By Steven Scheer

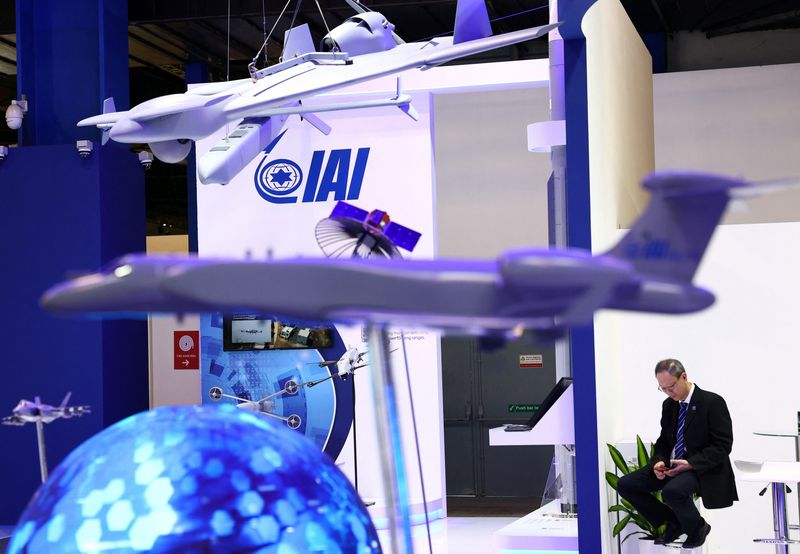

JERUSALEM (Reuters) – State-run Israel Aerospace Industries is ready for an initial public offering in Tel Aviv but awaits the go-ahead from the government, IAI chief executive Boaz Levy said on Sunday.

A ministerial privatisation committee in November 2020 had approved a plan where Israel could sell up to 49% of IAI, the country’s largest defence firm, on the Tel Aviv Stock Exchange, bringing in billions of shekels.

“We are moving towards an IPO,” Levy said at an investor conference at the TASE. “In the past year our business results have continued IAI’s growth trend. We are currently experiencing phenomenal performance.”

He said that according to the government’s decision that has already been approved, there will be an IPO of a minority stake in IAI as soon as the finance and defence ministries “reach a decision that it is time to do it.”

Those ministries declined to comment.

Israeli media have reported that the need to reach understanding with IAI’s union, and weakness in the stock market over the past two years, had put the IPO on hold.

IAI produces defence and civilian products including aircraft, air and missile defence, unmanned aerial systems (UAS), ground robotics, precision-guided weapons, munitions, satellites and systems for space activities.

Over the first nine months of 2024, IAI posted record profit of $416 million, up 74% on the year.

Sales rose 13% to $4.4 billion amid a rise in the country’s multi-front military conflicts, while IAI’s backlog of orders grew by more than $7 billion over the past year to $25 billion at the end of September.

It has 156 million shekels ($43 million) worth of bonds traded on the TASE.

In June, IAI paid a dividend of $155 million to Israel’s government.

($1 = 3.5995 shekels)