Cronos price has seen an impressive 60% surge in the last 3 days driven by a series of positive developments from the Cronos chain ecosystem. This sudden rise has brought life back into the CRO community with market analysts now calling it the next ‘BNB’. Will the price of CRO continue skyrocketing?

Why is Cronos Price Up 60% In 3 Days?

The latest CRO price is $0.1116 after the asset increased by 30.2% in the last 24 hours. This is part of a larger 60% increase over the last 3 days fueled by the release of their 2025 roadmap.

Today we are unveiling the blueprint for an A.I. agent-powered ecosystem on Cronos

The roadmap supports Cronos’ vision as the chain where A.I. agents can interact and transact autonomously.

Easy-to-use A.I. tools and major protocol improvements will drive a… pic.twitter.com/75abidGfyg

— Cronos (@cronos_chain) November 6, 2024

The roadmap outlines ambitious milestones that crypto.com aims to achieve by the end of the year 2025. Some of the more notable milestones include:

- Introduction of stock and ETF trading

- Launch of Crypto.com Stablecoin.

- Application for a Cronos Exchange Traded Fund (ETF).

- A scheduled CRO token burn, much like Binance.

Additionally, Cronos on Thursday announced it was expanding its strategic partnership with Google Cloud, in which the latter will join the Cronos chain as a validator.

Today, Cronos Labs announces an expansion of its strategic partnership with Google Cloud @googlecloud.

With this collaboration, Google Cloud has joined the Cronos ecosystem as a validator and will support independent developers in a wide range of ways.

Learn more:… pic.twitter.com/tECUh0bHCJ

— Cronos (@cronos_chain) November 7, 2024

This news further boosted the price of CRO, forcing it to break out of a 238-day down trend.

Is The CRO Price Surge Over?

Data from Coingecko shows CRO trading volume skyrocketed by 532%, increase from one day ago and signaling a recent rise in market activity. Strong volume indicates the upward trend may still continue.

Further, the CRO open interest (OI) just spiked 43% in the last 24 hours. With price up over 30%, it signals traders are entering longs positions on Cronos (CRO). This indicates the price may not be over.

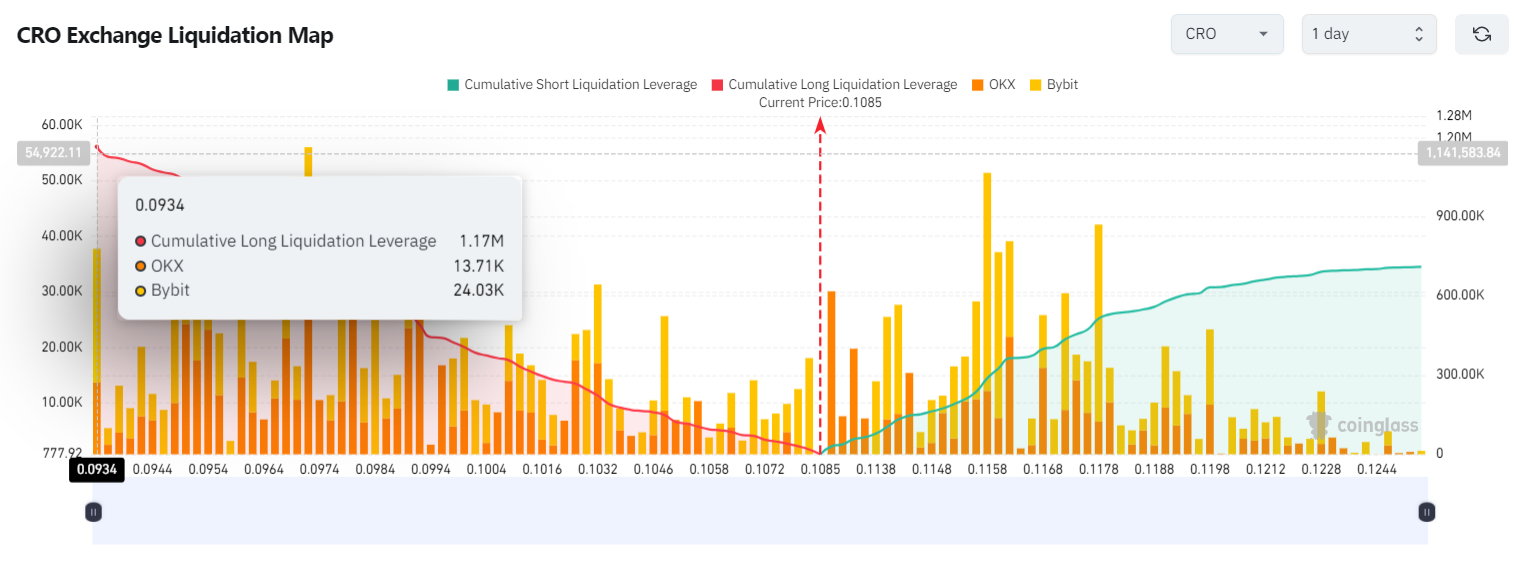

Data from Coinglass further verifies this observation as it shows there is $1.17 million worth of cumulative Long Liquidation Leverage on OKX and Binance, which about twice as much as shorts.

