Dogecoin price is down 9.3% in the last 24 hours after failing to break above a key resistance of around $0.36. Despite the increasing sell pressure at this resistance level, popular analysts predict that the DOGE price will soar to $3.15 in the next 17 days due to the repeat of a historical pattern. Will the price of DOGE soar above $3 by December 2?

Dogecoin Price Eyes $3 If History Repeats

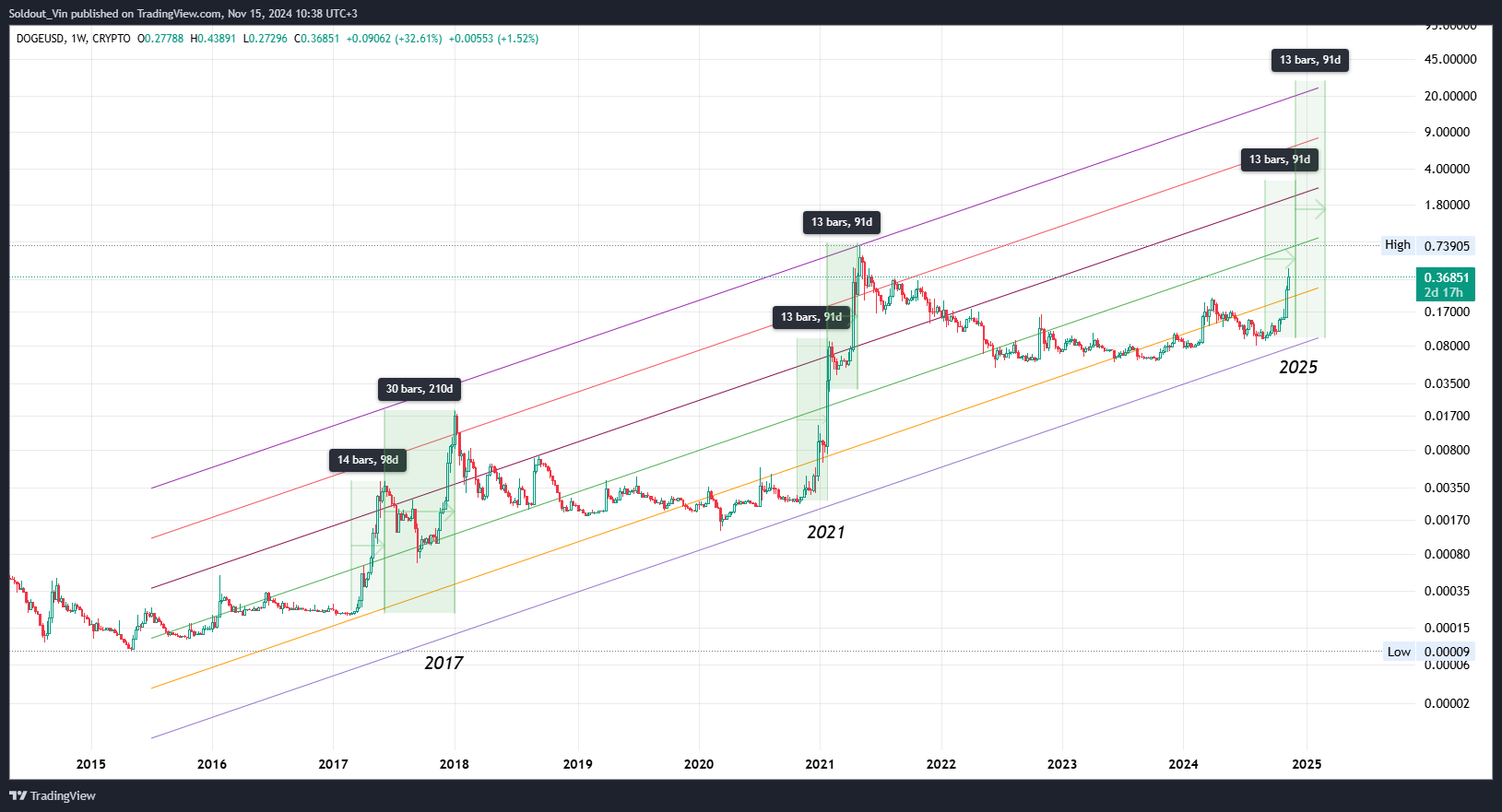

Famous crypto analyst Master Kenobi has predicted that Dogecoin price could hit $3.15 in the next 17 days. Historically, DOGE price growth during bull markets has had two phases. In the 2017 cycle, the growth lasted 91 and 217 days, while in 2021, both phases lasted 91 days.

Projecting off of these timelines, Kenobi predicts that DOGE price could reach $1.54 by December 2, and $6.88 by July 7, 2025 if it follows 2017 bull cycle (scenario 1). If it follows the 2021 bull cycle (scenario 2), Dogecoin could hit $3.15 by December 2 and $26.3 by March 3, 2025.

Such a bullish move would constitute a 327% increase to $1.54 or a 775% surge to $3.15. Kenobi says $3.15 is optimistic but $ 1.54 by December 2, 2024 is more realistic.

Can DOGE Price Hit $3? Key Levels to Watch

Dogecoin price forecast shows a strong upward trend, evidenced by the recent sharp price spike within an ascending channel. This breakout signals bullish momentum in the medium term.

The recent price increase is accompanied by high trading volume, supporting the validity of the upward movement and hinting at strong market interest. The immediate breakout from the ascending channel suggests the possibility of a potential parabolic price movement.

The major resistance level is at $0.7399, where the price previously faced significant rejection in early 2021. On the flip side, key support levels include $0.22, aligned with previous consolidation areas, and the lower bound of the ascending channel near $0.12.

Is A $3.15 DOGE in 17 Days Realistic or Just Hype?

Previous historical chart patterns during the 2017 and 2021 bull runs suggest different outcomes. However, the outcome will depend on different factors during this bull run.

- Potential approval of Dogecoin ETF, following the speedy approval of Ethereum ETF in June.

- A pro-crypto U.S government is looking to form a Strategic Bitcoin Reserve and adopt pro-crypto regulations.

- Increasing adoption of crypto assets and Dogecoin. For instance, Canadian company Spirit Blockchain Capital announced it would be using MicroStrategy’s investment strategy— but with Dogecoin (DOGE)

- The 2025 incoming bull run and alt-season could cause DOGE price to soar to new highs quickly.

These and other macro-economic factors will likely contribute to one of the best bull runs in history, potentially pushing Dogecoin price to $1.54 or even $3.15 before mid-December.

The post Here’s What Needs to Happen for Dogecoin Price to hit $3: Analyst Explains appeared first on CoinGape.