In a riveting turn of events, MicroStrategy founder Michael Saylor lost voting control over the company recently, sparking market discussions amid the giant’s soaring BTC adoption saga. While the company continues to acquire Bitcoin almost regularly, a pivotal shift in its governance system has caught significant attention among market participants. Notably, with Saylor losing voting control over the firm, the entity also forfeits its status as a “controlled company” on Nasdaq.

Here’s a brief report on the abovementioned development, offering a clear understanding as to why Saylor has lost control despite its pioneering stance in the industry.

Michael Saylor Loses Voting Control Sparking Market Speculations

According to ‘On The Brink’ podcast co-host Matt Walsh on X as of November 20, “Michael Saylor no longer has voting control over the firm, MicroStrategy.” Primarily due to the sheer volume of shares sold under the Sales Agreements, the company earlier anticipated that Saylor, the founder, would lose voting control this month as he would no longer hold more than 50% of the aggregate voting power. Notably, this aspect is vital for any firm to qualify as a ‘controlled company’ under Nasdaq’s directions.

However, with the firm’s Chairman losing voting power, the firm loses its ‘controlled company’ status while it also forfeits rights to avail of “corporate governance exemptions” offered by Nasdaq. Moreover, the governance change could also result in a paradigm shift surrounding the market sentiment for the firm, as MicroStrategy cemented its BTC buying plans alongside Michael Saylor’s bullish stance on the asset.

Market watchers continue to speculate as Saylor loses his voting control, a change in the company’s Bitcoin buying plans may be witnessed ahead.

MicroStrategy Forging Ahead With BTC Buying Plans

On the other hand, despite the firm facing substantial governance changes, its recent Bitcoin buying plans have continued to birth a bullish market sentiment. CoinGape Media recently reported that the tech giant announced upsizing its zero-interest convertible senior notes from $1.75 billion to $2.6 billion in Bitcoin acquisition plans. This saga has bolstered the market sentiment surrounding the firm as well as flagship crypto.

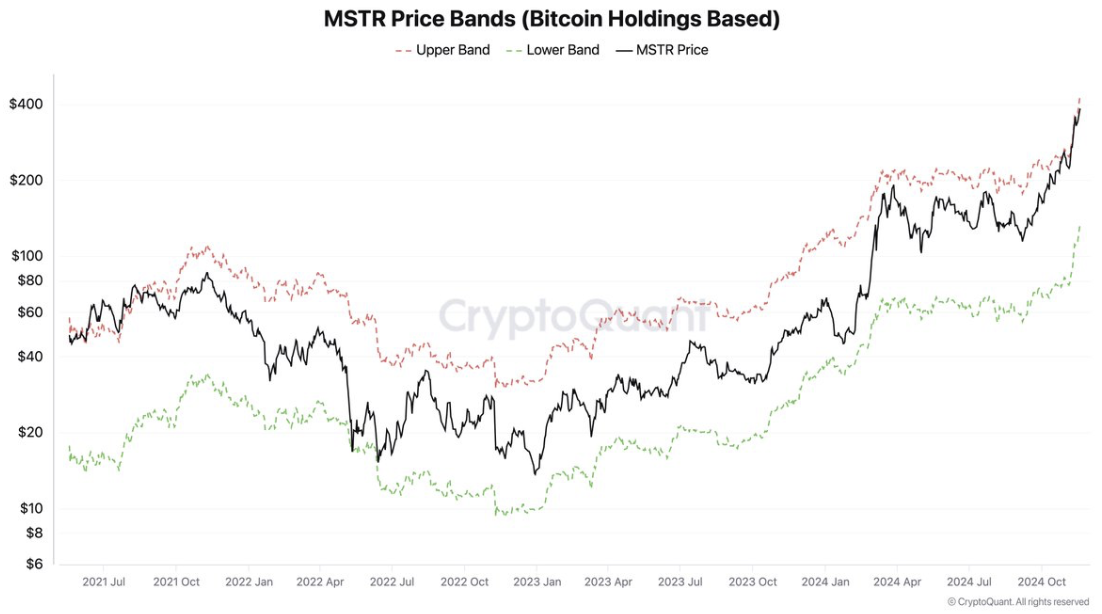

Simultaneously, another report revealed that the firm announced purchasing 51,780 BTC for $4.6 billion at an average price of $88,627. These massive buying plans, in turn, add bullishness to the MSTR stock price. Notably, MSTR stock price closed at $473.83, up nearly 10% on November 20. In light of this bullish movement, CryptoQuant CEO Ki Young Ju took to X on November 21, revealing that MSTR is getting hyped in light of its Bitcoin holdings. This statement adds a layer of intrigue to the firm’s future endeavors in the wake of Michael Saylor losing voting control and a bullish crypto market.

The post Michael Saylor Loses MicroStrategy Voting Control Amid Soaring BTC Adoption appeared first on CoinGape.