Cardano price, a proof-of-stake cryptocurrency, has surged over 200% this November, securing its position as a market leader. The impressive rally reflects widespread bullish sentiment across the crypto sector, reigniting investor optimism and interest in altcoins. ADA has showcased strong upward momentum, positioning itself as a standout performer. This surge highlights the altcoin’s resilience and potential, sparking discussions about its trajectory over the coming 90 day.

What Lies Ahead for Cardano Price in 3 Months?

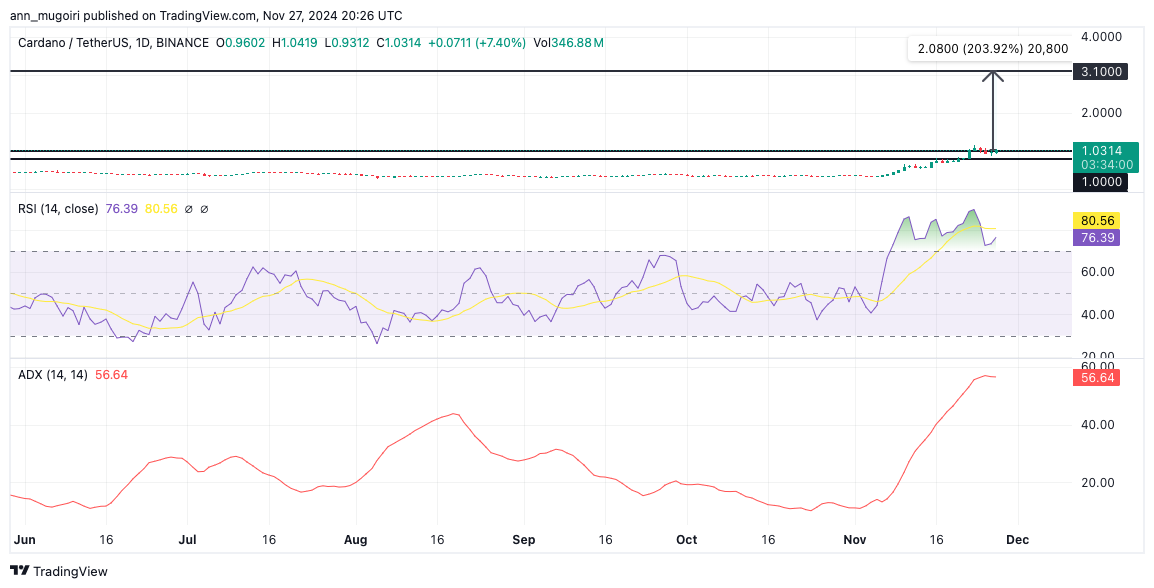

Cardano’s price has recently soared past the $1 mark, reaching its highest level in over two years. This rally underscores its robust market performance, showcasing a 170% price increase over the past year. The surge comes as blockchain innovations continue to attract significant investor interest.

Amidst this upward momentum, Bitcoin has surged to $95,000, signaling a strong bull market for cryptocurrencies. Ethereum, Solana, and BNB have also maintained steady growth trends, while XRP remains firmly above $1. Cardano’s current price trajectory suggests it could join this rally and potentially approach its all-time high if bullish market conditions persist.

Cardano’s previous peak was $3.10, achieved in September 2021. The price is still approximately 67% below that level, but experts believe a Bitcoin rally to $100,000 could push ADA beyond its historical high. Market sentiment remains optimistic, with Cardano’s strong fundamentals offering additional support for its growth.

Cardano recently announced an update for its Lace Wallet, focusing on enhanced speed and usability. This development is expected to strengthen its ecosystem and could positively impact ADA’s price.

Cardano Launches New Update for Lace Wallet Focused on Speed and Usability – Crypto Economy #Cardano #CardanoFeed #trading #ADA #crypto #CardanoCommunity #bitcoin #blockchain #governance #cryptocurrency #CardanoADA #btc $ADA https://t.co/TI59JuUsNC

— Cardano Feed ($ADA) (@CardanoFeed) November 27, 2024

Founder Charles Hoskinson has also been vocal about the cryptocurrency’s potential, providing bullish insights that further fuel investor confidence.

The ongoing crypto market rally has led to notable price increases across most major cryptocurrencies, including Cardano. As optimism continues to grow, ADA’s upward trajectory could gain additional momentum, potentially setting new milestones in the coming months.

Cardano Price Surges 11%; What’s Next For ADA?

The latest ADA price has seen a sharp upward movement, climbing to $1.02, reflecting an impressive 11% growth within the last 24 hours. This significant surge marks a positive trend for the cryptocurrency, which recorded a low of $0.89 during the same period.

The top altcoin is nearing a critical $1.5 resistance, supported by bullish momentum. A breakout could drive prices to $2, with potential further gains toward $3.1, reflecting a 200% increase.

The Relative Strength Index (RSI), at 76, signals overbought conditions. The Average Directional Index (ADX), at 56.64, confirms the strength of the ongoing trend.

Cardano’s impressive rally reflects strong market optimism and innovation-driven growth. With bullish sentiment and key updates fueling momentum, ADA could break resistance levels, potentially reaching new highs. Investors remain hopeful for continued upward trajectory in the next 90 days.

The post Cardano Price: What to Expect in the Next 90 Days? appeared first on CoinGape.