Cardano (ADA) price, a leading proof-of-stake cryptocurrency, has surged by over 120% in the past month. This exceptional rally aligns with a bullish sentiment in the cryptocurrency market, bolstering investor confidence. Breaking through significant resistance levels, ADA demonstrates strong growth potential. However, emerging sell signals suggest its recent uptrend could face a sharp correction, potentially leading to a 40% price decline.

Cardano Price May Crash 40% Soon: 4 Key Sell Signals

Cardano price shows signs of a potential 40% drop as multiple sell signals emerge on technical charts. The chart highlights that a repeating price fractal suggests a looming correction, while the Relative Strength Index (RSI) remains in overbought territory at 81, signaling caution for investors.

Additionally, market momentum appears to be weakening, further supported by bearish trends in technical indicators.

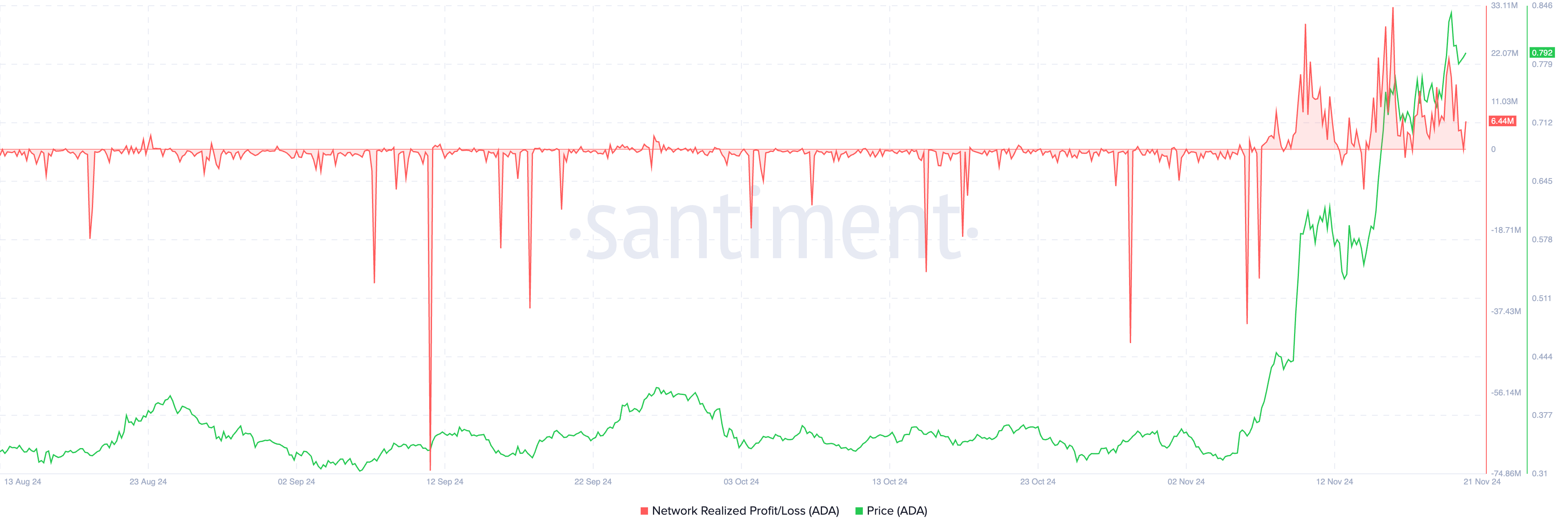

Cardano price might face a steep decline as key metrics indicate potential sell signals in the market. One such indicator, the Network Realized Profit/Loss, shows consistent positive spikes, signaling profit-taking activity among investors.

These spikes often suggest weakening market sentiment, with traders selling off at higher price levels.

According to recent market data, the Cardano price is at risk of a steep 40% drop. The 365-day Market Value to Realized Value (MVRV) metric highlights significant unrealized profits among investors, triggering concerns about mounting selling pressure. This indicator often signals an overextended market, raising the likelihood of profit-taking behavior.

