Investing.com — UBS economists expect the Federal Reserve to deliver the next interest rate cut in June, by 25 basis points (bps), followed by another one in September.

The Fed slashed interest rates by 25 bps at its latest FOMC meeting this month, aligning with market expectations. This marks the fourth cut since September, bringing the total reduction to 100 basis points and placing the policy target range at 4.25%-4.5%.

However, the updated dot plot presented a more hawkish stance than anticipated. The median projection now reflects only 50 basis points of cuts for 2025, a notable shift from the 100 basis points indicated in the September dot plot. The Fed’s outlook suggests that policy adjustments could extend through 2027.

Markets reacted negatively to the announcement. Equities fell sharply, bond yields climbed, and the dollar strengthened.

During the post-meeting press conference, Fed Chair Jerome Powell conveyed optimism about the state of the economy and the outlook for 2025. Powell acknowledged that economic growth had surpassed the Fed’s recent expectations, while inflation remains above the 2% target. As a result, the central bank intends to adopt a more measured approach to further rate reductions.

“Our own views on the economic outlook are similar to the Fed’s, and we therefore have adjusted our rate cut forecast in line with the new dot plot,” UBS senior economist Brian Rose said in a note.

The bank now anticipates 25 basis point cuts in both June and September, totaling 50 basis points for 2025, down from previous expectations of quarterly cuts amounting to 100 basis points over the year.

While this more cautious approach is currently favored, Rose highlights that “a March rate cut could quickly be back on the table if there is bad news from the labor market early next year.”

The Fed’s hawkish stance fueled a rally in the U.S. dollar, with the dollar index briefly surpassing 108. This trend aligns with interest rate movements over the past two years and is expected to persist into 2025.

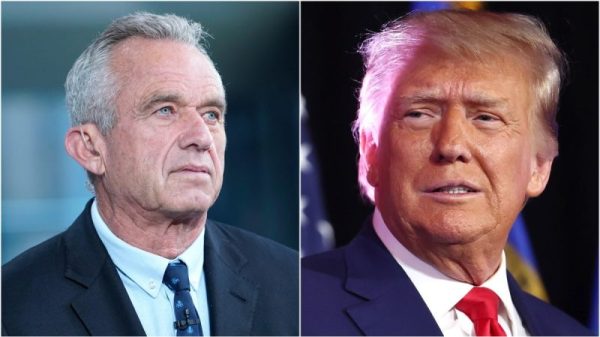

Political factors, including Donald Trump’s upcoming inauguration, are likely to keep the dollar elevated in the near term. Yet, UBS highlights limits to further dollar strength, citing overvaluation, minimal expectations for U.S. monetary easing in 2025, and the market’s focus on the positive aspects of Trump’s policies. Any deviation from these expectations could trigger a dollar pullback.

UBS views current dollar rallies as selling opportunities, forecasting EURUSD to return to 1.10 later in 2025.