Is MicroStrategy a bubble? That’s the question on everyone’s mind after a staggering 515% MSTR stock rally this year. Furthermore, MSTR’s staggering premium of nearly 195% over its Bitcoin holdings is making everyone nervous that the bubble could burst anytime soon.

MicroStrategy (MSTR) Is Not A Bubble

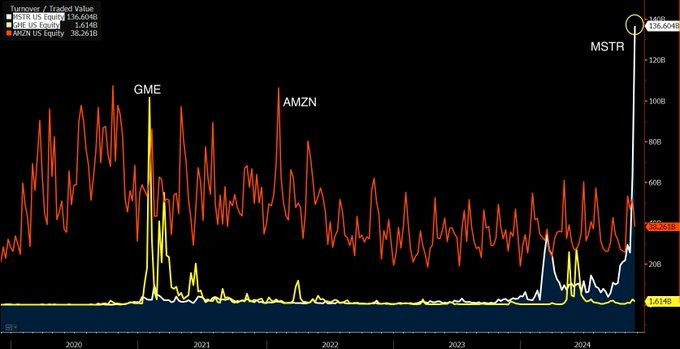

Last week, MicroStrategy (MSTR) stormed Wall Street clocking over $136 billion in trading volumes leaving behind giants from the “Magnificent 7” group. Not even GameStop (GME) during its peak frenzy in 2021 bull run attained volumes closer to this, noted The Kobeissi Letter.

The MSTR valuation is currently at 2.95x, or 195% premium to its Bitcoin holdings. This is the company’s largest Bitcoin holding premium since the 2021 bull run. After a staggering 515% MSTR stock rally already in 2024, investors remain in a dilemma about what will happen next. Notably, MicroStrategy purchased 51,780 BTC for a staggering investment of over $4 billion last week.

MicroStrategy (MSTR) has become the global proxy for seeking Bitcoin exposure. It functions on a simple model of issuing debt to raise funds to make more Bitcoin purchases. This creates a self-reinforcing cycle wherein the rising BTC price supports further investment and borrowing.

Bitcoin maximalist Fred Kruger explains that restrictive global regulations are behind MSTR’s success. He said that excessive regulation prevents direct access to Bitcoin and cryptocurrency ETFs in multiple jurisdictions, forcing investors to turn to alternatives like MSTR shares.

Citing Michael Saylor’s recent interview, Kruger said that British citizens and investors in countries like Singapore and South Korea face significant barriers in purchasing Bitcoin ETFs. In the U.S., major financial institutions such as Goldman Sachs, Merrill Lynch, and Morgan Stanley are constrained by banking regulations, limiting their ability to offer crypto ETFs directly.

Additionally, most 401(k) retirement plans in the United States do not permit ETF investments, further complicating access for individual investors.

“This regulatory window creates a world in which ‘buying a dollar bill for three dollars’ is the only solution,” Kruger remarked, referring to the premium investors pay for MSTR shares as a proxy for Bitcoin exposure. The analyst said:

“Saylor is in complete command of the markets this weekend. He can paint the tape. He can place sell orders with leverage. He can wait. He can buy slowly. Or he can steamroll you. He who has the money makes the rules”.

Michael Saylor Has Effectively Managed Debt

Some argue that purchasing MSTR equates to paying a “premium” for Bitcoin ownership. In response, Michael Saylor compares this to evaluating oil companies solely by their oil reserves. He explains that just as oil is refined into gasoline, MSTR adds value to Bitcoin through its strategic operations.

Furthermore, Cryptoquant CEO Ki Young Ju explains that during the last bear market, the company’s premium for Bitcoin holdings never dipped under zero. On the other hand, the Grayscale Bitcoin Trust (GBTC), now a Bitcoin ETF, experienced a steep discount, plummeting to -48%. This dramatic drop triggered a market crisis by the unwinding of leveraged positions.

Ki Young Ju said that throughout the 2022 bear market, Saylor effectively managed Bitcoin market risks and maintained MicroStrategy’s stability despite high exposure to the cryptocurrency. His strategic handling of leverage provided a blueprint for navigating volatile crypto markets, he added. Saylor has already hinted that he would continue to buy more Bitcoins moving ahead.

We need more green dots on https://t.co/Bx3917zeAK. pic.twitter.com/0VCrBs9oUa

— Michael Saylor

(@saylor) November 24, 2024

Last week, MicroStrategy completed its $3 billion convertible note offering at 0% interest. These notes have a strike price of $672. In essence, the notes are priced at a 55% premium to the current MSTR share price, meaning investors will only profit if MSTR’s stock climbs above $672.

Investors are expecting Saylor to announce a $3 billion additional Bitcoin purchase on Monday morning, with veterans like Robert Kiyosaki praising the move. Popular handle Mike Investing noted that the MicroStrategy frenzy on Wall Street can continue this week as well, taking the stock price to more than $700.

This week will make many millionaires.

If you own $MSTR this week might be one of the most exciting and profitable weeks in your lifetime.

On Monday if Michael Saylor announces he bought 100,000 $BTC we will see $MSTR at $700+ before Thanksgiving.

Be prepared… pic.twitter.com/xxTbmr20D5

— Mike Investing (@MrMikeInvesting) November 25, 2024

The post Here’s Why MicroStrategy (MSTR) Is Not A Bubble appeared first on CoinGape.