With these elevated profit levels, traders may capitalize on gains, potentially intensifying downward momentum

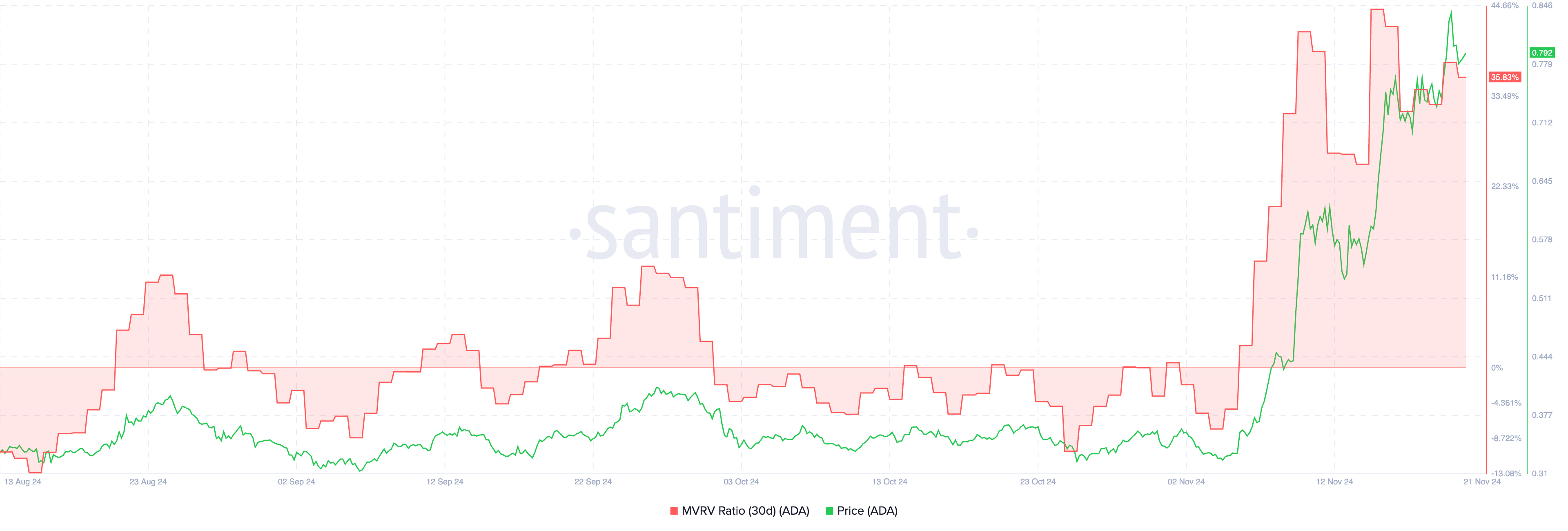

The top altcoin could experience a significant drop of up to 40% as critical sell signals emerge. One major factor contributing to this bearish outlook is the MVRV (Market Value to Realized Value) 30-day metric. This indicator suggests many investors are sitting on unrealized profits, which could lead to increased selling pressure.

The likelihood of a price downturn rises as holders aim to secure gains before potential losses occur. Such behavior could amplify downward momentum for Cardano’s price in the near term.

The latest ADA price has notably dropped, trading at $0.7904 after a daily decline of 4%. The cryptocurrency experienced price fluctuations throughout the day, with a high of $0.8309 and a low of $0.7704. This reflects ongoing volatility in the broader crypto market.

Cardano’s recent surge faces mounting bearish signals, including overbought RSI, weakening momentum, and profit-taking behavior highlighted by MVRV metrics. These factors suggest a potential 40% price correction, urging investors to approach ADA with caution amid heightened market volatility.

The post 4 Sell Signals That Suggest Cardano Price Could Crash 40% Soon appeared first on CoinGape.