Pepe Coin (PEPE) price has breached the upper limit of an ongoing consolidative pattern, suggesting that a breakout rally is near. If the momentum remains strong, PEPE could rally double digits and set up a new all-time high (ATH).

Pepe Price Techncial Analysis: 25% Breakout Rally Likely

After a 105% rally in second week of November, Pepe has been moving sideways, producing lower highs and relatively equal lows. Over the past ten hours the value of PEPE has shot up 18%, breaking out of the trend line connecting lower highs. The descending triangle setup with a bullish breakout forecasts a 25% rally.

Adding the triangle’s height to the breakout point of $0.0000287 reveals a target of $0.0000264. So, investors can expect a 25% rally for PEPE.

Supporting this bullish outlook for PEPE is the recent uptick in the 50-period Exponential Moving Average (EMA). This uptick shows that the momentum is shifting to the upside and also maintains the short-term MA above the long-term MA of 200. So long as this is maintained, investors can expect the breakout to be successful.

Furthermore, the RSI is also heading for the overbought conditions, indicating that the bullish momentum is in control. The AO indicator has crossed over to the upside, signaling a shift in momentum favoring bulls. Additionally, AO is printing green histograms above the 0 mean level, aligning with the breakout, showing confidence and strength.

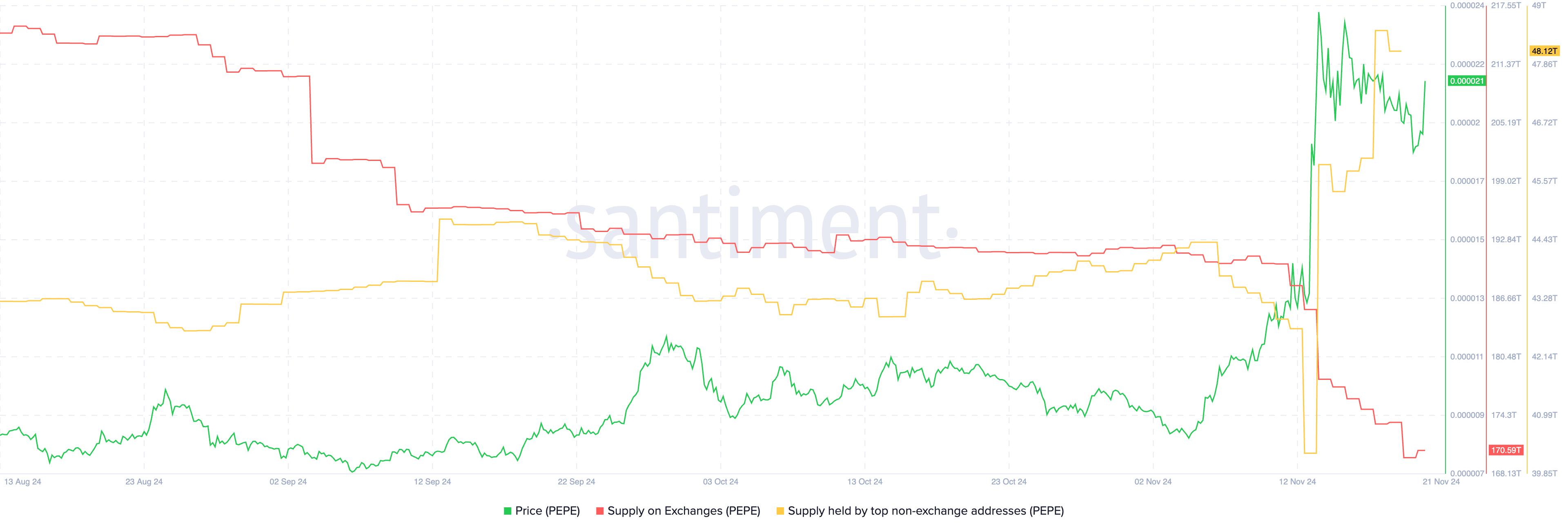

PEPE Supply on Exchanges Drops, Investors Accumulate

In addition to the technicals, the supply of PEPE held over the past four months supporting has been on a steep decline in. A drop in this metric shows investor confience and reduces the selling pressure. While a drop in supply is bullish, accumulation from non-exchange addresses shows further confidence that the outlook is massively optimistic.

All in all, the outlook for PEPE looks bullish but if price fails to hold above the declining trendline after breakout, it will signal weakness. A retracement inside the descending triangle will indicate that the meme coin could slide down toward the end lower end of the triangle at $0.0000193.

The post 3 Reasons Why PEPE Price Will Rally 25% This Weekend appeared first on CoinGape.