The naming of the Department of Government Efficiency, D.O.G.E., under the forthcoming administration of Donald Trump, has caused much debate especially when it comes to US inflation and – Tyler Winklevoss. Tyler, the co-founder of Gemini, commented on D.O.G.E., which proposed to root out government waste and fight US inflation that rose over 2,6%. He has insisted that such initiatives are crucial in the fight against the “silent tax” of inflation, which affects poor Americans most.

D.O.G.E. Is Crucial to Combat Inflation’s ‘Regressive Pressure’

The announcement of the Department of Government Efficiency (D.O.G.E.) under a potential Trump administration has sparked considerable debate. Tyler Winklevoss, co-founder of Gemini, weighed in on the proposed initiative, which aims to eliminate wasteful government spending and tackle the price rise. US inflation rose by 2.6% year-over-year last month, slightly up from September.

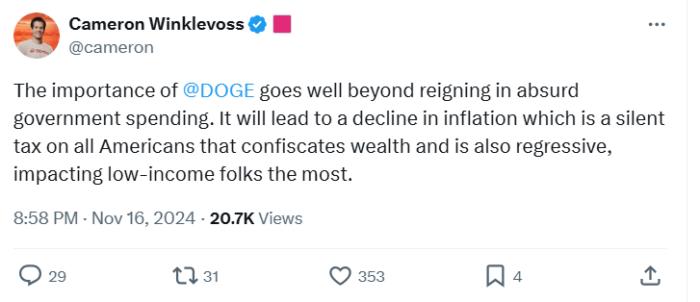

He emphasized the importance of addressing the price rise, a “silent tax” that disproportionately burdens low-income Americans, arguing that such measures are essential for economic fairness and sustainability.

Be it as it may, Tyler, who recently criticized SEC Chair Gary Gensler, calling him evil, said now that inflation requires a more innovative approach to manage because it works to destroy wealth and exert regressive pressure on economies, particularly those that are ill-equipped to bear it.

The Department aims to reduce federal inefficiencies, but its potential impact on US inflation remains a main subject. Critics suggest that the lack of clear governmental power could limit D.O.G.E.’s ability to tackle it effectively.

Previously, Tyler severely criticized the Chairman of the SEC, Gary Gensler, over his approach to regulating cryptocurrencies. Specifically he exclaimed that Gensler should be permanently removed from any positions of influence, claiming he undermined the crypto industry to further his political ambitions.

Meanwhile, the US dollar is constantly weakened as a store of value because of the increase in the money supply by the Federal Reserve. Keeping these factors in mind, the Winklevoss brothers are of the view that Bitcoin is going to grow significantly.

This is upon the basis of the fact that its adoption—majorly by central banks—could see a spike in price, probably up to $500,000 per coin. Just for comparison, regarding the inflation, recently Peter Brandt predicted Bitcoin to go bullish, suggesting that the crypto could hit new highs in the coming days.

Winklevoss Urges Action on Inflation’s Impact on Low-Income Americans

The US inflation rose by 2.6% year-over-year last month, slightly up from September. This follows a series of rate cuts by the Federal Reserve. These cuts aimed to address cooling prices and a weaker labor market. The October Consumer Price Index (CPI) met predictions and marked a rise from September’s 2.4%. This increase coincided with a 0.5 percentage point rate cut and a second reduction in November.

The Winklevoss twins were describing some unique attributes that set Bitcoin apart: its immutable supply of 21 million coins creating scarcity and a decentralized system offering security and protection against physical seizure. Such qualities make it “digital gold” or “gold 2.0.”

Tyler Winklevoss views Bitcoin’s scarcity and decentralization as key solutions to counter inflation and protect against economic instability. He advocates for embracing innovative financial tools to ensure equitable opportunities in the face of rising costs.

In contrast to more traditional inflationary hedges such as oil, gold, and the US dollar, Bitcoin is resistant to geopolitical volatility and central bank manipulation. Whereas oil, though necessary, undergoes price discrepancies, gold faces practical challenges regarding transportation and the risk of confiscation.

The post Vinklewoss: D.O.G.E. Is Crucial for Fighting US Inflation appeared first on CoinGape.