(Reuters) – A.O. Smith missed third-quarter revenue and profit estimates on Tuesday, hurt by lower sales of its water heaters in North America and China, sending its shares down more than 1% before the bell.

The company’s revenue for the quarter ended Sept. 30 fell nearly 4% to $902.6 million compared with the previous year, and below estimates of $904.73 million, according to data compiled by LSEG.

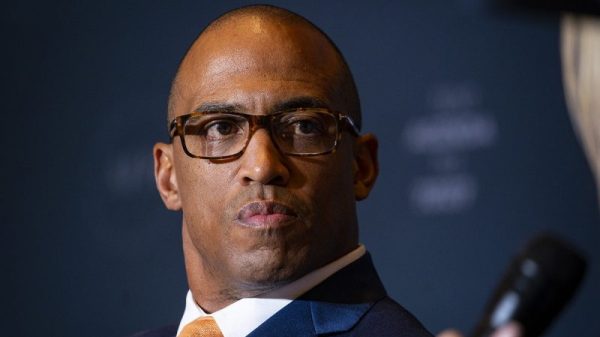

“We expect consumer demand to remain challenged in China through the end of the year and we are cautious about North America residential and commercial water heater end-market demand,” A. O. Smith CEO Kevin J. Wheeler said.

The Milwaukee, Wisconsin-based firm, earlier this month, cut its full-year adjusted profit forecast citing softness in China.

It now expects 2024 adjusted profit to be between $3.70 and $3.85 per share compared with the prior forecast of $3.95 to $4.10 per share.

A prolonged downturn in the Chinese real estate sector affected international sales, comprising 25% of total 2023 sales, mainly from China, and fell nearly 10% to $210.3 million.

Sales in North America, which accounted for 75% of its annual total sales, fell 1% to $703.3 million.

Net income for the third quarter was $120 million, or 82 cents per share, compared with $135 million or 90 cents per share a year earlier. Analysts had expected a quarterly profit of 83 cents per share.