(Reuters) -Philip Morris International’s (PMI) (N:PM) shares hit record highs on Tuesday after the cigarette maker raised its annual profit forecast and beat third-quarter estimates thanks to higher prices and strong demand for its smoking alternatives.

PMI has invested billions of dollars in developing substitutes for cigarettes as health-conscious consumers switch to smoking alternatives in some markets, including its IQOS heated tobacco device and ZYN nicotine pouches, which are now a key focus for investors.

U.S. ZYN shipments in the quarter grew 41.4% over the prior-year period, rebounding after supply constraints curtailed rapid growth. The Marlboro maker has been investing to expand production capacity for ZYN, in an effort to meet strong demand.

The company’s flagship heated tobacco device, IQOS, also saw strong growth in regions such as Japan, Europe and Indonesia, reassuring investors after volumes lagged expectations in the past.

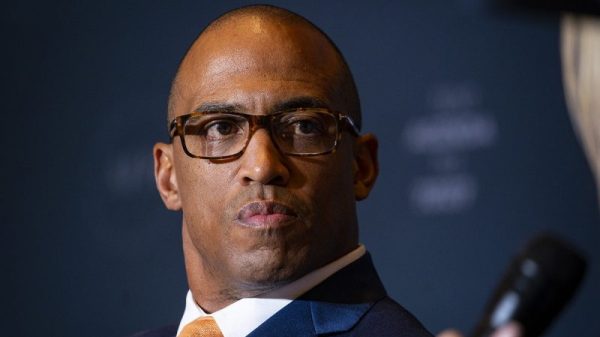

“We delivered exceptionally strong performance, with record quarterly net revenues and earnings per share,” said Chief Executive Officer Jacek Olczak, adding IQOS growth had also accelerated.

PMI’s shares rose 9%, and remained almost 8% higher at 11.43 a.m. (1543 GMT) in New York trading.

The company also enjoyed higher shipment volumes for cigarettes, with higher pricing also driving a 5.2% increase in revenues from its combustible tobacco business.

PMI raised its forecast for 2024 adjusted earnings per share, excluding currency, to between $6.85 and $6.91, compared with its prior range of $6.67 to $6.79.

It reported revenue of $9.91 billion for the third quarter, versus analysts’ estimates of $9.69 billion, according to data compiled by LSEG.

Its quarterly adjusted profit of $1.91 per share also beat estimates of $1.82 per share.

Last week, Philip Morris said it, along with peers British American Tobacco (NYSE:BTI) and Japan Tobacco (OTC:JAPAF), would pay C$32.5 billion ($23.6 billion) to settle long-running health-related lawsuits in Canada.