The world’s largest altcoin Ethereum (ETH) continues to remain in the bear grip while failing to sustain above $2,600 for a long time. Amid the broader crypto market correction, the Ethereum price has slipped another 5.5% and is currently trading at $2,509 levels with a market cap of $302 billion. Veteran trader Peter Brandt predicts an ETH crash all the way to $1,550 amid low buying interest for the altcoin.

Ethereum Price Can Crash to $1,550, Says Peter Brandt

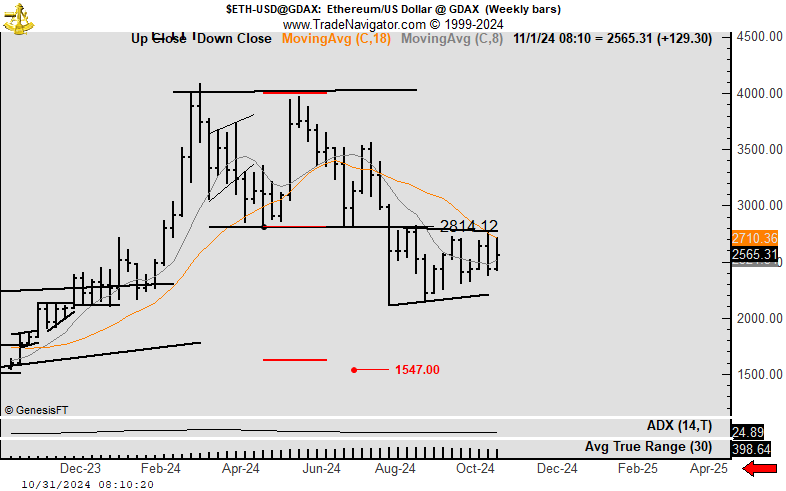

Veteran trader Peter Brandt noted the absence of a buy signal for Ethereum (ETH), emphasizing that the chart structure remains bearish. According to Brandt, ETH still has an unmet downside target of $1,551, reinforcing a cautious outlook for the altcoin amid recent crypto market movements.

The Ethereum price has been forming a downward trending channel of lower highs and lower lows. Popular crypto analyst Michael van de Poppe suggested that if ETH continues with its current downward momentum, the asset could see an additional 10-20% decline from here.

On the other hand, van de Poppoe also believes that the market conditions are nearing a potential reversal, both for U.S. Treasury yields and for ETH itself. He pointed out that tomorrow’s U.S. unemployment data will be pivotal, potentially influencing broader market direction.

ETH Approaches The Demand Zone, What Happens Next?

Popular crypto analyst Mammon highlighted that the Ethereum price is approaching a critical demand zone with bulls looking to form a higher low formation and support the ongoing bull trend. Mammon cautioned that a close below approximately $2,460 could signal risk, given the liquidity accumulation below the mid-range level.

On the other hand, if Ethereum successfully forms a higher low within this support zone and retests the volume area high (VAH), Mammon sees a strong potential for a breakout. Reclaiming this level could set the stage for a significant price rally, according to his analysis. some market analysts are also giving targets of Ether price to $18,000.

Furthermore, the inflows into spot Ethereum ETFs have been picking up once again. Over the last three days, the spot Ether ETFs have registered net positive inflows. On Thursday, October 31, the BlackRock Ethereum ETF (ETHA) saw inflows of $50 million as per Farside Investors data. However, the Grayscale Ethereum ETF (ETHE) saw outflows of $36.6 million taking the total inflows to $13 million.

The post Ethereum Price Can Crash to $1550 Predicts Veteran Trader Peter Brandt appeared first on CoinGape.