The world’s largest crypto exchange Binance on Tuesday announced the official launch of its reward-bearing asset BFUSD. The exchange clears that the crypto asset will provide users returns on qualifying balances in their futures account, with yield as high as 19.55%.

BFUSD is a reward-bearing asset by Binance, one of the top crypto exchanges, to provide users with returns on their qualifying balances in their futures account. It can also be used as a margin in the multi-asset mode while still earning rewards.

Binance Introduces High-Yield BFUSD Margin Asset

Binance Futures in an official announcement on November 26 revealed BFUSD reward-bearing asset’s launch. Users can start purchasing the margin asset at 2AM UTC on November 27.

The crypto exchange has set limit quota of the margin asset, which is based on a user’s VIP level. In order to participate, transfer USDT to UM wallet. Holders who traded UM futures one day prior will only get boosted APY. Interest payments will be distributed daily to users’ UM Futures accounts.

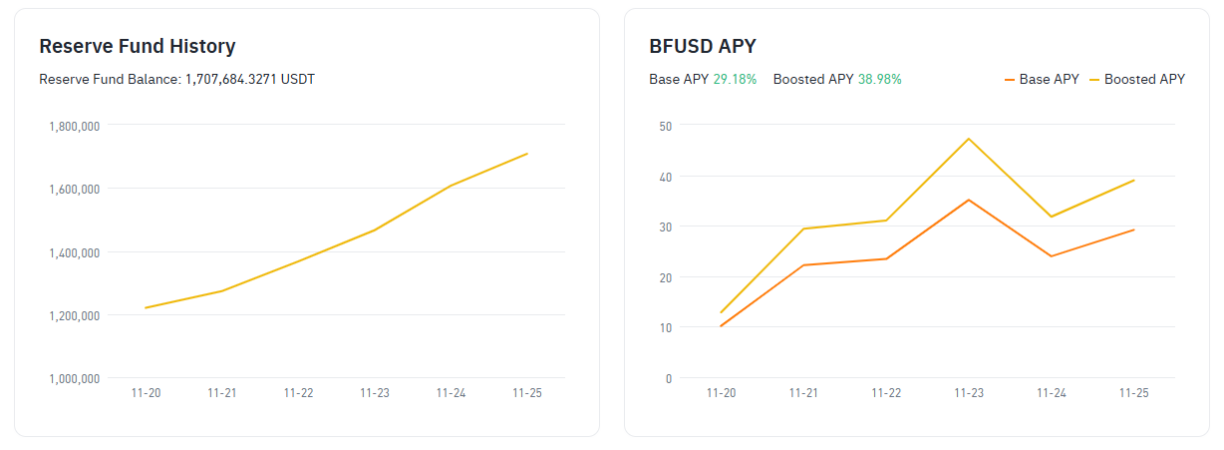

The supply is 120 million, with a collateralized percentage of 101.32%. It will offer base APY of 29.18%, with a boosted APY of 38.98%, as per Binance data.

Benefits and Risks of Holding the Asset

BFUSD is redeemable for USD stablecoin. It means users can redeem it for the US dollar, making it an ideal choice for seeking a stable solution in the crypto market.

Moreover, the exchange has also set BFUSD Reserve Fund specifically to cover potential costs from funding dees, supporting the maintenance of the Collateral Pool and the Hedging Portfolio.

One of the major benefit is its use as margin to trade USD-M contracts in multi-asset mode. There are two reward rates available each day – base rate and boosted rate. The exchange will use proceeds from BFUSD sales to execute investment strategies that generate passive income.

Some risks of holding the margin asset include negative funding rates and no right, claim, entitlement or other interest from collateral pool, hedging portfolio or reserve fund. Also, users are also exposed to Binance credit risk, redemption failure, and viable fees.

Binance earlier cleared to CoinGape that BFUSD is not a stablecoin. The exchange has also announced a promotion for early adopters. These include zero fees at purchase and 100,000 USDT in token vouchers.

The post Breaking: Binance Announces Official Launch of BFUSD appeared first on CoinGape.