The recent Dogecoin price action is flashing a familiar signal from 2021, sparking speculation about whether history is poised to repeat itself. Back then, DOGE price experienced a meteoric 15,000% rise, captivating the crypto space. As a similar pattern has emerged, could it herald another substantial surge, driving DOGE to new heights again?

DOGE price has decreased 7.4% in the last 24 hours following the stock market crash, which wiped out over $900 billion. The ripple effect reached the crypto markets, which have dropped by 5.2% and now have a $2.433 trillion market cap. The price of Dogecoin is $0.1596.

Despite the fall, the Dogecoin price remains bullish. As traders prepare to ride the next wave higher, an analyst has predicted that a similar pattern observed in 2021 could result in a massive DOGE price explosion in this bull run.

Dogecoin Price Repeats 2021 Signal, Will 15,000% Rally Follow?

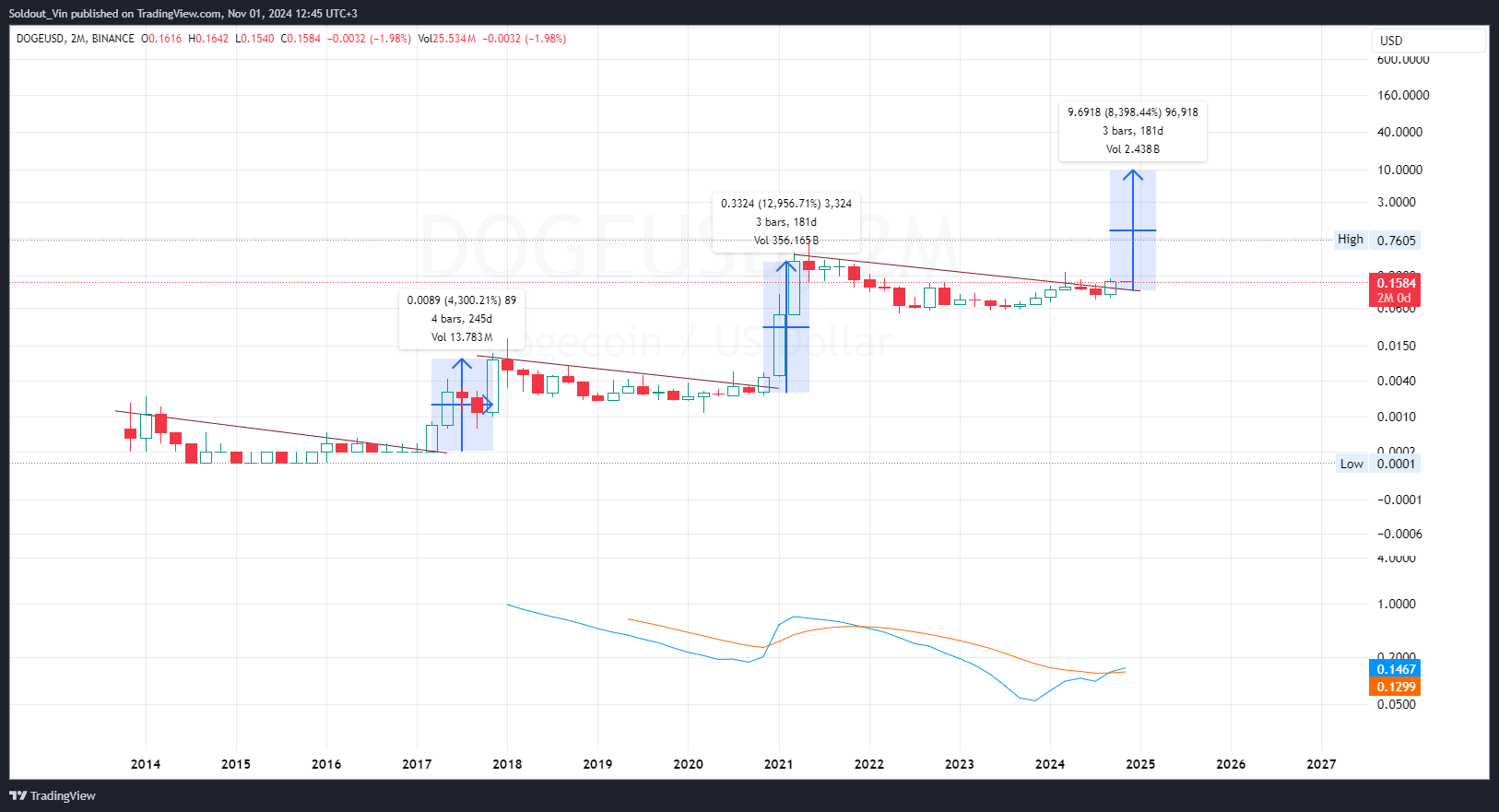

Head of Research at NewsBTC Tony Severino shared his observation on the Dogecoin chart, noting that the two-month Logarithmic Moving Average Convergence Divergence (LMACD) had crossed bullish for the first time since 2021.

Moreover, Trader Alan observed a golden cross on the weekly chart. He noted that the last golden cross in 2023 pumped Dogecoin from $0.069 to $0.23, a 233% increase. If DOGE repeats the same scenario, it will reach $0.47.

From Severino’s observation, a quick mean calculation of the two previous price surges gives a potential increase of 8,628% if history repeats. This puts Dogecoin price around $10, with a potential market cap of $1.466 trillion.

Additionally, the average of the two periods it took to surge 4,300% and 12,000% comes down to 213 days. This means that from the time the breakout candle began forming, the 8,600% DOGE rally is likely to take 213 days, ending April 2025.

DOGE Price Forecast: Can Dogecoin Reach $10?

Dogecoin price forecast shows the meme coin has found resistance (R2) around $0.18 and is currently on a retrace. At its current price, there is weak resistance, which, if it fails, could allow the price to drop to Resistance 1 at $0.145.

However, if resistance holds, the resulting price action is a bounce to higher highs with the same target of around $0.23, which coincides with the current yearly high. That represents a 44% increase from the current price or a 60% surge from $0.145 if a price drops to that support level.

If the Dogecoin price falls below $0.145, it will signal market weakness. However, the asset will remain bullish in the long term. If the price breaks into the triangle, DOGE will officially be back in the bear market.

The current set-up is ripe for a pump likely to be fueled by the upcoming U.S. elections. The odds are significantly in Donald Trump’s favor, according to Polymarket data. If the odds convert to real results on D-Day, DOGE’s price could soar to new yearly highs.

The post Dogecoin Price Flashes Signal From 2021: Will 15,000% History Repeat? appeared first on CoinGape.