The recovery momentum in the crypto market continues to accelerate as Bitcoin hits another high of $92,500 during Wednesday’s U.S. market session. The U.S. Consumer Price Index (CPI) report fueled this surge in buying pressure, which revealed a year-over-year increase of 2.6%. Following the trend, the XRP price shows sustainability after a major breakout from 38 months of accumulation, signaling a rally to $1.5 insight.

By press time, the Ripple coin price trades at $0.71 with an intraday gain of 1.63%. While the asset’s market cap is at $40.78 Billion, and its 24-hours trading volume is at $9.18B.

XRP Price Breakout from Multi-Year Consolidation Signals a Rally to $01.5

Over the past three years, the XRP price has traded sideways, resonating within the formation of a symmetrical triangle pattern. This pattern is defined by two converging trendlines that act as dynamic resistance and support, gradually narrowing the price range and creating a squeeze in the altcoin’s price movement.

Amid the ongoing Ripple vs. In The SEC case, this prolonged consolidation indicates a lack of clear dominance from either buyers or sellers in determining the asset’s price direction. However, the crypto market witnessed renewed interest in bullish momentum following Donald Trump’s victory in the U.S. presidential election.

Thus, the XRP price rallied sharply from $0.49 to $0.715— a 44% increase— in the last 10 days. The recovery trend gave a decisive breakout from the triangle pattern key resistance on November 10th, projecting an early sign of major trend reversal.

If the pattern holds true, the XRP price could rally 33% to reach $0.92, followed by an extended rally to $1.5.

HODLers Take Control as XRP Supply on Exchanges Falls

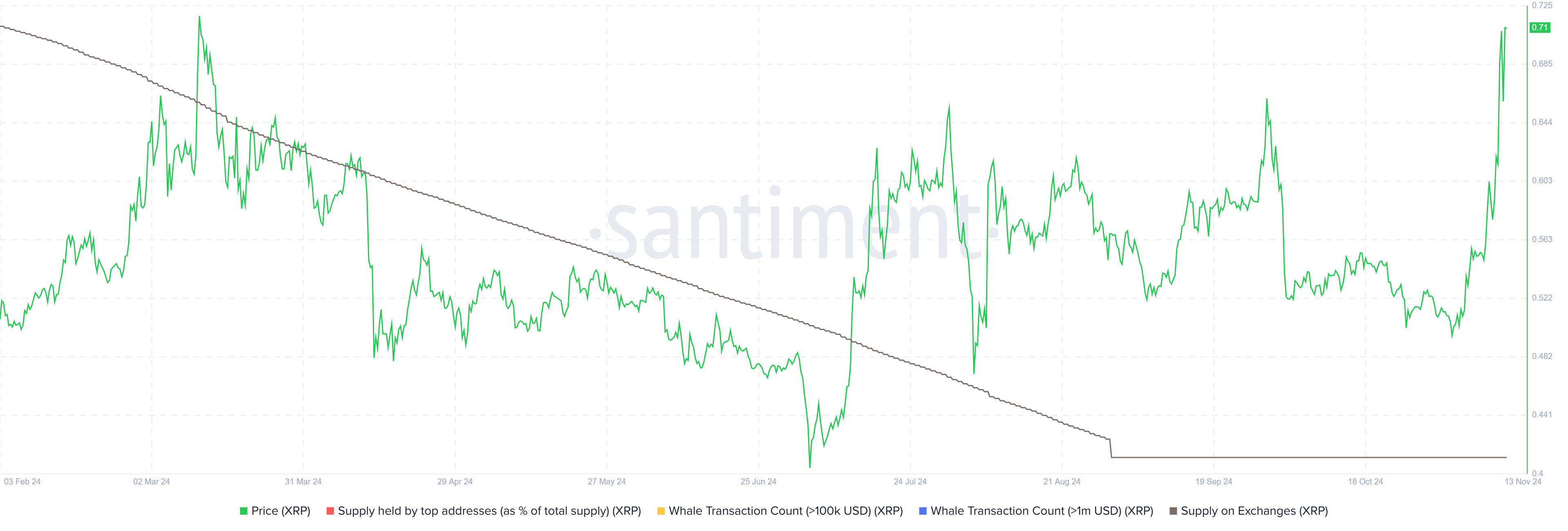

Since early February, the XRP supply on crypto exchanges has drastically dropped from 3.3 Million to 2.6 Million coins, according to Santiment data. This decline indicates that investors are moving their assets from exchange wallets to private wallets, highlighting a growing “HODL” sentiment among investors.

This trend suggests that holders are opting for long-term storage rather than engaging in short-term trading, which could reduce selling pressure on the market.

However, a unidirectional uptrend in a financial asset is unlikely to be sustained without a steady stream of positive news. From a technical analysis perspective, no trend remains unchanged indefinitely.

As a result, the XRP price is expected to pull back to recover and recharge its exhausted bullish momentum.

The post Will XRP Price Breakout from 40-Month Accumulation Drive a FOMO Rally to $1.5? appeared first on CoinGape.