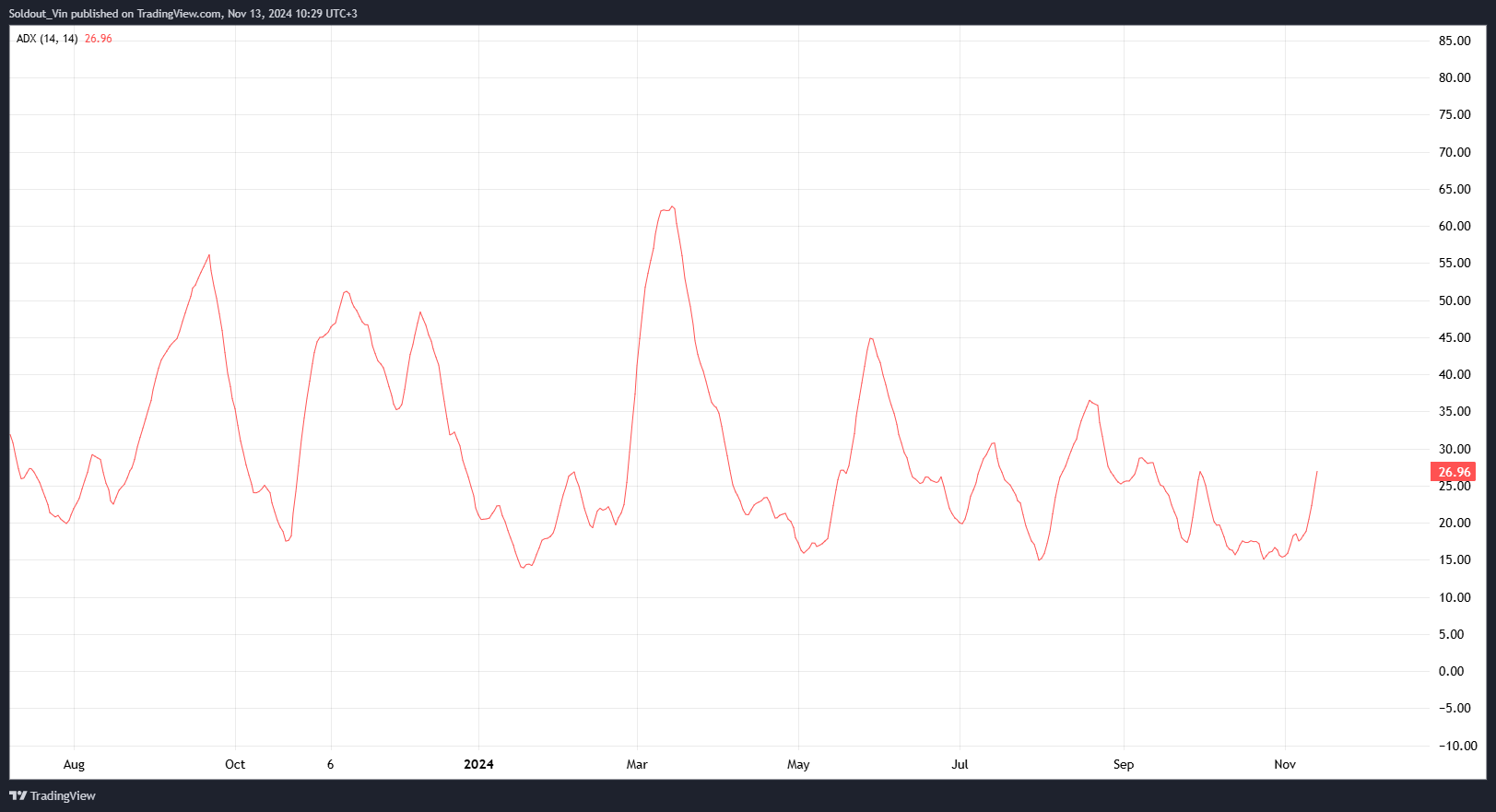

Heightened activity around a coin can increase price volatility as more buyers and sellers enter the market. The Average Directional Index (ADX) indicator, which tracks asset volatility, confirms that Pepe’s trading activity is rising.

Crypto analyst CryptoZeus said PEPE price was looking “Monstrously Bullish” as predicted the frog-themed meme coin will soar to the moon in ‘The Most Exciting Bull Run Of All Time”.

Bullish Indicators: Can PEPE Price Gain 1500%?

The current trend appears bullish as the Pepe coin price is above the 50-day and 200-day simple moving averages (SMAs), with the 50-day SMA acting as support. A breakout from a triangular consolidation pattern also indicates bullish momentum.

