Investing.com– The return of President-elect Donald Trump to the White House in January could lead to renewed trade tensions, higher inflation, and market volatility, with tariffs on Chinese and other imports posing the most significant risks to the global economy, according to UBS analysts.

However, they believe that Asia is better positioned to weather these challenges compared to the trade war of 2018-2019, thanks to improved supply chain integration, a more resilient regional growth outlook, and opportunities in emerging sectors like artificial intelligence and greentech.

The UBS research note outlines a scenario where Trump’s administration escalates tariffs on Chinese imports to as much as 60% by the end of 2026, which would have a cumulative drag of 200-300 basis points on China’s GDP growth. While this could dampen Chinese economic expansion, UBS anticipates that a robust fiscal stimulus, potentially worth CNY 5-8 trillion, could offset some of the adverse effects, maintaining growth in the mid-4% range.

UBS also expects that China will respond to tariffs with targeted retaliatory measures and increased non-US trade partnerships, mitigating the overall economic fallout.

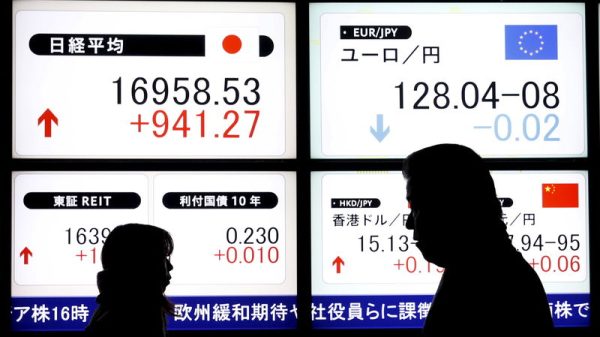

In terms of broader regional impact, it is expected that Asian growth will slow modestly in 2025 as tariffs take effect, particularly for smaller, export-dependent economies such as South Korea, Taiwan, and Singapore. These economies, heavily reliant on US tech imports, are vulnerable to trade disruptions.

Larger, domestically-focused markets like India, Indonesia, and the Philippines are expected to be less affected by tariff hikes due to their lower trade reliance and larger room for monetary policy easing. The net tariff drag on overall Asian growth is forecasted to be limited to no more than 1 percentage point of GDP.

Despite the challenges, UBS remains optimistic about the region’s long-term prospects. The firm projects strong earnings growth of 13% in US dollar terms for the MSCI Asia ex-Japan index by the end of 2025, driven by structural GDP growth, China’s stimulus measures, and falling interest rates both in the US and the region.

Key growth industries such as artificial intelligence, greentech, healthtech, and fintech are expected to outperform, with market leaders in Taiwan and India poised to benefit from technological innovation.

In China, UBS advises focusing on defensive, high-yield sectors such as financials, utilities, energy, and telecoms, while in ASEAN markets, sustainable dividend yielders could provide stability in a volatile environment.

UBS also continues to favor investment-grade bonds in Asia, noting their resilience due to strong government linkages or state ownership among many issuers.