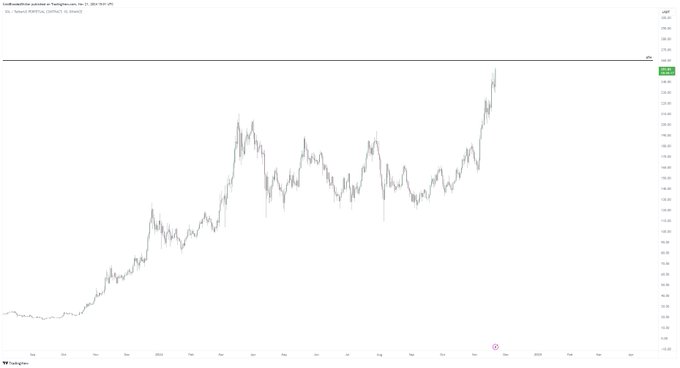

Solana Price, a Layer 1 blockchain, has witnessed significant price volatility throughout November, capturing the attention of investors. Following a consistent bullish trend, SOL recently experienced a notable price surge, reflecting growing market confidence in its ecosystem. The cryptocurrency achieved an impressive ATH, further fueling speculation about its potential trajectory. Analysts now speculate whether Solana could reach a price target of $500.

Analyst Predicts Next Target For Solana Price After New ATH

The crypto analyst recently highlighted his bullish stance on Solana price, noting its undervaluation over the past five months. According to analysts, the cryptocurrency had been consolidating within a high-time frame range, indicating a potential for an upward breakout. His predictions are playing out, as SOL has surged 35% since his latest recommendation.

The layer 1 token has breached its previous all-time high and is now trading in a bullish trend. Analysts remain optimistic, forecasting $500 as the next target in this bullish cycle.

SOL Price Hits ATH Amid Market Surge

Over the past month, the SOL price has surged 60%, reaching $259.98, reflecting significant daily growth. The latest SOL price has shown a 7.26% increase, marking a notable performance in the market. Over the last 24 hours, the price ranged from a low of $240.17 to a high of $263.70, nearing its all-time peak.

Most of the crypto market today is trading in a bullish trend. BTC price is nearing an ambitious $100k, currently at $98k. The ETH price is also at $3300, fueling the surge in other top coins like SOL hitting ATH.

Solana has gained traction in the cryptocurrency market and has shown strong bullish momentum recently. If the bulls mount more pressure, the Solana price prediction could soon challenge the $300 resistance level.

Market watchers highlight that if this momentum persists, SOL might aim for its all-time high of $500. This would represent a potential surge of over 90% from its current value. The Relative Strength Index (RSI) also reflects the market’s growing momentum. The RSI reading of 68 indicates that Solana is approaching overbought territory.

According to Coinglass, the Solana market has seen a significant rise in both trading volume and open interest. This growth underscores increased investor participation, reflecting a notable boost in market activity.

Solana’s bullish momentum continues to captivate investors as it eyes the $500 target. With strong market support, increased adoption, and growing interest, SOL’s upward trajectory suggests a potential for further gains if the bullish trend sustains.

The post Pundit Forecasts Solana Price Next Target After SOL Hits New ATH appeared first on CoinGape.