Pendle price rallied to a four-month high as the positive sentiment in the crypto industry remained. It jumped to an intraday high of $5.69, continuing a bull run that started on August 5 when it bottomed at $1.828. This rally, however, could come under pressure after a team address sold tokens.

Pendle Price Could Be At Risk As The Team Sells

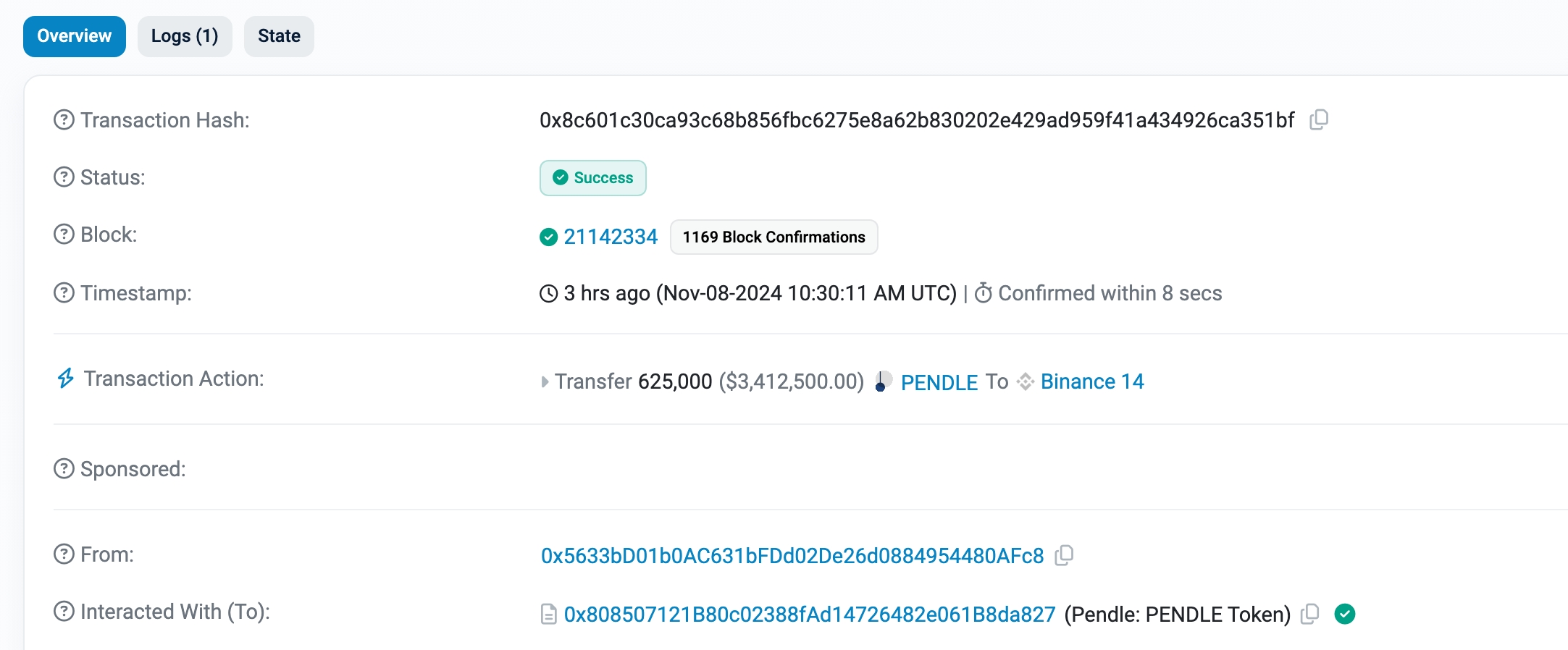

On-chain data shows that Pendle’s insiders are selling their coins, which could be a red flag to holders.

Data shows that an address owned by the Pendle team transferred 625,000 tokens to Binance on Friday. Moving tokens to a centralized exchange is usually the first step for holders to sell them.

More data shows that other whales continued to move their tokens. One address transferred 1 million tokens worth $5.6 million to Binance. Also, another user moved 600,000 Pendle tokens worth $3.2 million to Binance on Friday. Cumulatively, according to DeFi Llama, whales sold Pendle tokens worth $12.2 million in the last 24 hours.

A likely reason for the selling is to take profits since Pendle token has jumped by 200% from its lowest level in August. Besides, data by CoinCarp shows that the top ten holders hold 65% of all the coins in circulation.

Still, news of insider sales could put the coin at risk of a reversal if other holders start to exit their trades as well.

Pendle Price Analysis Signals Major Reversal

Turning to the daily chart, we see that the Pendle price has been in a strong bull run since August. This price action mirrors those of other altcoins like Solana, which have soared in the past few weeks.

Pendle’s rally this week was mostly because of the US election in which Donald Trump won by a large margin. As a big stakeholder in the industry, Trump has pledged to enact friendly regulations that will grow the industry.

Pendle price has formed an ascending channel, which connects the lower highs and higher highs since August. It has now retested the upper side of this channel.

The token has also formed a golden cross pattern as the 50-day and 200-day Weighted Moving Average (WMA) crossed each other.

These insider sales happened after the Pendle token price retested the upper side of the channel. If it closes below $5.5, it will be a sign that it has formed a shooting star candlestick, which could push it lower. If this happens, it could drop to the lower side of the channel at $4.8.

Further, a drop below the channel puts it at risk of falling to $1.82, its lowest level this year, which is 65% below the current level.

This bearish Pendle price forecast will become invalid if the coin rises above the psychological point at $6. Such a move will point to further gains to the year-to-date high of $7.5.

The post Pendle Price Stalls As Team Wallet Dumps; Is a 66% Dive Likely? appeared first on CoinGape.