Asia’s MicroStrategy Metaplanet recently raised fresh capital of 10 billion Japanese Yen through its stock sale, in preparation for its next mega Bitcoin purchase. Earlier today, the company concluded its 11th series of Stock Acquisitions Right. The company is following in the footsteps of MicroStrategy to raise more capital for its Bitcoin purchases. Meanwhile, the BTC price continues to experience selling pressure at $69,000 levels while trading 2% down at press time.

Metaplanet Raises 10B Yen for Bitcoin Buying

A total of 13,774 individual shareholders participated in the recent stock sale by Metaplanet in the company’s 11th series of Stock Acquisition Rights. The full exercise by EVO FUND has resulted in total proceeds of ¥10 billion.

*Metaplanet Announces Results of Stock Acquisition Rights Exercise* pic.twitter.com/MquO6JFNEX

— Metaplanet Inc. (@Metaplanet_JP) October 22, 2024

With participation from big players like BlackRock, a large number of corporate players have been willing to seek exposure to BTC. Furthermore, market players are conducting stock sales in what seems to be the Bitcoinization of traditional securities markets. Commenting on the development, Metaplanet CEO Somin Gerovich said:

“The Company has also approved the transfer of unexercised rights to EVO FUND, which has committed to exercising all transferred rights by October 22, 2024. Once completed, the total funds raised via the stock acquisition rights will reach 10 billion yen”.

Following today’s stock sale, the Metaplanet share price tanked by 5.85% under 1,200 JPY, however, it is still trading 644% gains on a year-to-date basis.

As we know, the Japanese firm has been on an aggressive Bitcoin buying spree over the past month. As of date, the company already holds more than 850 BTC on its balance sheet, all of which were acquired in the past 6 months since May 2024.

Enhancing the BTC Acquisition Strategy

Metaplanet is making every effort to increase its Bitcoin stash as quickly as possible until the BTC price continues to trade under $70,000 levels. As a result, the company has been adopting different methods to raise cash for its BTC purchases.

On the other hand, the company has also recently indulged in trading Bitcoin options while collaborating with QCP Capital for this initiative. Through this strategy, the company has also made healthy profits of over $2 million.

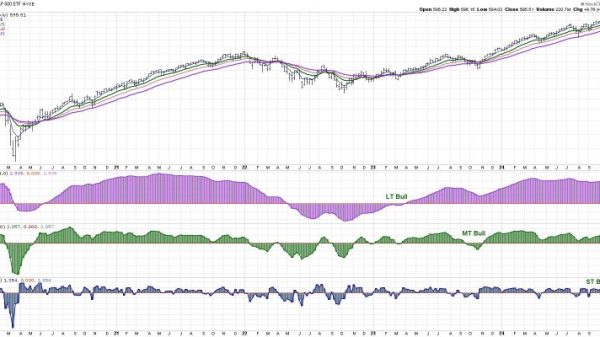

As the BTC price remains rangebound between $60,000-$70,000, long-term investors are making the most of the opportunity to build their Bitcoin holdings. Currently, the BTC price is experiencing selling pressure at $69,000 and is trading down 2% at $67,389.12.

The post Asia’s MicroStrategy Metaplanet Raises 10B Yen to Buy Bitcoin appeared first on CoinGape.