Recent candlesticks indicate bullish momentum with strong upward wicks, suggesting buying pressure.

The breakout from the triangular consolidation has been accompanied by a surge in volume, indicating strong interest and a potential trend reversal. Sustained high volume would confirm the strength of this breakout and could lead to continued upward movement.

This chart suggests the possibility of an impulsive wave structure forming following the breakout. The upward targets could correspond to wave extensions, with the projected target of 0.00019749 aligning with the end of a potential wave 3.

If bears push the price back into the triangle, the current breakout would count as a fakeout, and the bullish thesis would be invalidated.

Key levels to watch for include $0.00002214 and $0.00002798, which coincide with the 0.27 and 0.618 Fibonacci extension levels, respectively. Conversely, a key support zone is $0.00001119 at the 0.38 fib retracement level.

Whales Are Fueling the Pepe Coin Price Rally

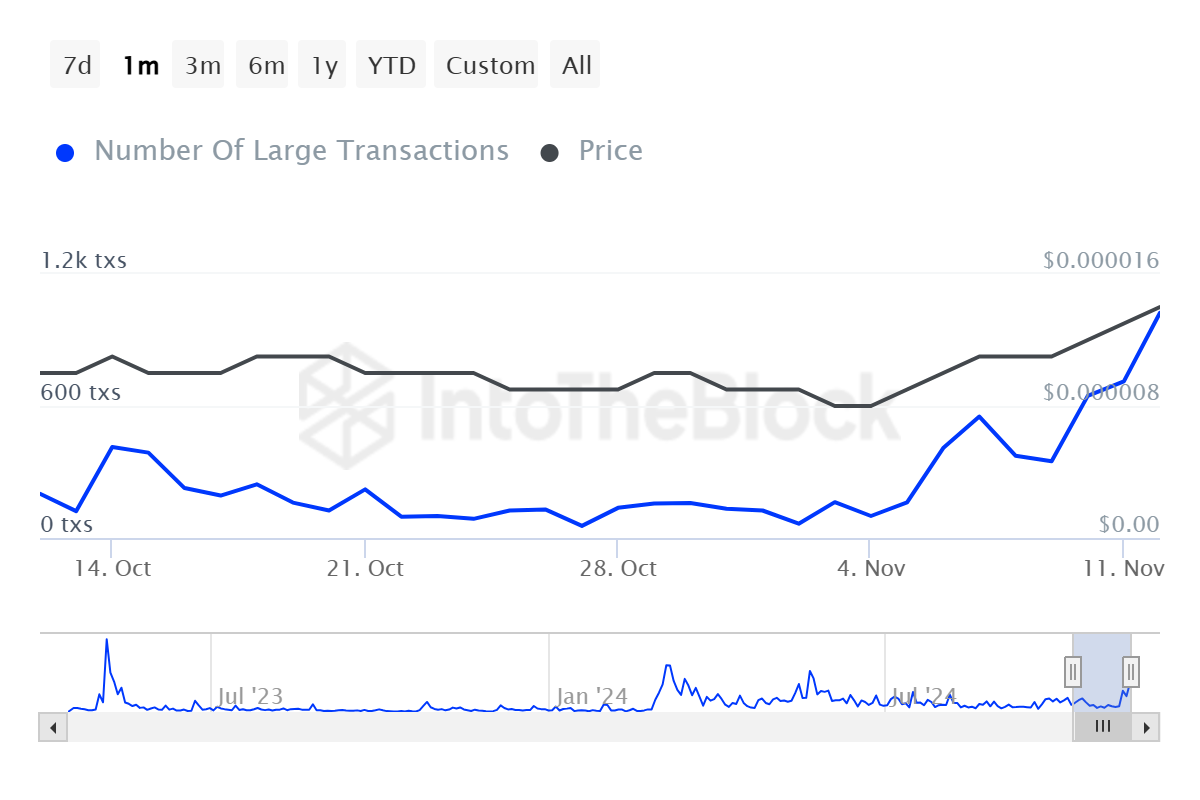

Data from IntoTheBlock shows that the PEPE large transaction count soared over the last week, increasing from 100 to over 1,020 in a week. Subsequently, large holder inflow has soared 104% in the past 7 days and 195% in the past month.

When large investors, often called “whales,” increase their activity, it can signal strong confidence in a crypto asset’s potential, leading to increased price volatility and potentially driving the price up due to higher demand.

The post Will Pepe Coin Price Soar 1500% After Volume Breaks 3-Month High? appeared first on CoinGape.