The latest SHIB burn rate data has once again sparked noteworthy bullishness surrounding the renowned dog-themed meme token, Shiba Inu. The token’s burn rate witnessed a whopping 2200% uptick on Thursday, amid reports of a potential rally in the asset’s price ahead. For context, recent on-chain metrics sparks optimism with investors anticipating a parabolic rally ahead for the meme coin, primarily in light of the broader sector’s ongoing bull run.

SHIB Burn Rate Pumps 2200% Delivering Massive Blow To Supply

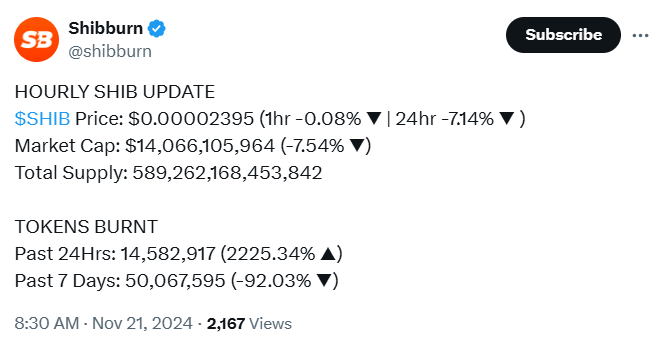

According to an X post from the official tracker Shibburn on November 21, the SHIB burn rate blew up 2225% intraday as 14.58 million coins were destroyed. This massive burn rate surge resulted in a massive hit to the meme token’s circulating supply.

Per the data, the total supply at the time of reporting was evaluated as 589.26 trillion tokens. Simultaneously, it’s noteworthy that the weekly burn data pointed out that 50.06 million coins were burnt in the past seven days.

Overall, the massive burning chronicles have bolstered market sentiment for the leading dog-themed meme coin as the supply continued to shred. Notably, the SHIB burn mechanism aims to kill the token’s excessive market supply by sending tokens to a null address. In turn, the token eyes a bullish market sentiment on account of the law of supply and demand as these null-address tokens can never be used again.

Shiba Inu Parabolic Rally Ahead?

However, despite the abovementioned burn rate surge, Shiba Inu price fell 2% intraday and is currently sitting at $0.00002386. The token’s 24-hour low and peak were $0.00002311 and $0.00002478, respectively. Although this waning movement caused apprehension among investors, it’s worth mentioning that the monthly chart indicated gains worth 30%. This broader bullish trajectory further falls in line with the monthly SHIB burn rate data, as 192.78 trillion tokens were burnt this month.

Simultaneously, a recent SHIB price analysis by CoinGape Media has added to market optimism surrounding the token. A price forecast for the crypto spotlights key reasons why investors should not sell the coin, especially amid a broader meme coin bull market.

Moreover, it’s also worth mentioning that recent on-chain data indicates that the meme sector is poised to witness further rally ahead. This report has also sparked optimism over a continuing rally for top meme coins like SHIB, DOGE, PEPE, and others. Notably, meme coins like PEPE and DOGE have also been up by 90%-169% over the past month.

The post SHIB Burn Rate Surges 2200%, Shiba Inu Eyes Parabolic Rally Ahead? appeared first on CoinGape.