This imbalance suggests traders hold a bullish sentiment on the Cronos price, anticipating a further increase in the future.

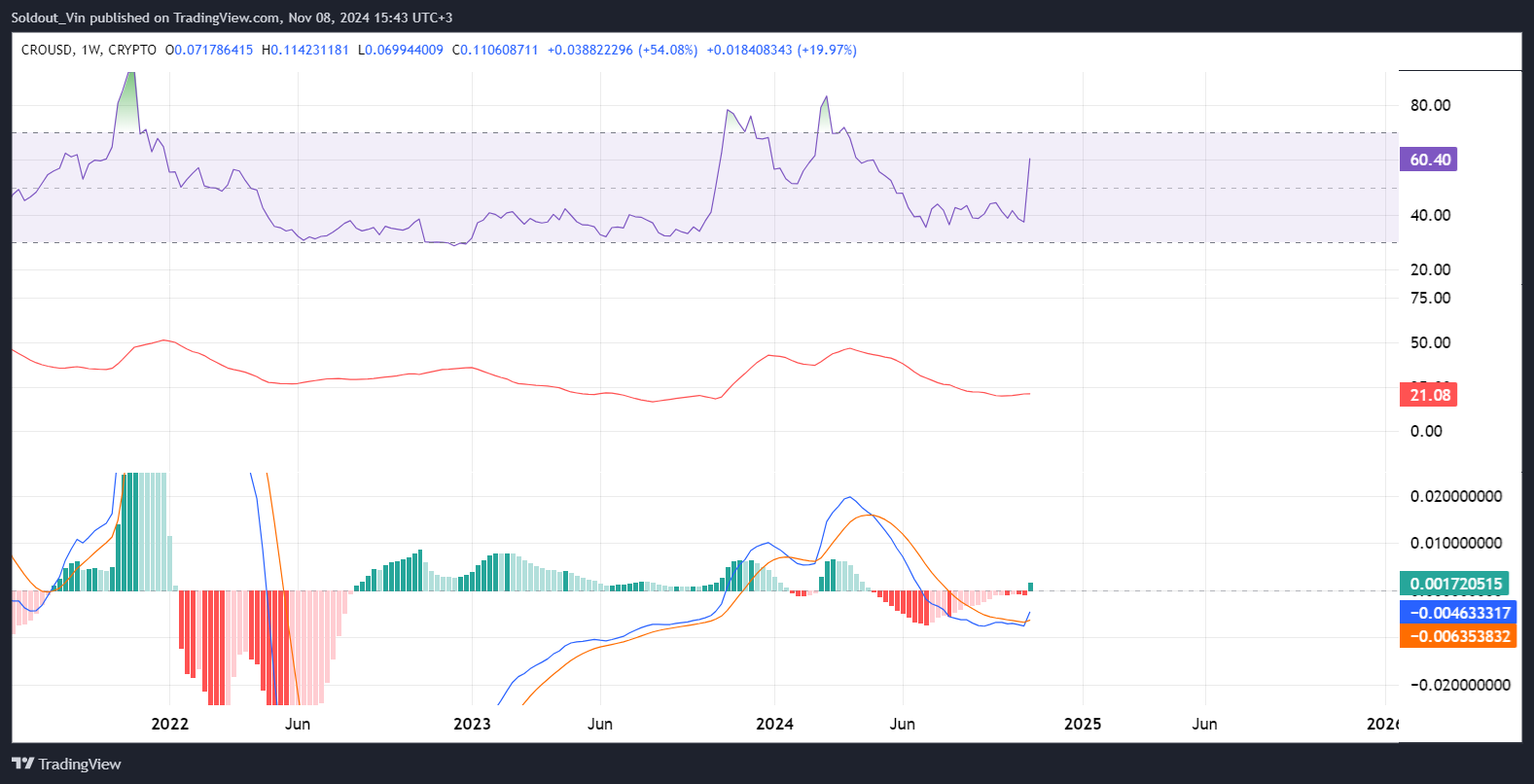

Looking at the relative strength index (RSI), which is at 60.40, there is still room for more upside before it reaches the overbought zone. There is also a bullish moving average convergence divergence (MACD) crossover, which signals the Cronos price rally has only begun.

The Average Directional Index (ADX) indicator which shows the volatility of an asset is at 21, which is still a bit low. However, the indicator is moving up, suggesting aggressive price upswings are likely to start soon.

Cronos Price Analysis: Is $1 Next After 60% Surge?

The weekly CRO price chart shows the a strong bullish engulfing candle, which signals potential upward continuation. However, the current price level also coincides with resistance trend line which has kept the price down since the March mini bull run.

A bullish breakout from this price trendline resistance would result in an explosive 63% jump to $0.185, where the next significant resistance is located. Beyond this Cronos price will likely target previous all-time high around $0.98 and beyond as the market enters the 2025 bull market.

The post 60% In 3 Days: Here’s Why Cronos Price Is Surging appeared first on CoinGape.